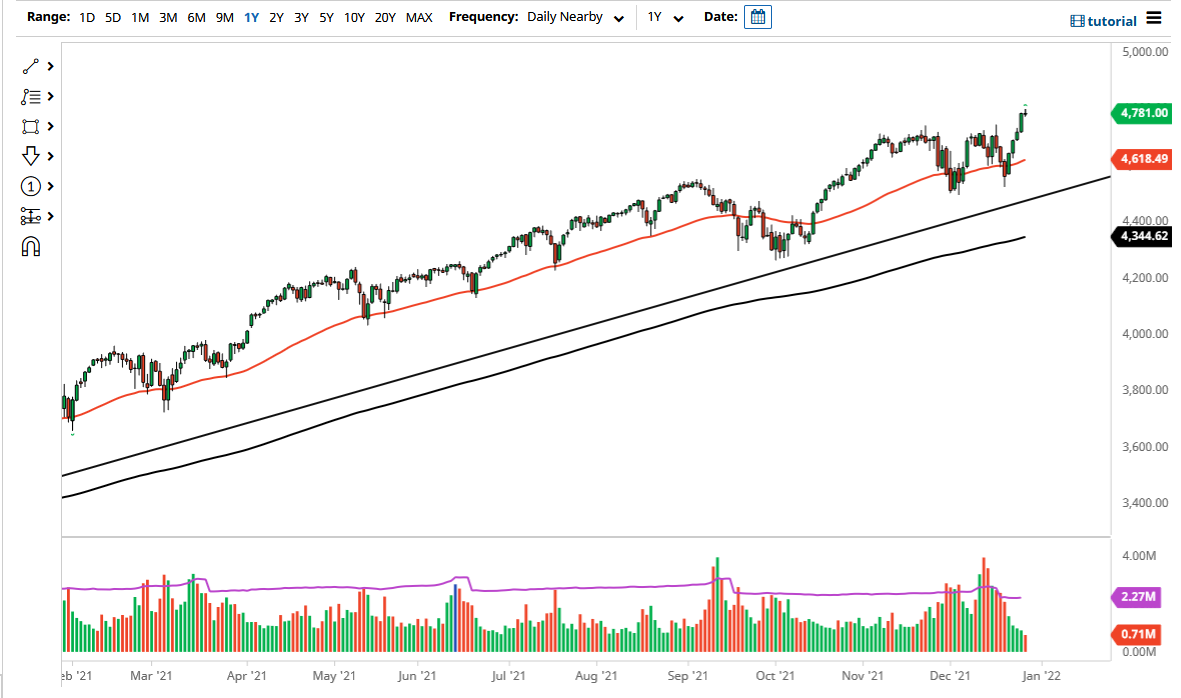

S&P 500

The S&P 500 went back and forth during the trading session on Wednesday, as we continue to see a lot of volatility. However, later in the day we have seen the S&P 500 futures contract break back above the 50 day EMA, which of course is a very bullish sign. I also recognize that the 2600 level underneath should be massive support, so I think it’s only a matter of time before buyers would jump in and as we pull back. That being said, if we break down below the level, then we could break down rather significantly. Otherwise, if we break to the upside the 2700 level will be massive resistance. A break above that level allows the market to go looking towards the 2800 level eventually. I think the one thing you can probably count on is a lot of volatility more than anything else.

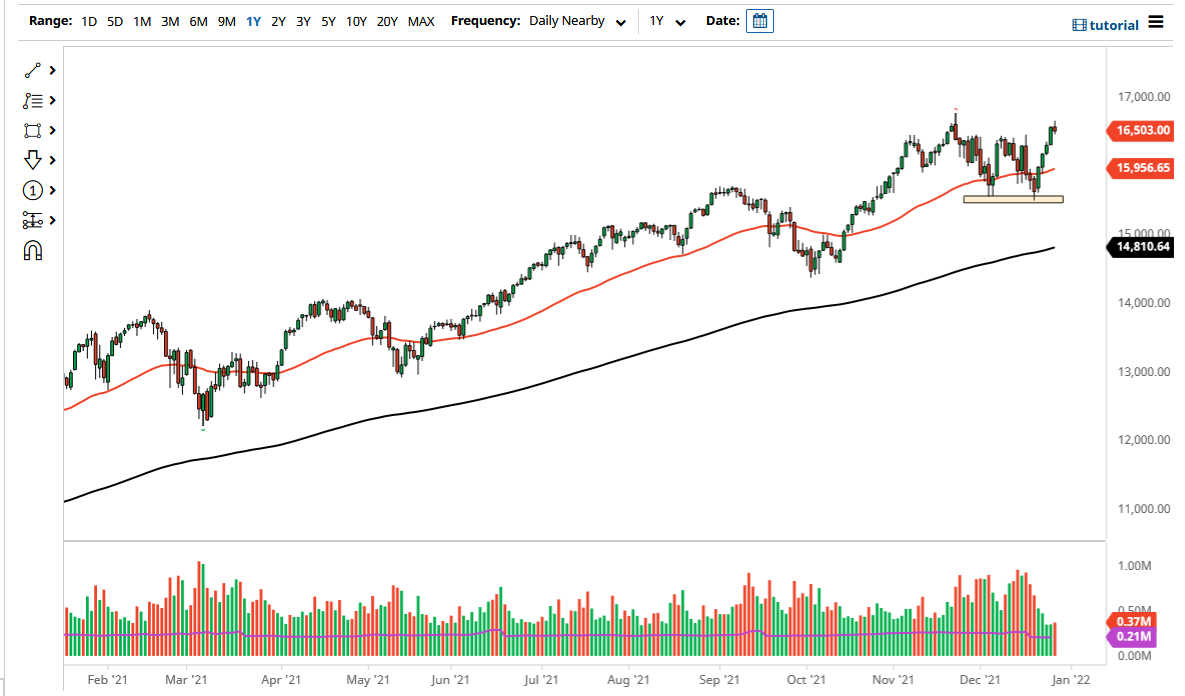

NASDAQ 100

The NASDAQ 100 had a relatively volatile day, but quite frankly by the time we closed, the candle stick was a little bit bullish in the sense that after the very bearish candle stick during the day on Tuesday, we held our own and the 20 day EMA has caused a bit of a bounce. I think if we can break above the top of the candle stick for the trading session on Wednesday, then I think the market could continue to go much higher. Overall, I do believe that we are trying to break out to the upside but obviously there is a lot of noise in this general vicinity. If we were to break down below the 6500 level, then the market could break down rather drastically. This is a market that looks like it is a beach ball held underwater, meaning that once we break out we could explode to the upside. Keep in mind that this market is highly influenced by the US/China trade situation as well.