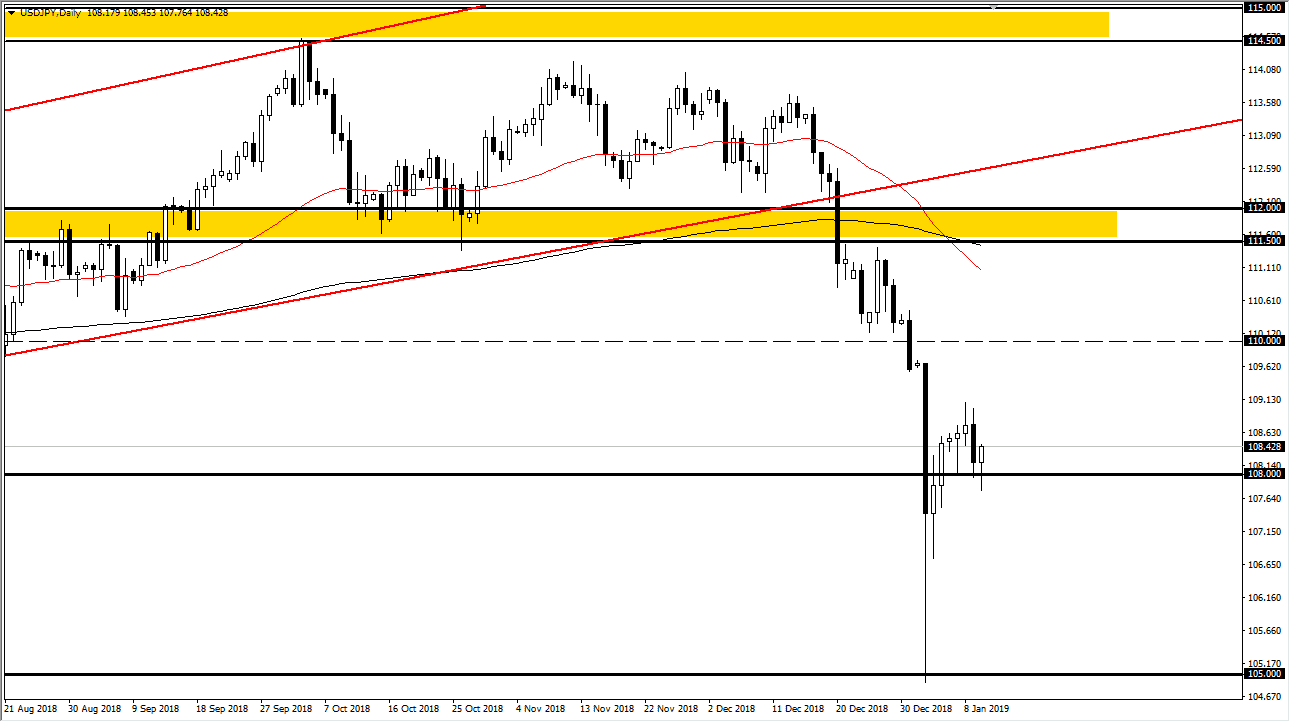

USD/JPY

The US dollar has initially pulled back against the Japanese yen during trading on Thursday but found buyers later in the day as the ¥108 level has offered significant support. The fact that we pierce that level of course sets us up to finally break through it again, but right now it looks as if we will probably get a short-term rally. I think the rally fizzles at the ¥109 level, so the first signs of exhaustion should be sold from what I see. If we break above the ¥109 level though, then we have major resistance above at the ¥109.60 level if followed by the ¥110 level. In other words, I feel it’s only a matter of time before we sell off yet again. A break down below the bottom of the candle stick for the session on Thursday would be extraordinarily negative as well. Once we break through there, I anticipate that the market will go looking towards the ¥106.50 level.

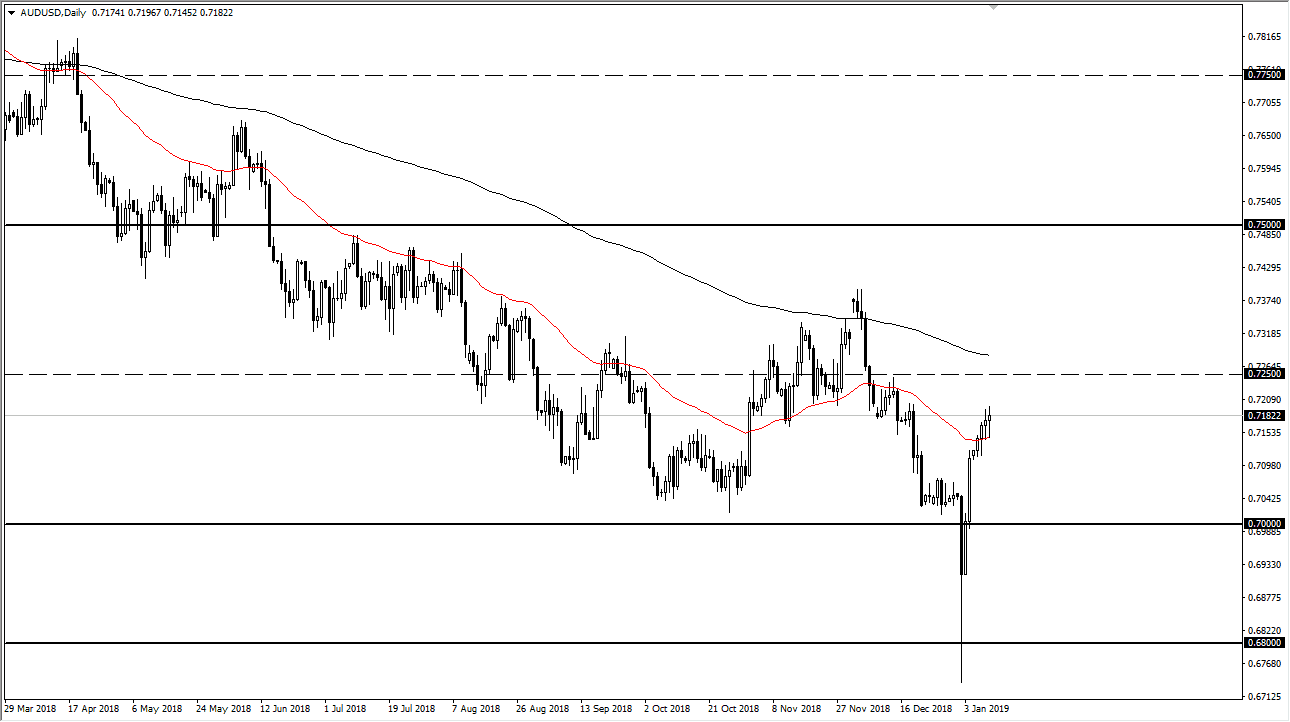

AUD/USD

The Australian dollar had a back-and-forth type of trading session during the day on Thursday, bouncing off the 50 day EMA. The market is starting to turn a little bit higher again, but this is more of a grind that anything else. At this point, I anticipate that the 0.7250 level will cause a massive amount of resistance, and I think that any signs of exhaustion near that level, which coincides nicely with the 200 day EMA, is a selling opportunity. At that point, we probably break down towards the 0.70 level after that. Once we break down below there, we will probably test the 0.68 handle. Ultimately though, I think that were looking at a slight pullback rather soon, and I certainly wouldn’t be a buyer at this point as we have been so overbought.