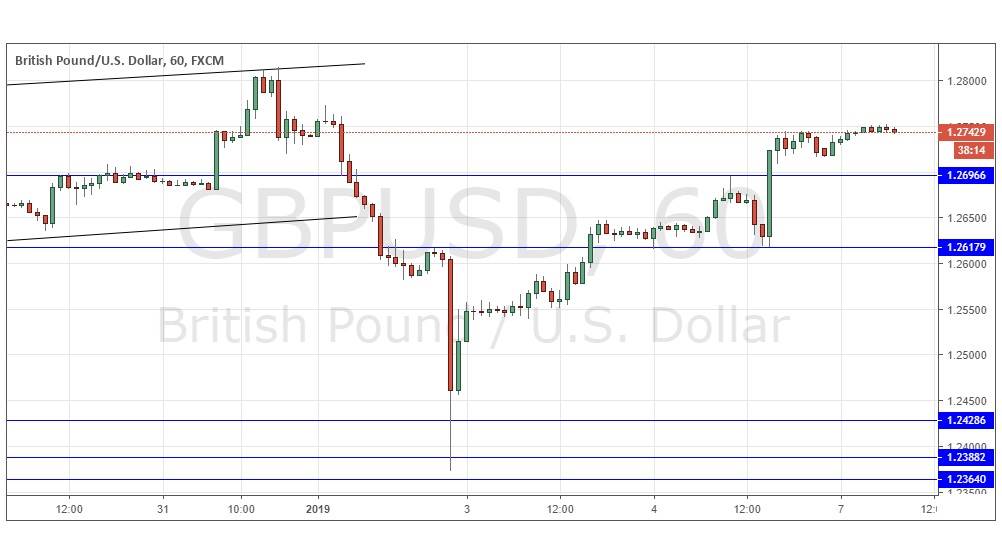

Last Thursday’s signals were not triggered, as there was no bearish price action at 1.2626.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Short Trade

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2918.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trades

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2697 or 1.2618.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Thursday that following the “flash crash” which temporarily sent the British Pound sharply lower, that there was short-term bullish momentum. After such dramatic movements, it is typically wise to stand aside for a few hours and to let things settle. I had no directional bias here, and I thought that the nearest resistance level at 1.2626 was likely to hold today. I was wrong, it was broken, and the price continued to recover which has surprised me.

If the price can get established above 1.2750 that would be a bullish sign, and there are no key resistance levels until beyond 1.2900. However, it might be too early to be bullish. The bullishness is surprising considering the British Parliament will be holding a vote on the Brexit deal next week which the Government still seems likely to lose. I have no directional bias today, but I am expecting more volatility as we get closer to the vote each day and some trading opportunities are likely to arise. There is nothing of high importance due today concerning the GBP. Regarding the USD, there will be a release of ISM Non-Manufacturing PMI data at 3pm London time.

There is nothing of high importance due today concerning the GBP. Regarding the USD, there will be a release of ISM Non-Manufacturing PMI data at 3pm London time.