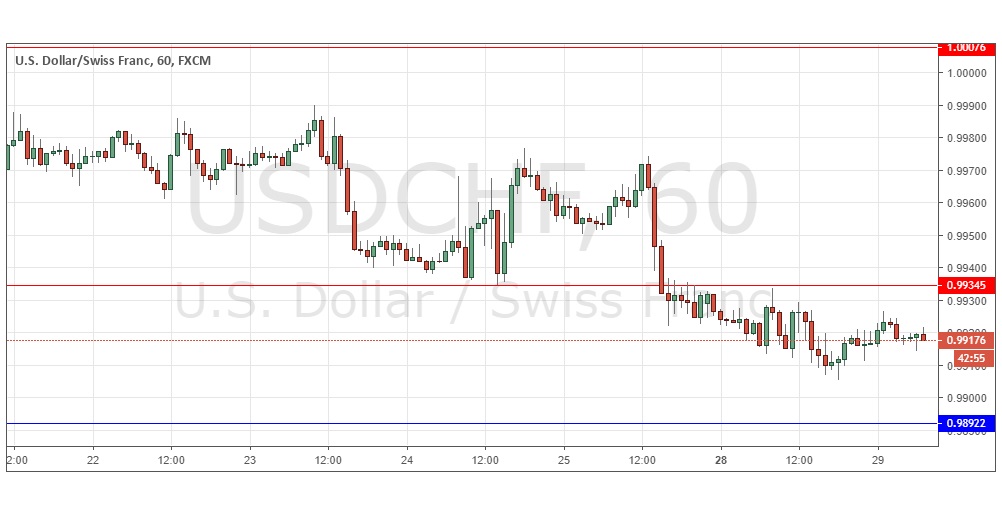

Yesterday’s signals were not triggered, as none of the key levels were ever reached, although the high price of the day was just a pip or so below the resistance level identified at 0.9935.

Today’s USD/CHF Signals

Risk 0.75%.

Trades may only be entered before 5pm London time today.

Short Trade

Go short following a bearish price action reversal upon the next touch of 0.9935.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade

Go long following a bullish price action reversal upon the next touch of 0.9892.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I wrote yesterday that the picture was slightly more bearish, with a new lower resistance level at 0.9935 which might produce a profitable short trade for a conservative profit target. This was a good call, with the high of the day only a pip or two below that level, and the price now trading lower.

At present, both the Swiss Franc and the Euro appear to be strengthening, and the short-term and medium-term price action suggest lower prices still today. I take a bearish bias today below 0.9925 but the round number at 0.9900 or the support a few pips below that will be likely to stop the downwards movement. There is nothing of high importance due today regarding the CHF. Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time.

There is nothing of high importance due today regarding the CHF. Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time.