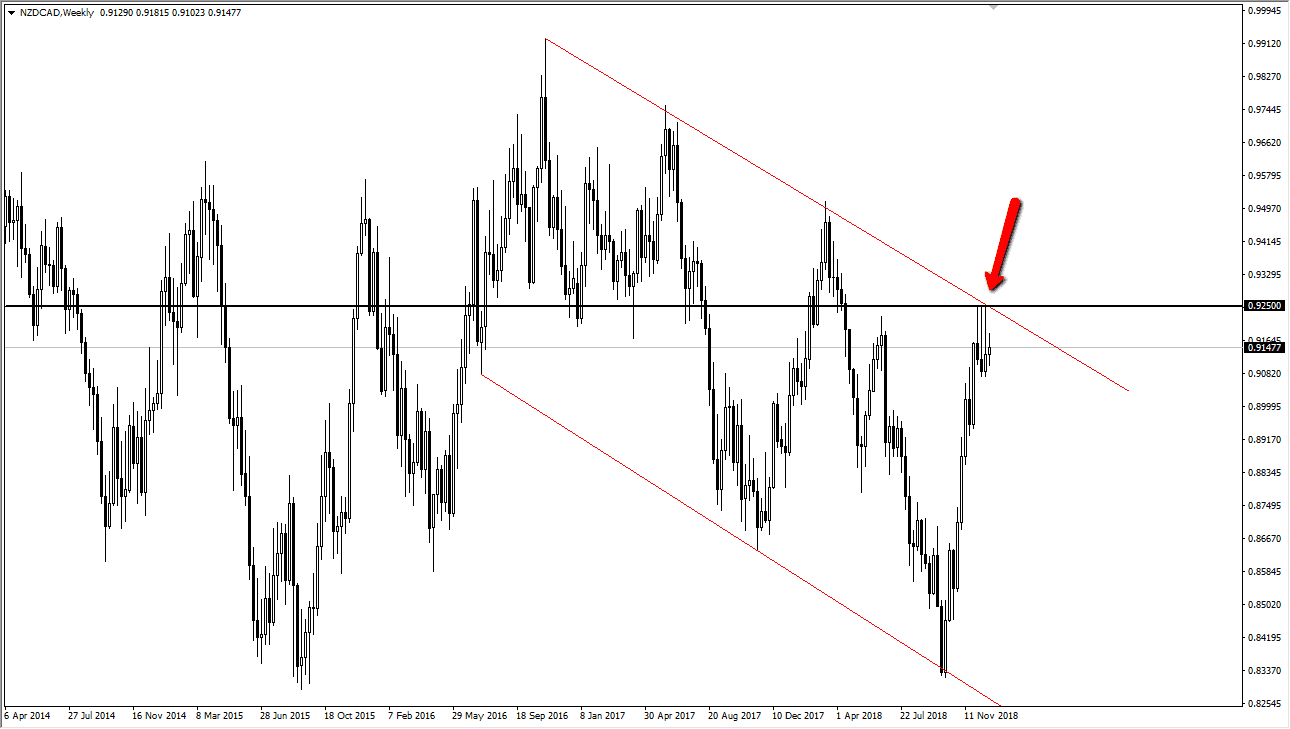

NZD/CAD

The New Zealand dollar has been very bullish against the Canadian dollar of the last several months, but December started to see significant resistance from around the 0.9250 level. Beyond that, there is also a major downtrend line from the massive channel that crosses in that general vicinity. I think at this point it’s likely that we will eventually see some type of exhaustion but look for short-term rallies to take advantage of.

The New Zealand dollar of course has exploded to the upside against the Canadian dollar, but quite frankly I think this has more to do with oil in Canada than it does New Zealand. All it would take is a little bit of negativity when it comes to the US/China trade situation to weigh upon the Kiwi dollar, and that of course could shift focus back to North America and away from Asia.

If we can break down below the 0.91 handle, I think the market could very well go looking towards the 0.8850 level rather quickly. We are in a downtrend longer term, and therefore it would make sense that we try to go all the way back down to the bottom of the channel. Obviously, that’s the longer-term call and I don’t think we will reach their by the end of January. I do think that January is going to be bearish for this market though, based upon the technical analysis that looks so obvious to me. However, there is always the possibility that things turn around. If they do, and we get a daily close above the 0.93 handle, then we could look at a move to the 0.95 level, possibly even parity over the longer-term. All things being equal though, I do like fading rallies for January.