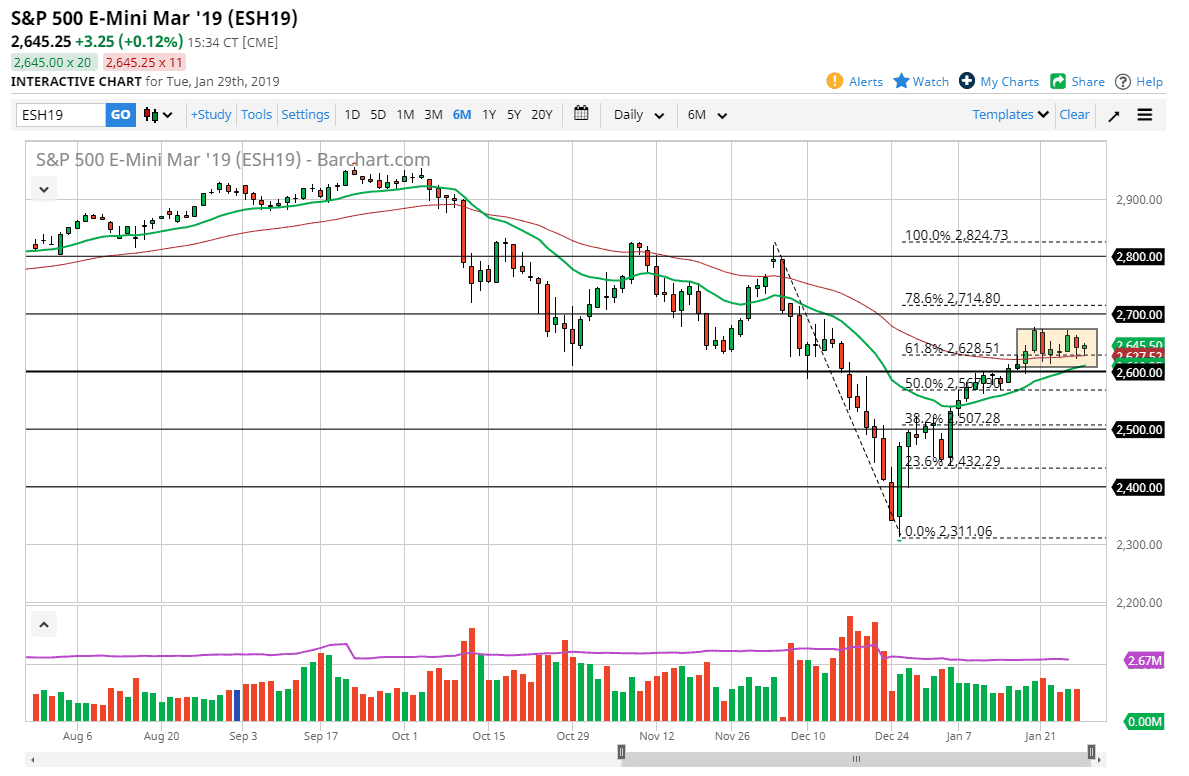

S&P 500

The S&P 500 has gone back and forth during the trading session on Tuesday, as we continue to bounce around the 50 day EMA. We are waiting for a lot of information over the next three days, with the Wednesday session featuring the FOMC Meeting and of course the press conference which will be parsed rather significantly by traders around the world to figure out where the Federal Reserve moves next. There is a lot of questions about whether or not the Federal Reserve is likely to continue to raise interest rates, or if they are willing to step away. If they look likely to step away, that should send this market higher but we also have the jobs number coming out on Friday, so that could keep this market somewhat compressed over the next couple of days. I believe we are essentially consolidating in a 100 point range overall, meaning that we need to clear the 2700 level, for the buyers to take over. On the other side of the equation, if we can break down below the 2600 level, then we could drop towards the 2500 level.

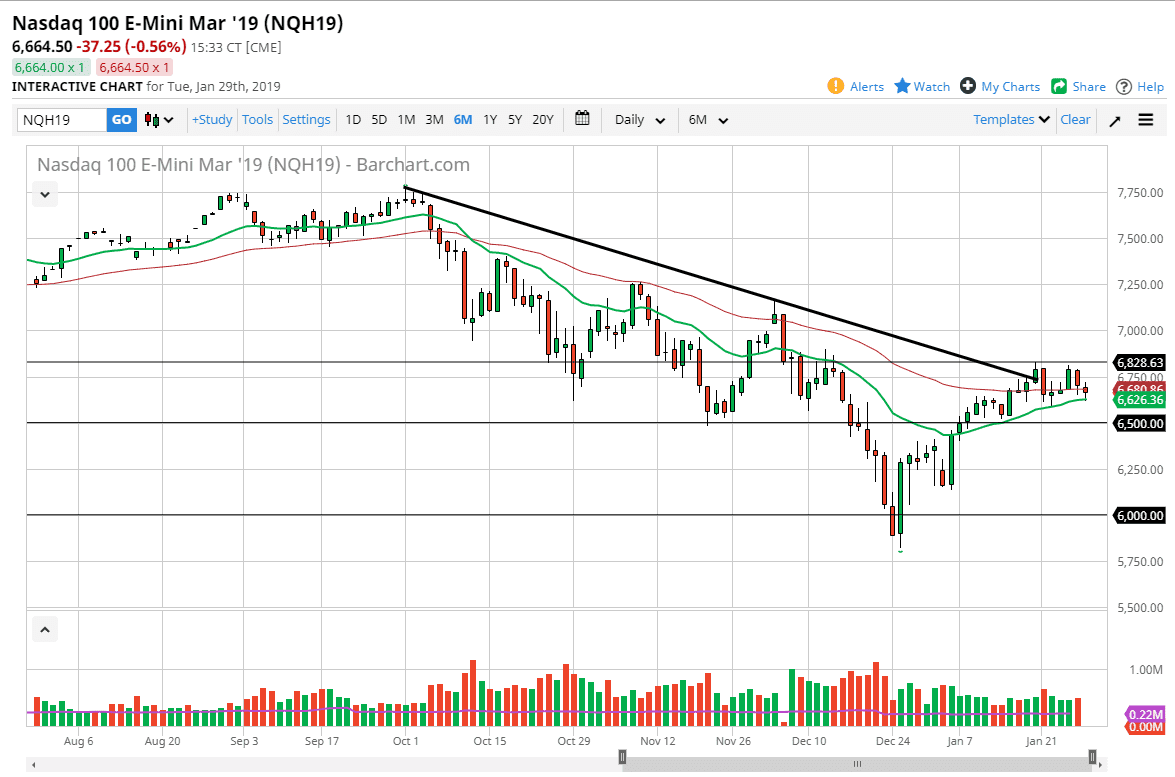

NASDAQ 100

The NASDAQ 100 had a slightly negative candle stick for the day on Tuesday but seems to respect the 20 EMA underneath it for support. At this point, it’s very likely that we could bounce from here, but I believe the 2868 25 level is going to cause a bit of resistance. We have Apple reporting after the bell on Tuesday, so that could greatly influence where the NASDAQ 100 goes in the short term. Beyond that, we have the US/Chinese negotiators speaking on Wednesday, and if something good comes out of that the NASDAQ 100 should take off. Otherwise, if we get negative results out either one of those two it could send this market a bit lower.