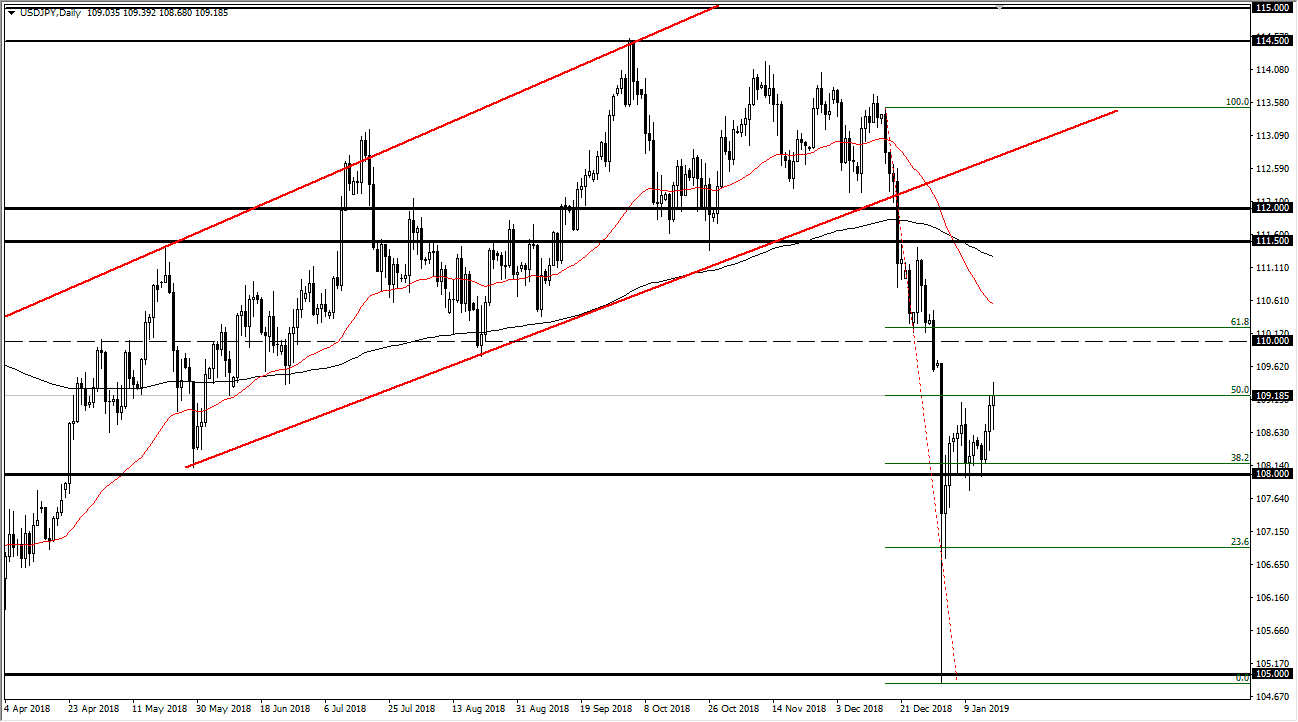

USD/JPY

The US dollar has gone back and forth against the Japanese yen in a rather difficult session. Word had gotten out that perhaps the Americans were thinking about cutting back tariffs to move the situation with China forward, and that of course cause a lot of volatility in the marketplace. We have broken above the ¥109 level, which of course is a very bullish sign. If that’s going to be sticking, it’s possible that we could go to the ¥110 level next. That being said, I believe that the ¥110 level is even more resistive, and I would expect more trouble in that area as it is a confluence of a large round number, and of course the 61.8% Fibonacci retracement level. Think of it this way: the pair had gotten ahead of itself to the downside so this bounce back makes quite a bit of sense.

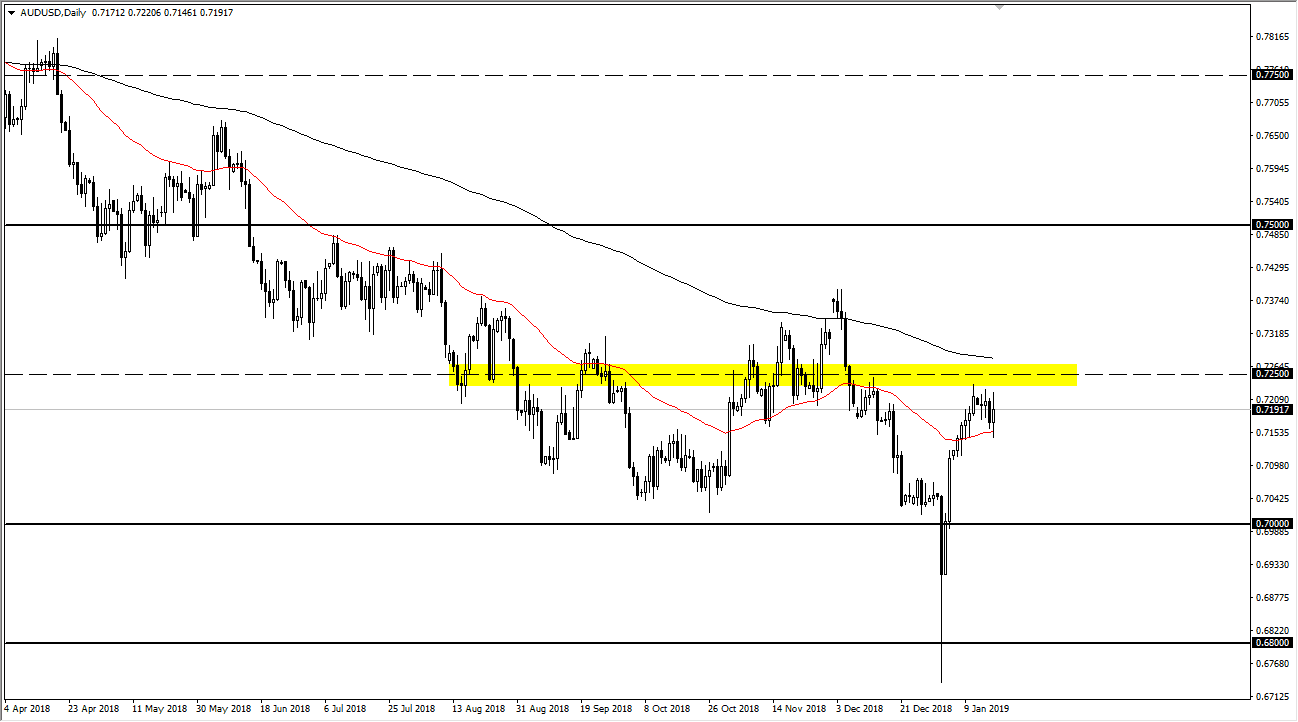

AUD/USD

The Australian dollar went back and forth during the day as well, moving for many of the same reasons. The 0.7250 level above continues to offer a significant amount of resistance, so if we can somehow break above there, we then could make an attempt at the 200 day EMA. That of course is a longer-term signal, and the close above that on a daily candle stick will probably have longer term money flowing into the Aussie dollar. However, if we break down below the lows of the session for Thursday, then I think the Aussie continues to pull back, which makes sense as we await some type of certainty when it comes to the US/China situation. Remember, the Australian dollar is a bit of a proxy for China, and the economic numbers in that country are not looking very good lately.