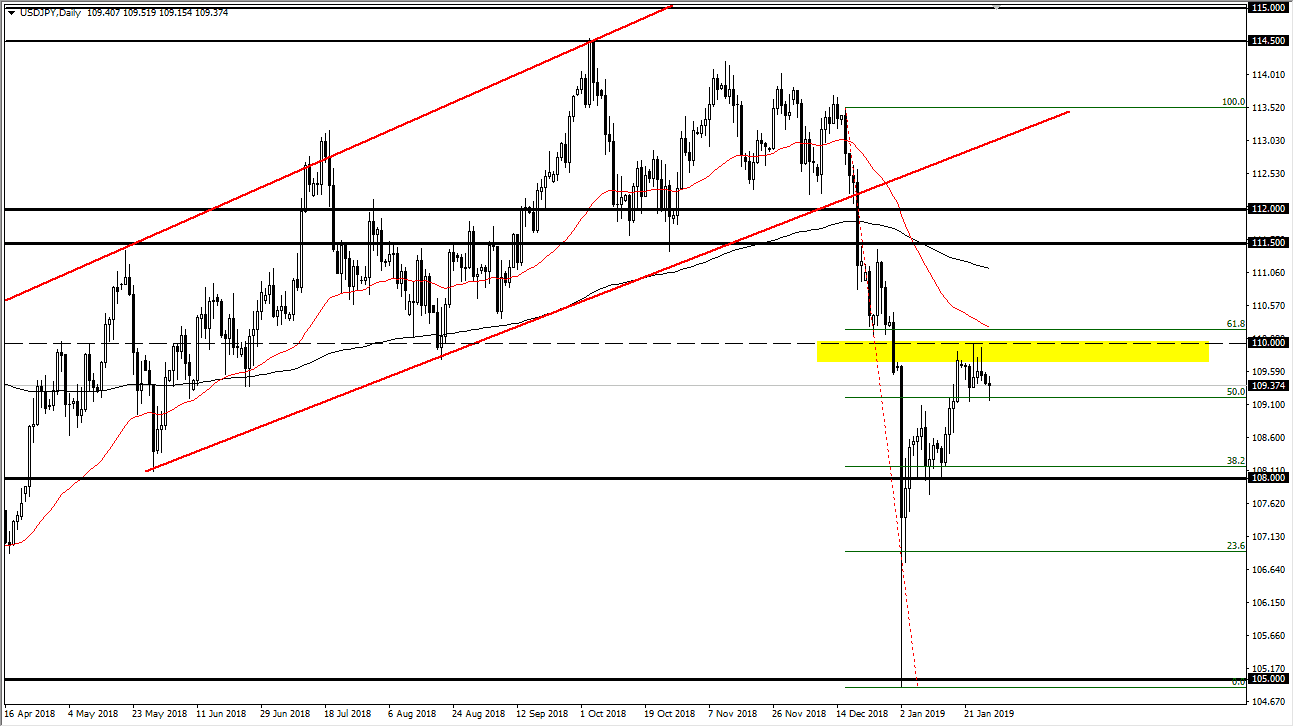

USD/JPY

The US dollar has pulled back a bit against the Japanese yen, but also bounced to form a less than impressive negative candle stick. However, we do have a couple of shooting stars above that should continue to cause significant resistance, with the ¥110 level of course being important. The 61.8% Fibonacci retracement level is just above there, just as the 50 day EMA is. That being the case, I think that the market is ready to roll over, but we may have to consolidate in this area. If we can break down below the lows of the trading session on Monday, then I think we will probably continue to go lower, perhaps reaching towards the ¥108 level an area that should be massively supportive. Alternately, if we were to break above the 61.8% Fibonacci retracement level, then I think we could go towards ¥111, but that doesn’t seem to be so likely at this point.

AUD/USD

The Australian dollar initially tried to rally during the trading session on Monday, but then pulled back a bit near the 0.72 handle. I think at this point we are looking to rollover but you can also see that I have a blue rectangle underneath that should represent support, based upon the “tweezer bottom” that we made on Thursday and Friday. Even if we break down below there, I think there is plenty of support at the 0.70 level that extends down to the 0.68 level. There is massive amounts of support in that area, and I think that we will have plenty of buyers in that general vicinity, so even though we are rolling over, I think that it’s a nice buying opportunity for a longer-term move. Keep in mind that the Australian dollar is highly sensitive to the US/China trade talks, which of course are going on this week. That of course will move this market.