S&P 500

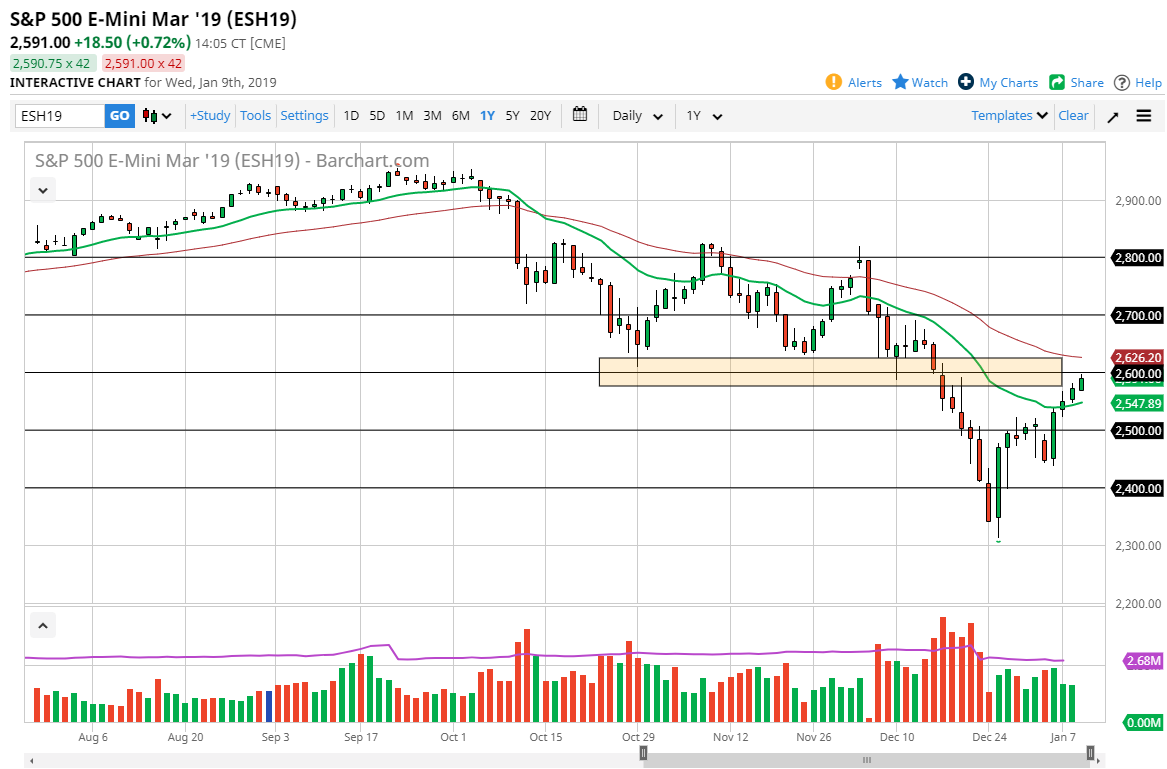

The S&P 500 rallied during trading on Wednesday, reaching towards the 2600 level. This is an area that I have marked as potential resistance due to the fact that it was massive support in the past. I think signs of exhaustion will be sold though, and I also recognize that the 50 day EMA is just above. It’s very likely that we could turn around there, if the market doesn’t get what it wants. What the market wants is some type of dynamite deal between the Americans and the Chinese, to be announced during the trading session. I believe that the next major move is setting up for the S&P 500 during the session today, because we now have a Federal Reserve that looks a bit more dovish or at least relaxed after the meeting minutes were released on Wednesday. Be very cautious but await the daily close before putting money to work. As things stand right now, there is still significant resistance to be overcome.

NASDAQ 100

The NASDAQ 100 took off to the upside as well and continues to press higher. The market is testing the 50 day EMA, and while we did have a nice move during the day, we have not broken through the important 50 day EMA, which I think is the tell to go long for the longer-term. I think at this point, we will have to wait until the end of the Thursday session to put serious money to work. A daily close above the 6750 level will have traders flooding into this market. However, if we get some type of disappointing or lackluster statement coming out of Beijing, it’s likely that this market will roll over and break down. The next 24 hours should be very crucial.