Gold prices rose $8.21 an ounce on Thursday, as the dollar weakened and investors sought safety from volatile stock markets. The Institute for Supply Management reported that its index of national factory activity dropped to 54.1 from 59.3 a month earlier. Despite signs of slowing economic growth, the labor market appears healthy. The private sector added 271000 jobs in December, according to the ADP’s National Employment Report. All eyes will be on the U.S. monthly jobs data due out later today. Some traders tend to use ADP’s data to get a feeling for the Labor Department’s report, though these figures aren’t always accurate in predicting the outcome.

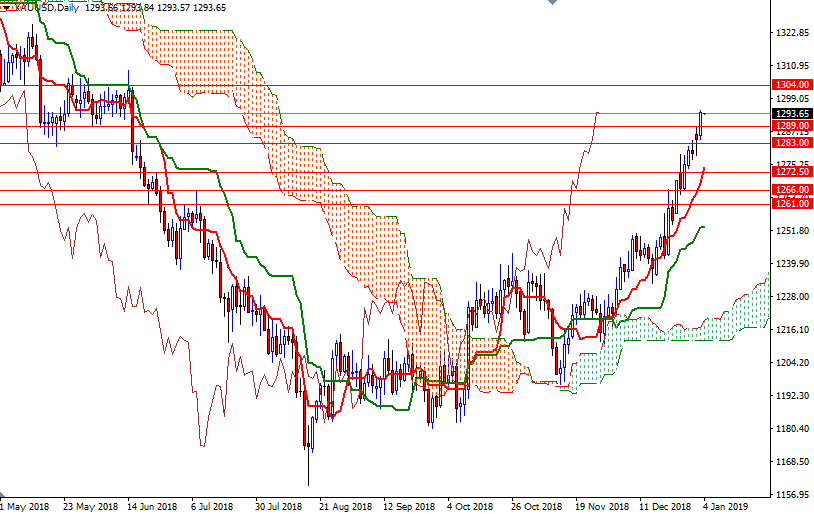

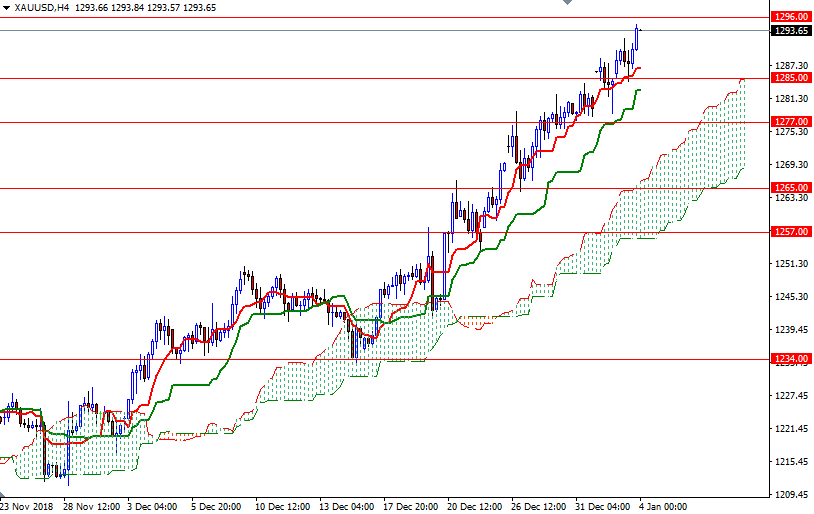

XAU/USD is trading above the Ichimoku clouds on the daily and the 4-hourly charts, suggesting that the bulls have the overall near-term technical advantage. Closing above the 1293.50 level indicates that the market is headed towards the 1296 level. If the market can climb and stay above 1296, then the next target will be 1300 - this barrier may remain intact until the release of the U.S. jobs report. A break through there could trigger a push up to 1307/4.

The bears, on the other hand, have to pull prices back below 1289 to test the support in 1285/3, an area occupied by the hourly Ichimoku cloud. If this support is broken, we may revisit the 1279/7 zone. A break below 1277 implies that prices will return to the 4-hourly cloud. In that case, look for further downside with 1274 and 1272.50-1270 as targets.