USD/JPY

The US dollar has rallied during the trading session on Tuesday but gave back some of the gains as we approached the ¥109 level. There is massive support underneath though, so don’t be surprised at all if we continue to go back and forth during the next couple of sessions. However, I do recognize that headline risks are still out there, and most decidedly skewed to the downside at this point. If we get bad news globally, that could send this pair below the ¥108 level. Beyond that, the US dollar is now being repriced due to the Federal Reserve looking likely to hesitate a bit to raise rates. If that’s going to be the case, pay attention to this chart because it could be the next great trade. If we break higher, and clear the ¥109 level, then I think ¥110 will be even more resistive.

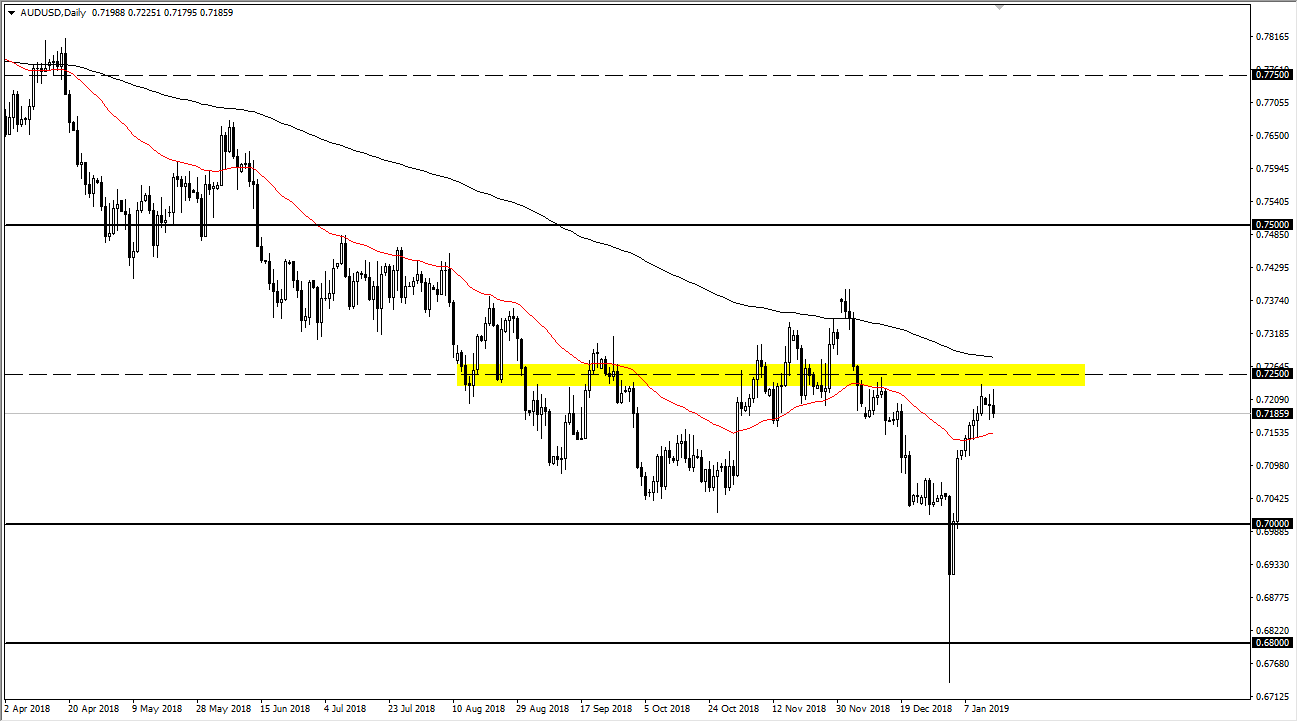

AUD/USD

The Australian dollar tried to rally on Tuesday again but continues to find sellers just below the 0.7250 level. That’s an area that has been important more than once, and I think the fact that the 200 day EMA is sitting just above that level of course adds even more credence to that resistance barrier. Remember that this pair is highly sensitive to the US/China trade talks and of course Chinese economic numbers, which have been relatively poor lately. I think that the market is ready to roll over and continue to go lower, at least in the short term. That being said I expect to see the 0.70 level underneath be the beginning of significant support again. This is a classic “push/pull” market as a softer Federal Reserve won’t do favors for the dollar, but at the same time there is no reason for the Aussie to take off.