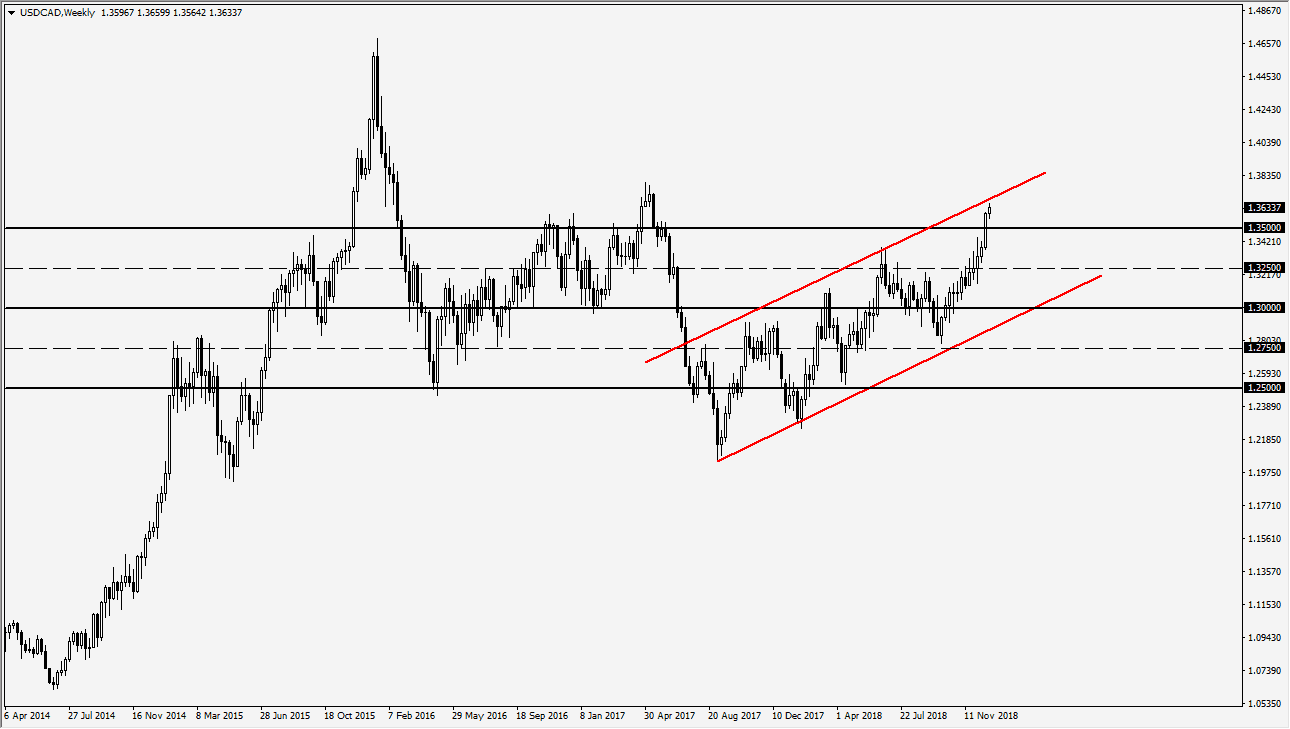

USD/CAD

The US dollar rallied quite significantly against the Canadian dollar during most of December, reaching towards the top of a major channel. At this point, the market does look a little bit stretched and the last full week of December suggested that perhaps we were getting a bit exhausted. Beyond that, crude oil looks as if it is trying to form some type of bottom, and that does of course have an inverse relation to this market. That’s not to say that I think crude oil is going to turn around drastically, but certainly a bounce in that market and perhaps a pullback in this market makes a lot of sense.

So the question of course is “how far can we pull back?” I think this comes down to several factors, with the obvious correlation to oil being in play, and then of course the Federal Reserve and its lack of hawkish language during the last press conference. I think the US dollar may have gotten a little bit ahead of itself against the Canadian dollar, and at this point I think we will probably see support closer to the 1.34 handle.

Even though I fully anticipate that we are going to get a pullback initially during the month of January, I think this will only offer a better buying opportunity if you are patient enough. Buying the dips should still continue to be profitable, but you will need to be patient and pick your levels. If we do not pull back all the way to the 1.34 level, then I would expect the 1.35 level to be an area of interest as well, as it is a large, round, psychologically significant figure. Below the 1.34 handle, I think the next support level is 1.3250. I do believe that we will get an initial pullback, but falling will be somewhat limited as not only is oil under pressure, the Canadian economy itself is showing signs of slowing down slightly.