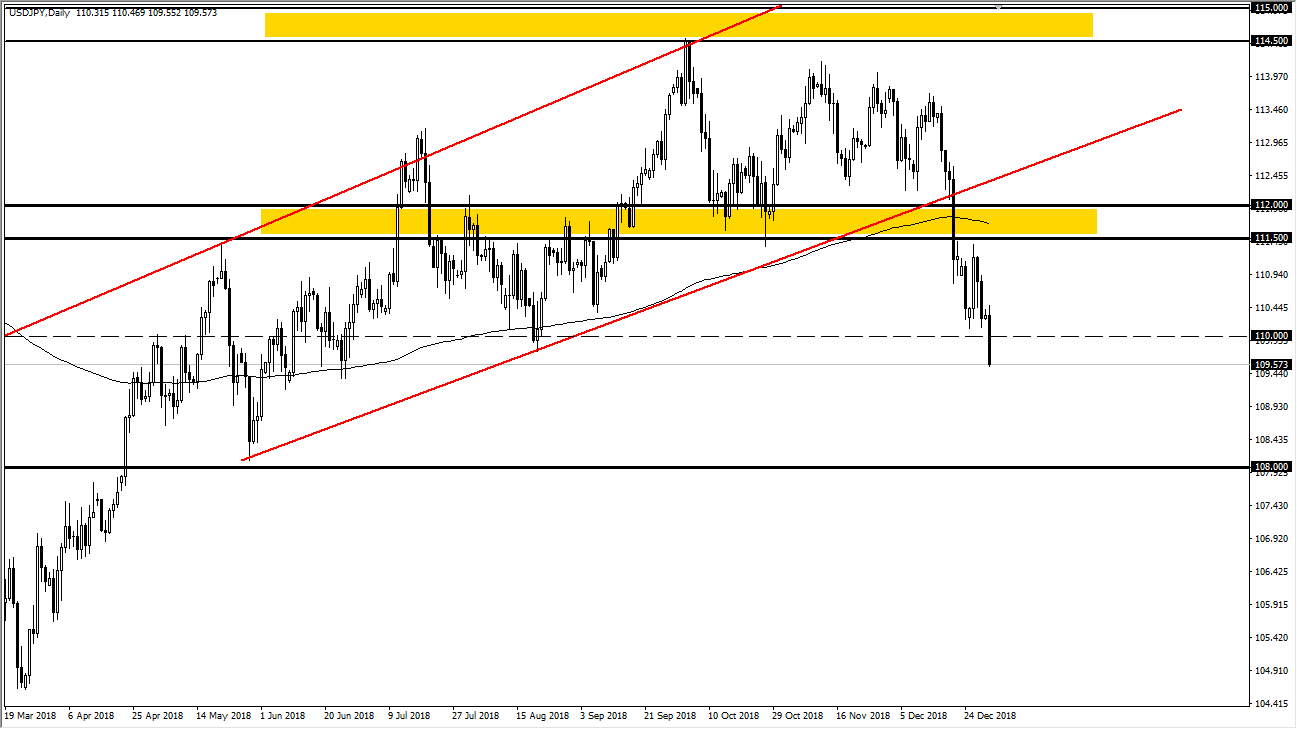

USD/JPY

The US dollar has fallen again against the Japanese yen, with accelerated selling towards the end of the day on New Year’s Eve. Now that we have cleared the ¥110 level, I think we will probably continue to try to wind down to the ¥108 level. I would not be surprised to see a short-term bounce, which should offer a nice selling opportunity, especially near the ¥110 level. The Japanese yen is supposed to be one of the strongest performing currencies for 2019, and it will certainly be seen as a safe haven trade just waiting to happen. I think at this point, we could see some volatility but that would be normal in this type of macroeconomic environment. Ultimately, I think the ¥112 level above is now the ceiling, as well as the 200 day EMA just below there.

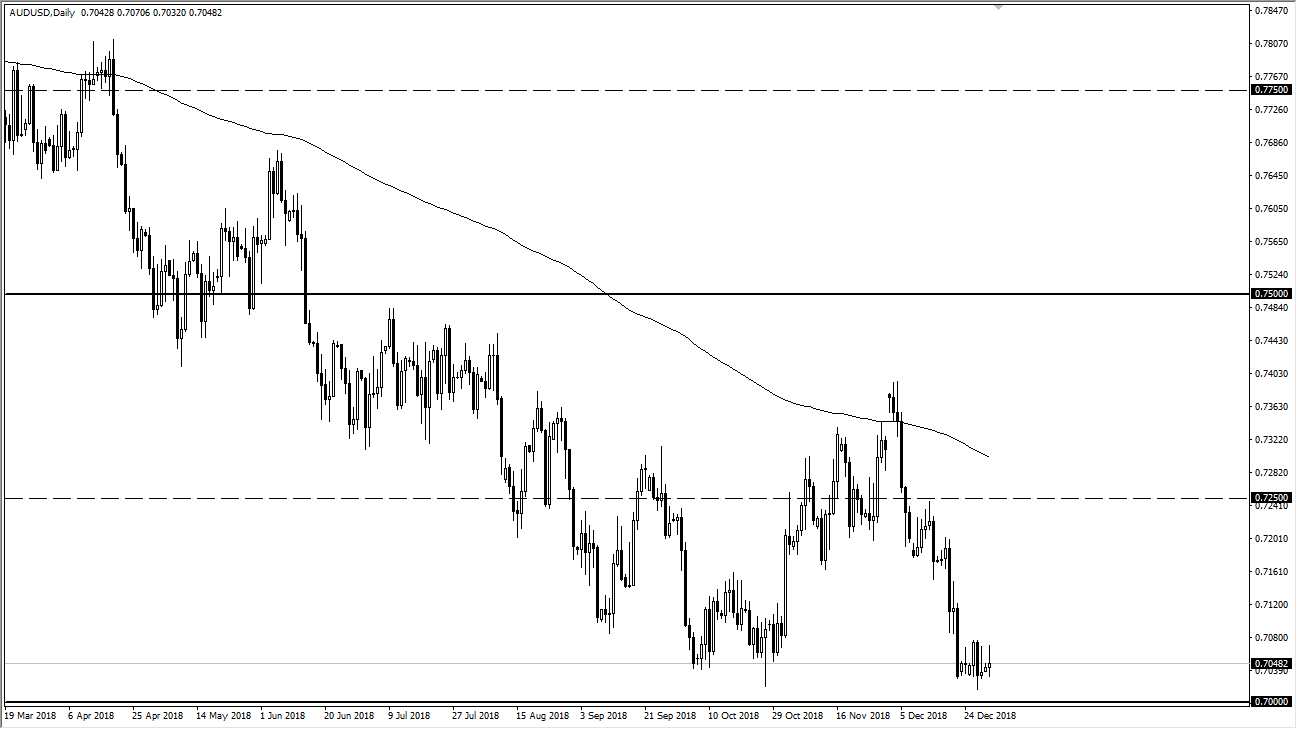

AUD/USD

The Australian dollar try to rally during the trading session on New Year’s Eve but rolled over to form a shooting star again. It looks as if the market is hell-bent on trying to break down below the 0.70 level, which makes sense as there are a lot of concerns about global growth. Beyond that, the Chinese economic numbers have not been good, and that certainly doesn’t help Australia. That’s the one big issue with the Australian economy, it is so highly levered to China. Most traders look at the Aussie dollar as a proxy for China, so it makes sense that we continue to struggle. Rallies at this point should be sold, and I think there is plenty of resistance above at the 0.7250 level to keep this market down. I look at rallies as an opportunity to pick up the US dollar “on the cheap.”