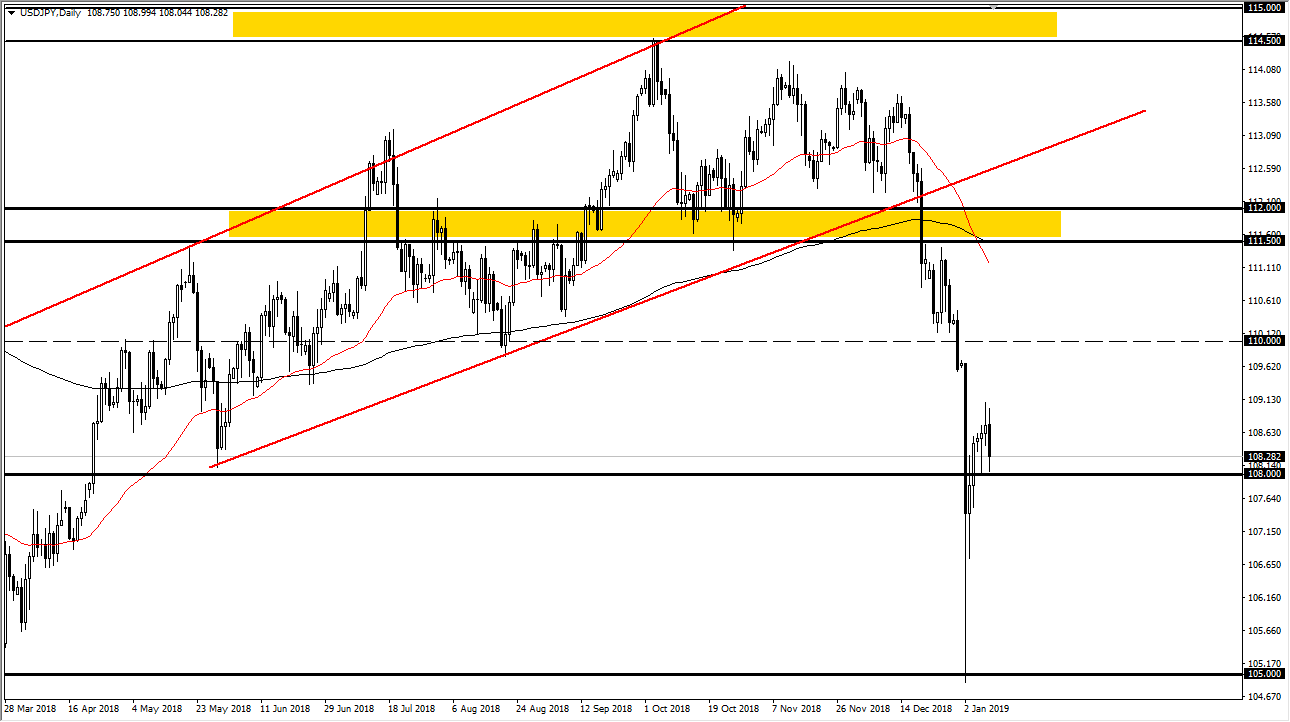

USD/JPY

The US dollar initially tried to rally against the Japanese yen during trading on Wednesday, but then fell hard after the Federal Reserve released its meeting minutes of the last gathering. It looks as if there is more dovish and this in the Federal Reserve than anticipated, and as a result we have seen some US dollar selling. At this point, if we can break down below the ¥108 level, I feel that this market can go much lower. That would be a continuation of the technical destruction that had been seen in this market previously, so I believe it makes sense that we will see this as an obvious place for traders to put money to work as the Japanese yen features a central bank that it’s at least trying to step away from quantitative easing. Rallies are to be sold.

AUD/USD

The Australian dollar has rallied a bit during the day after initially trying to fall. After the meeting minutes, we have seen volatility, but it now looks as if the US dollar will be on its back foot. That being said, I think the Australian dollar is going to be a bit of an outlier as it will rely heavily on results of the meeting between the Americans and the Chinese. There is an announcement during the Thursday that is coming out, which of course will have a major influence on where we go next. If it is positive and bullish, it’s likely that we will see money flow into the Aussie dollar as it should give the Chinese some relief. However, if it falls flat or underwhelmed, this pair will turn around and go back towards the 0.70 level. I think waiting 24 hours will probably be the best move you can make in this pair.