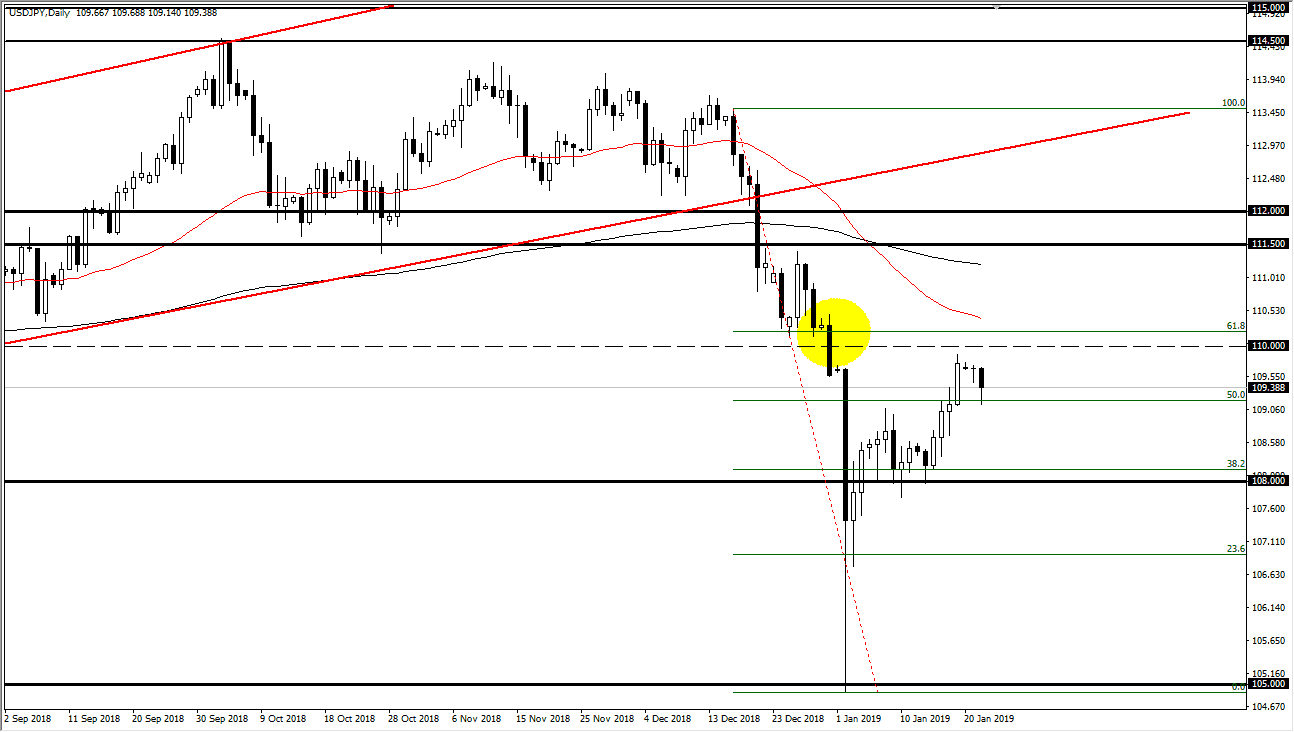

USD/JPY

The US dollar pulled back against the Japanese yen during the trading session on Tuesday, reaching towards the ¥109 level. We did find support there and bounced about 40 pips towards the end of the session. Nonetheless, the 61.8% Fibonacci retracement level is sitting just above at the ¥110 level, or just slightly above it. I think it is only a matter time before we sell off on any attempted rally, and a break down below the trading range for the Tuesday session is probably reason enough to start shorting as well. I think ultimately we will go looking towards the ¥180 level which I see as much more supportive. We have recently had a “death cross”, and as you can see by the yellow ellipse on the chart, I have an area marked that has seen a massive spike in selling pressure, before the “flash crash” that we had seen just after that.

