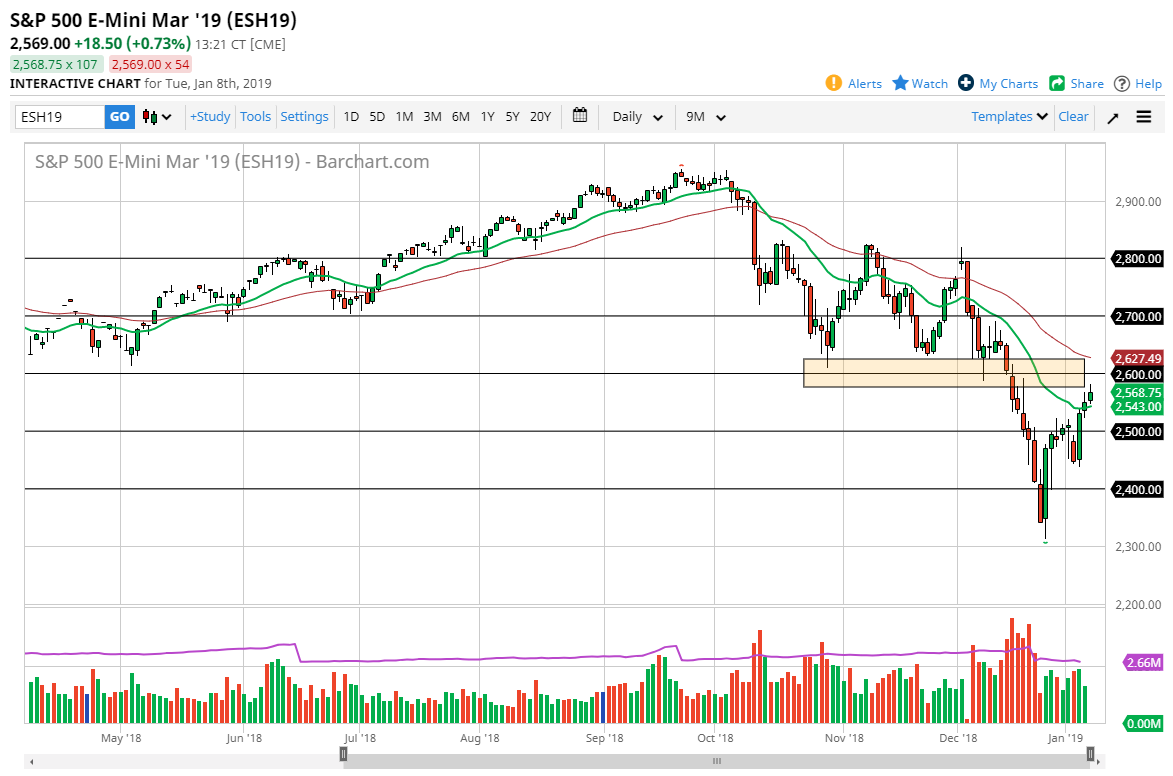

S&P 500

The S&P 500 rallied a bit during the trading session on Wednesday, reaching towards the major resistance barrier that was previous support hovering around the 2600 level. I think at this point, it’s likely that there is going to be a lot of difficulty to get above there, especially if we don’t get good news out of the United States/China trade talks. The 50 day EMA above of course is going to offer resistance, which is just above the resistance I was talking about. Signs of exhaustion could be selling opportunities, but if we can close above the 50 day EMA, then it would be an extraordinarily bullish sign and could send this market higher. I think at this point it’s all going to come down to the talks and China.

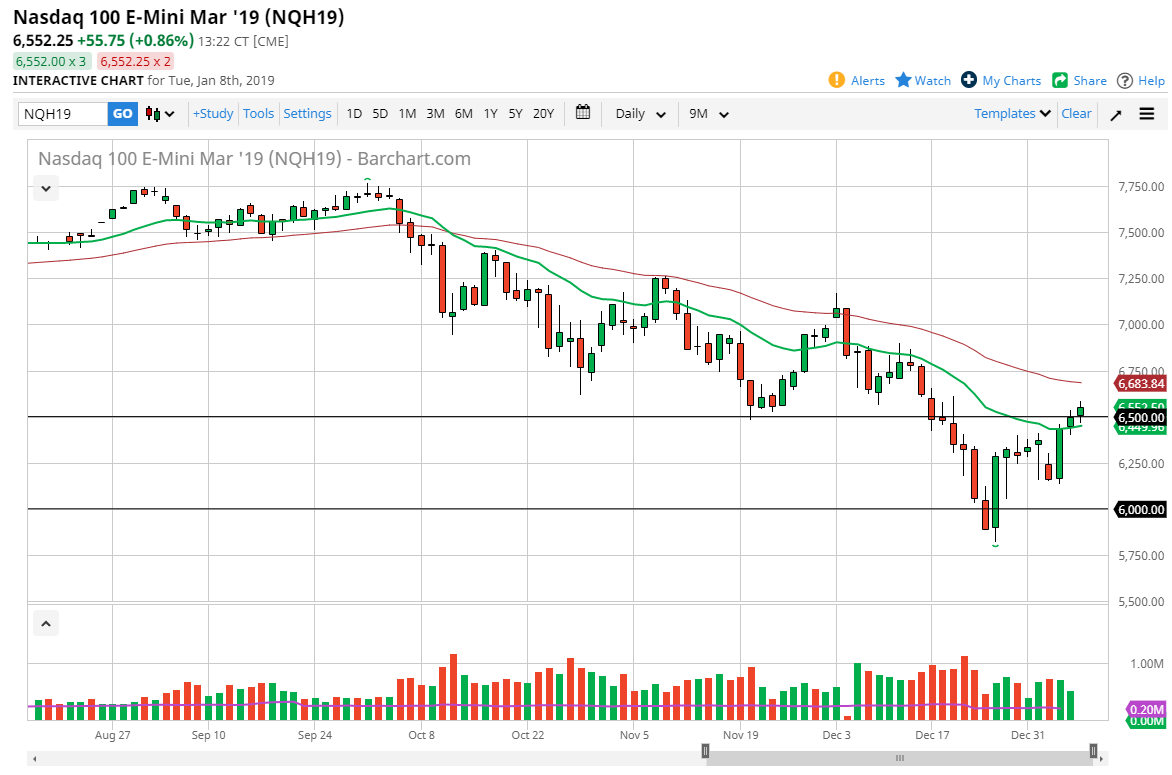

NASDAQ 100

The NASDAQ 100 has broken above the 6500 level, which of course is a round figure that a lot of people would pay attention to. I think that we will probably see this market react strongly to however the US/Chinese talks play out, because there is so much to win or lose by technology companies through those negotiations. I think we are entering an area that could be difficult to overcome though, so we will have to wait and see. It daily close above the 50 day EMA, pictured in red on the chart, would be a bullish sign and have me looking to go long. Otherwise, if we get some type of exhaustive candle in this area I think we could get a bit of a pullback. I do think that the worst is probably over, barring some type of nasty headline coming out of mainland China.