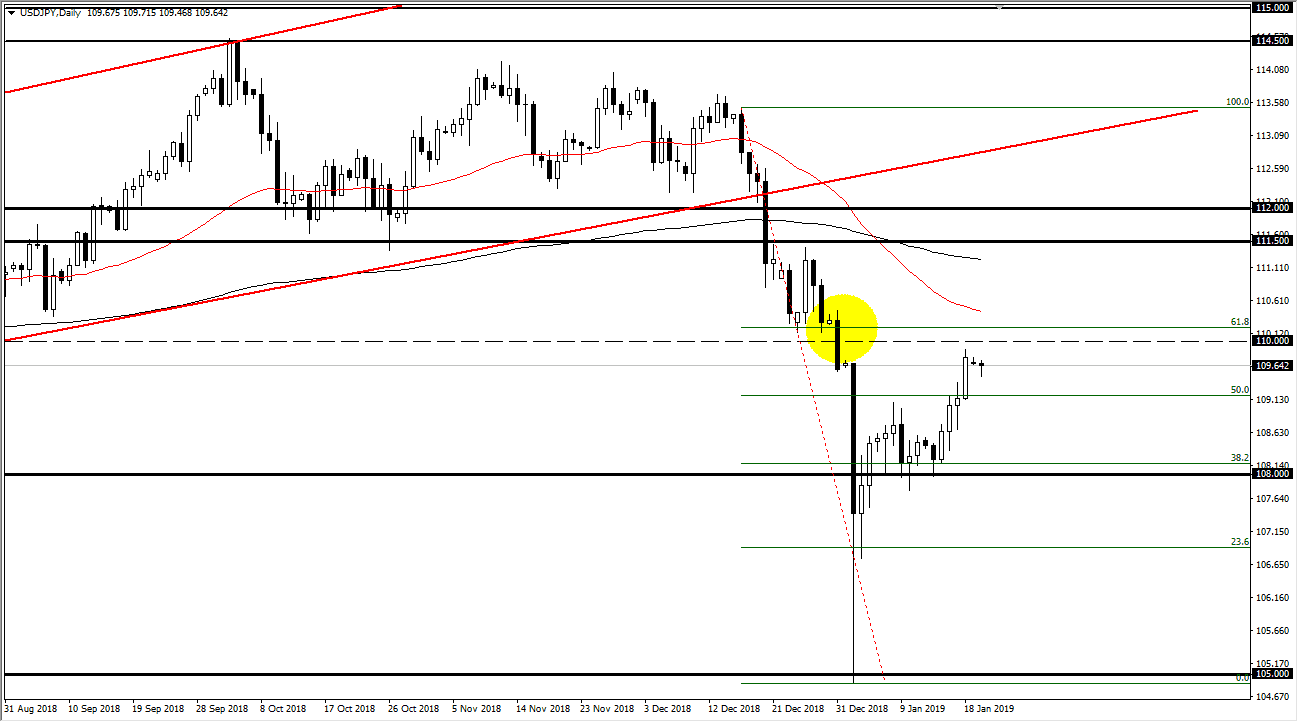

USD/JPY

The US dollar pulled back a bit during the trading session on Monday but did bounce a bit to turn things around. The ¥110 level above is going to be important as well, so having said that the market will probably find a bit of resistance based upon the round number, and of course the impulsive move to the downside that we have just retraced. Beyond that, this pair does tend to move with the stock market, which is also offering a lot of resistance just above. As you can see, the 50 day EMA is just above that level as well, just as the 61.8% Fibonacci retracement level is. Ultimately, the market should then drop towards the ¥108 level underneath as it was a major support. If we did break above the 50 day EMA, the market then will face significant resistance above at the 200 day EMA, pictured in black. I do think that any type of bad economic news will turn this market around.

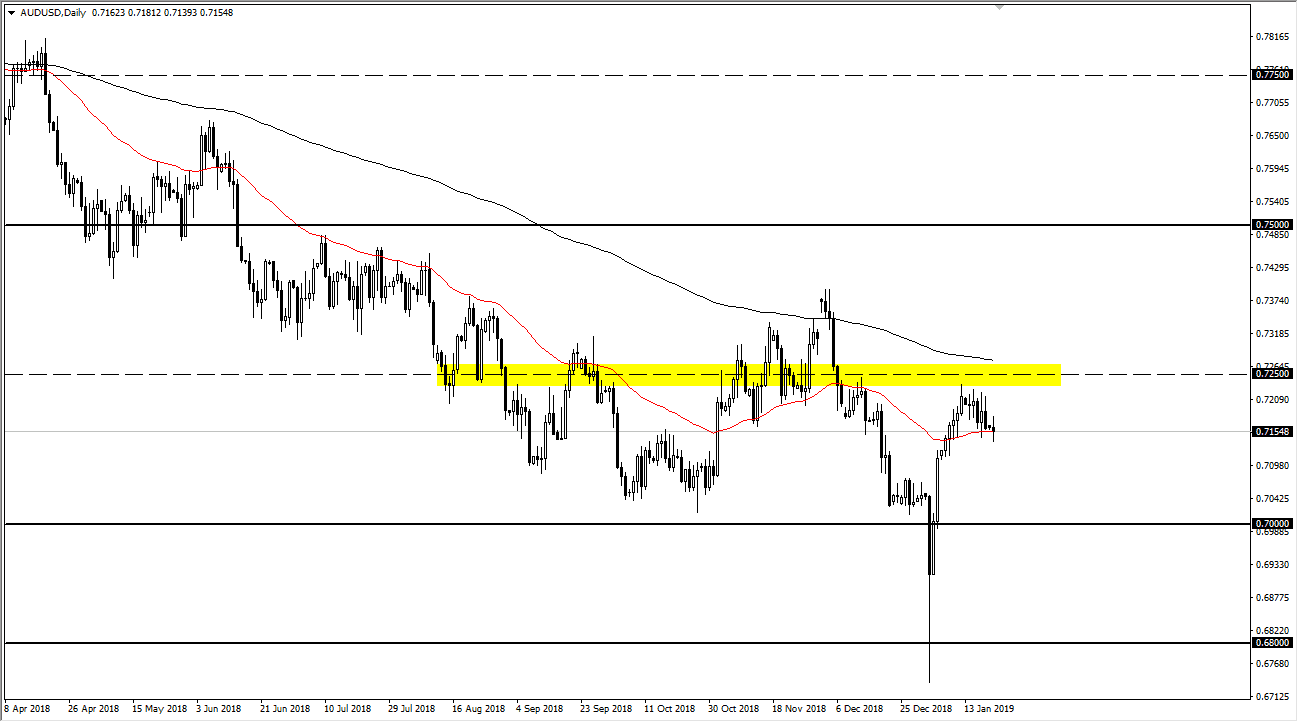

AUD/USD

The Australian dollar went back and forth during the trading session on Monday, hovering the 50 day EMA. The Americans were away for the Martin Luther King holiday, so volatility dried up towards the later part of the day. If we can break down below the bottom of the candle stick for the trading session on Monday, we could drop rather significantly, perhaps down to the 0.7050 level. I believe there is plenty of support underneath down to the 0.70 level as well, so I think a short-term pullback should officer buying opportunity. There should be plenty of support below there to the 0.68 handle, which is a larger term support barrier on the monthly timeframe. Because of this, I think this pullback will eventually find buyers, but I think it’s also necessary to try to continue to build the base.