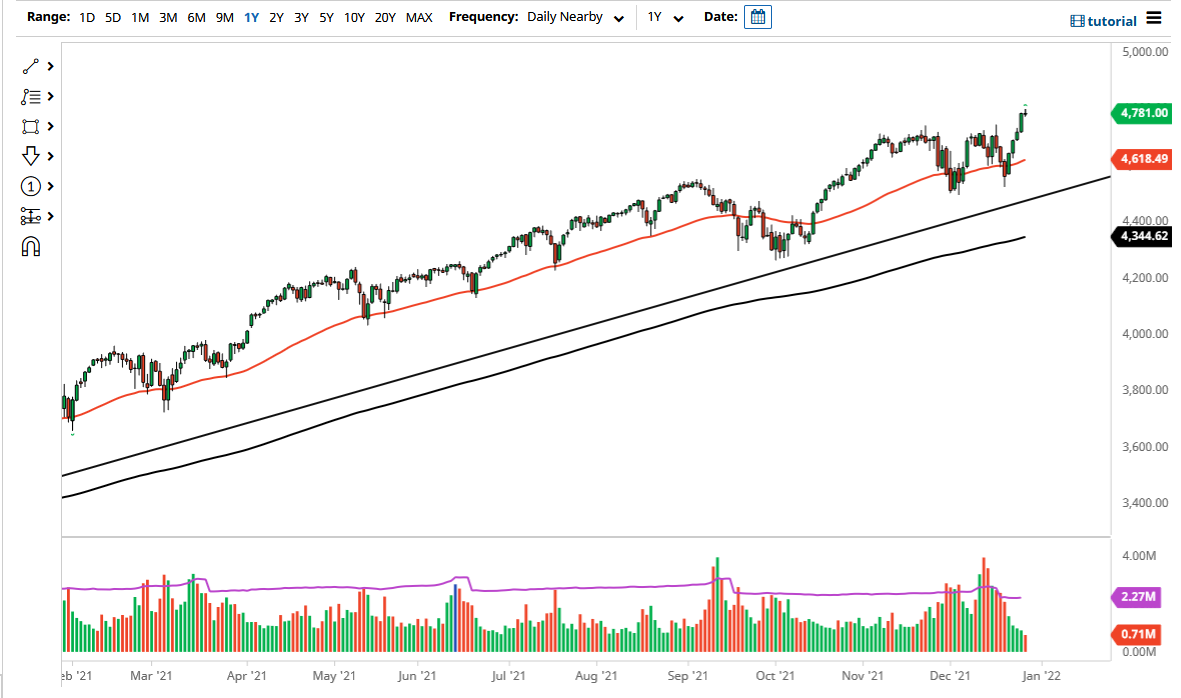

S&P 500

The S&P 500 rallied quite stringently during the trading session on Wednesday, breaking above the 2600 level overnight and slamming into the 50 day EMA towards the end of the day. However, we did close right at that moving average and could not break above it on the close. Because of this, I think that we may be getting ready to roll over slightly. However, if we can close at the top of the range for the session and will above the 50 day EMA, then I think we will finally see a complete change of trend. We are such precariously perched at this level and of course in the middle of the earnings season, expect a lot of volatility. I think ultimately though, the next couple of days will be crucial. At this point, I think this is an excellent place to lose money so if you are looking to shrink your account a bit, this is where you want to be because you’re going to be gambling.

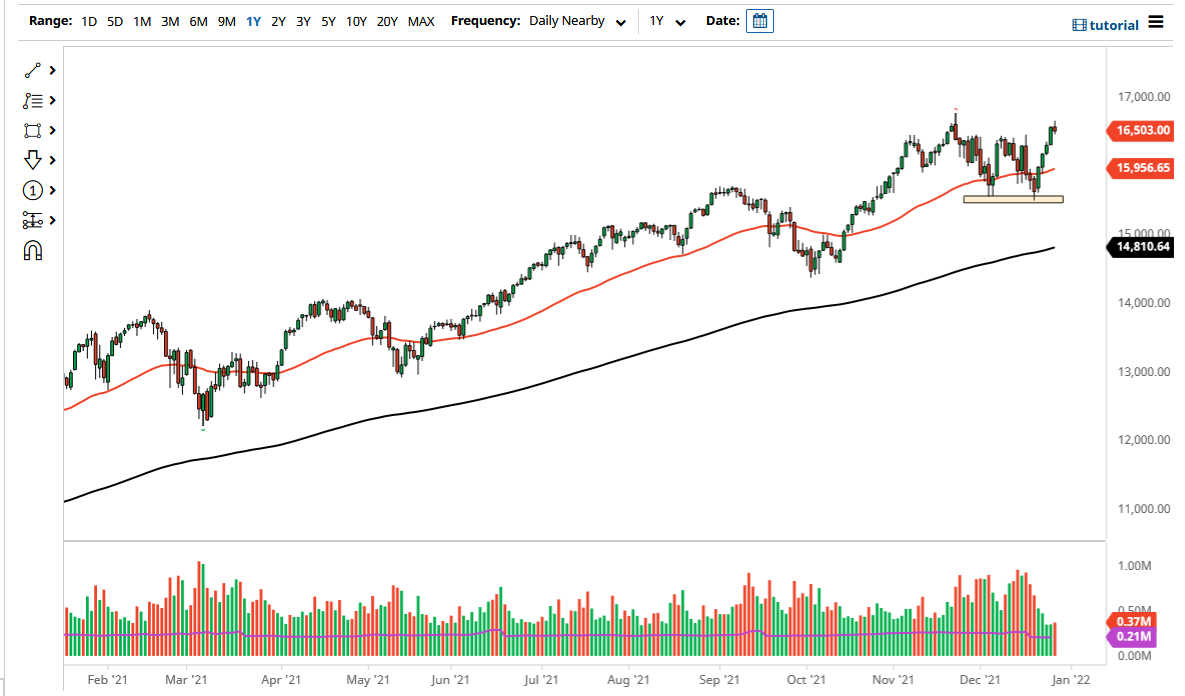

NASDAQ 100

The NASDAQ 100 rallied towards the 6750 level but then turned around to form a bit of a gravestone doji. With that, I think that we are probably going to see this market pull back towards the 20 day EMA, but if we do break above the 6750 handle, then it would show a continuation of bullish pressure and could send this market higher. I believe there is a bit of resistance just above though, so if we do roll over it shouldn’t be much of a surprise. I believe that the 20 day EMA or at least the 6500 level should offer support though, I think we are just simply getting a bit ahead of ourselves right now.