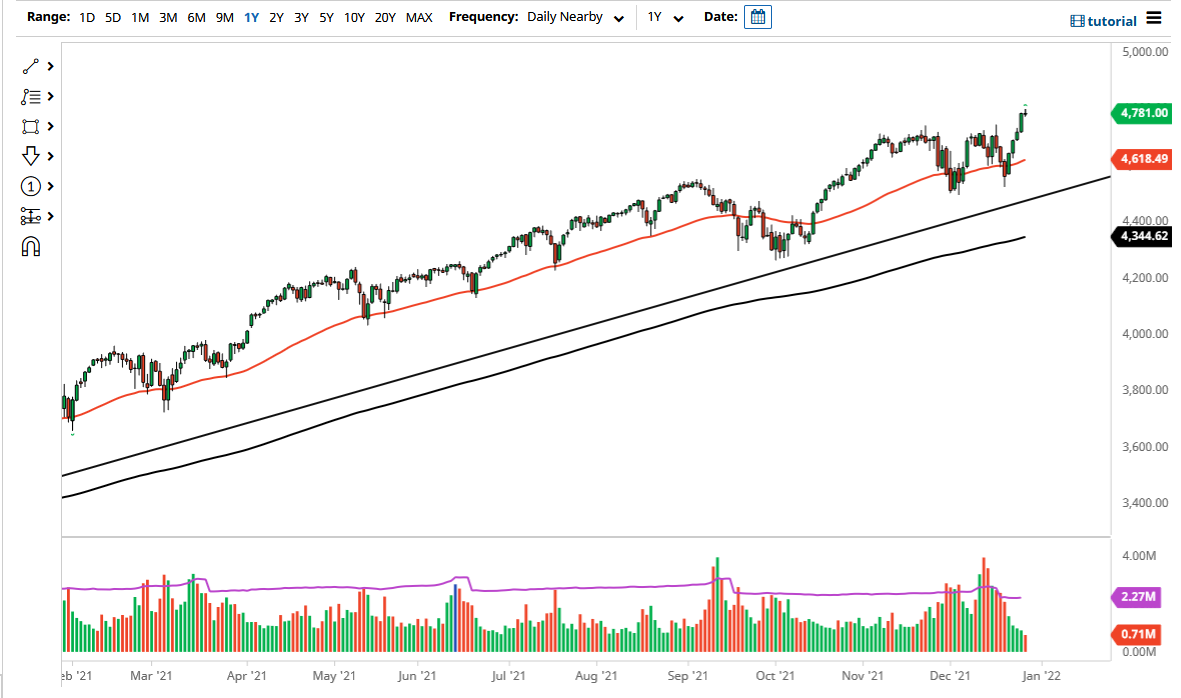

S&P 500

The S&P 500 initially pulled back during trading on Wednesday, but as the day went on, we started to see buyers jump in. We attempted to break out of the consolidation area during the day after the Federal Reserve press conference, but still remains well below a breakout level. With that being the case in the fact that jobs numbers come out on Friday, it’s very likely that this market will growing more than anything else. It certainly looks as if we are trying to build up the momentum to go higher, but quite frankly the clothes left a lot to be desired on the shorter-term. The 50 day moving average is just below, and therefore I think it’s only a matter time before buyers jump in on short-term pullbacks. That being said, if we were to break down below the 2600 level that would change everything.

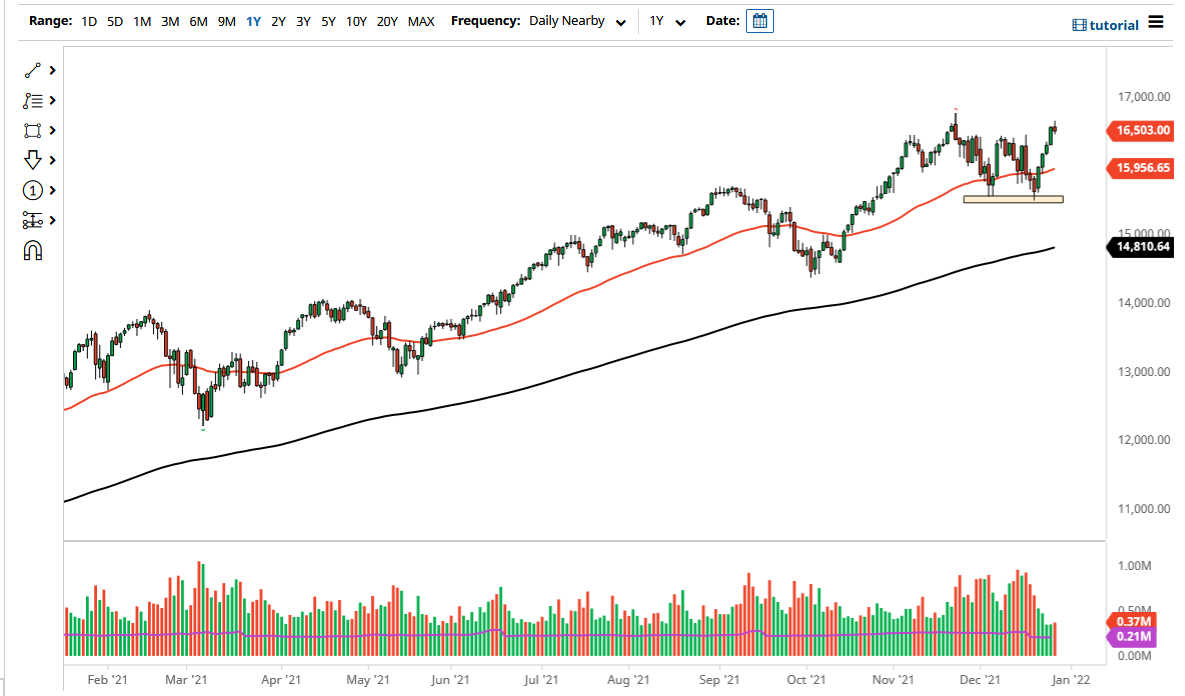

NASDAQ 100

The NASDAQ 100 looks much healthier, closing just below resistance. If we can break above the 6825 level for any significant amount of time, then I think the NASDAQ 100 is likely to go much higher. Pullbacks at this point should be well supported near the 50 day EMA, and therefore I am bullish of the NASDAQ 100 but I also recognize that the next couple of days offer a lot in the way of potential headlines problems. At this point, I think that a “buy on the dips” situation is what we are looking at, and if we get a good jobs number, or better yet some type of breakthrough with the US/China trade relations, that should send this market much higher. Obviously, if we get bad news from either of those, that could cause a bit of a pullback.