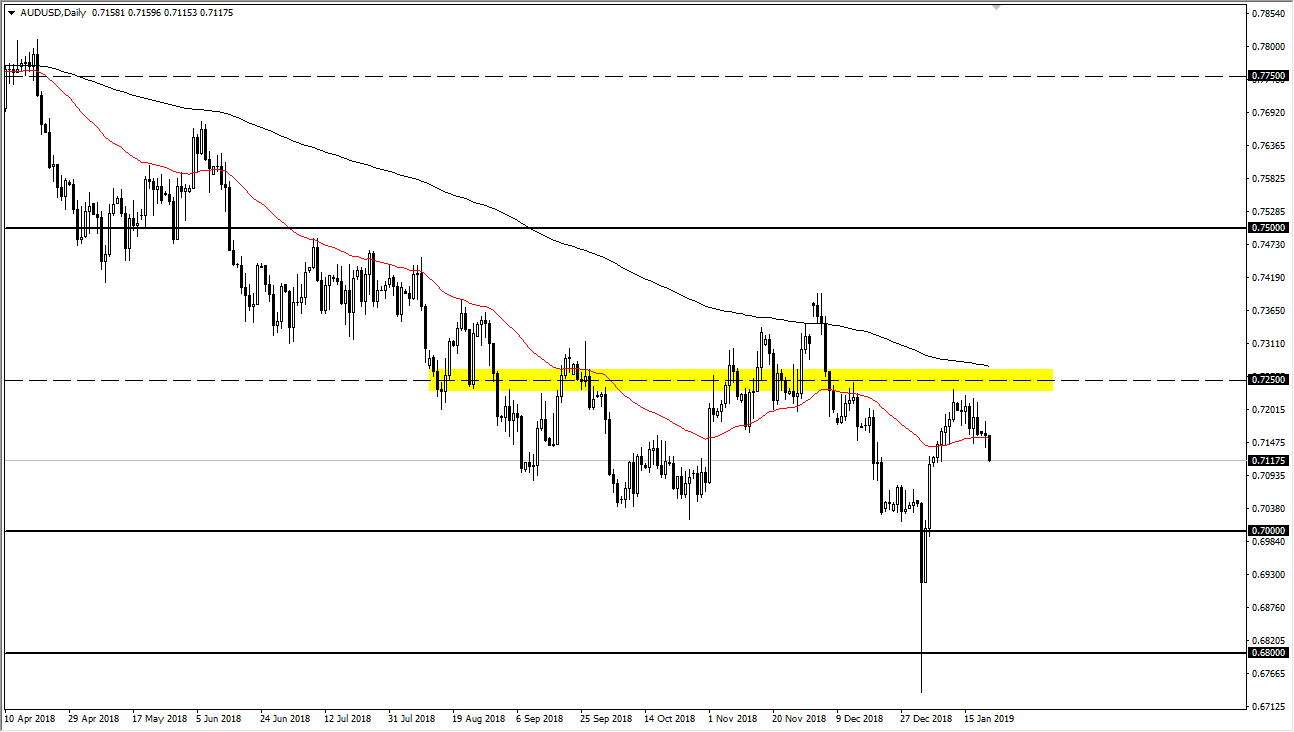

AUD/USD

The Australian dollar broke down a bit during the trading session on Tuesday, as it looks like we are finally rolling over after this spike higher. At this point though, I do think there is plenty of support below, and the closer we get to the 0.70 level, the more likely we are to see buyers come back into this market to pick it back up. I believe there is a massive amount of support between the 0.68 level and the 0.70 level, based upon longer term charts such as the monthly and the weekly time frames. If we were to break down below the 0.68 handle, that would be an extraordinarily negative sign. At this point, I think we are simply trying to form some type of base, and of course we have not had the agreement between the Americans and the Chinese we hoped we would have gotten by now, which will send this market much higher once it finally comes.