Gold

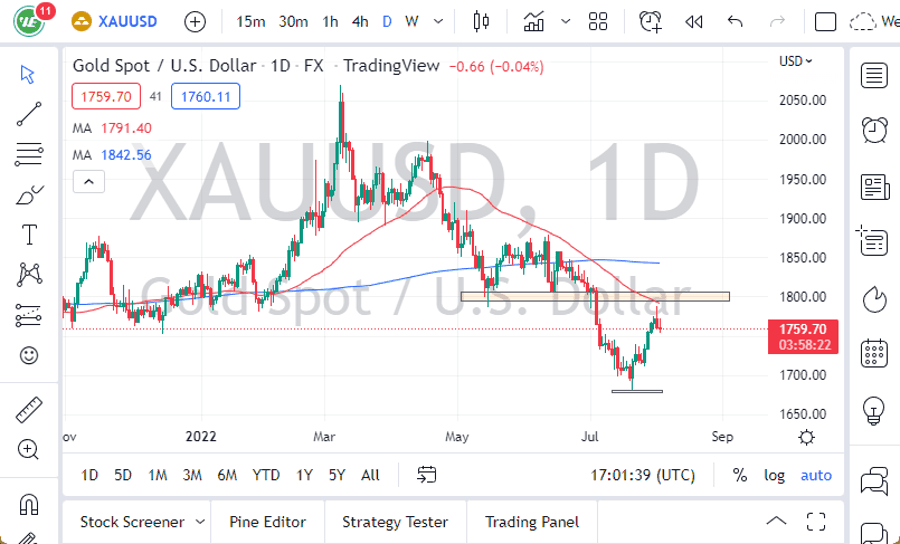

Gold markets went back and forth during trading again on Wednesday as we continue to trade in a very tight range bound market. This makes sense though, because we are hovering just below a major round figure in the form of $1300, which will make a lot of traders pay attention. We have the 20 day EMA underneath though, which offers plenty of support. Beyond that, we have the top of the previous uptrend channel, so I think there are plenty of reasons to think that the market may try to break out to the upside. However, the session on Wednesday was very quiet and I think the market is simply trying to buy at its time before building up enough momentum to finally break out.

Pay attention to the EUR/USD pair, because it is a bit of a harbinger as to what’s going to happen with the US dollar. If it breaks out to the upside and continue to go higher, it’s very likely that the Gold markets will follow right along as it should be a move against the US dollar. I believe that the market breaking above the $1300 level on a daily close sends it looking for the $1325 level, the $1350 level, and then eventually the $1400 level above which is my target. After all, the $1400 level was the top of a major consolidation area, and therefore will more than likely need to be tested again as is the norm in these markets.

If we do break down below the 20 day EMA on the chart, pictured in green, then I think will probably go looking towards the 50 day EMA underneath where I would expect to see even more buyers. This is all about the Federal Reserve being a bit more dovish now, and that of course has given a lift to many of the precious metals.