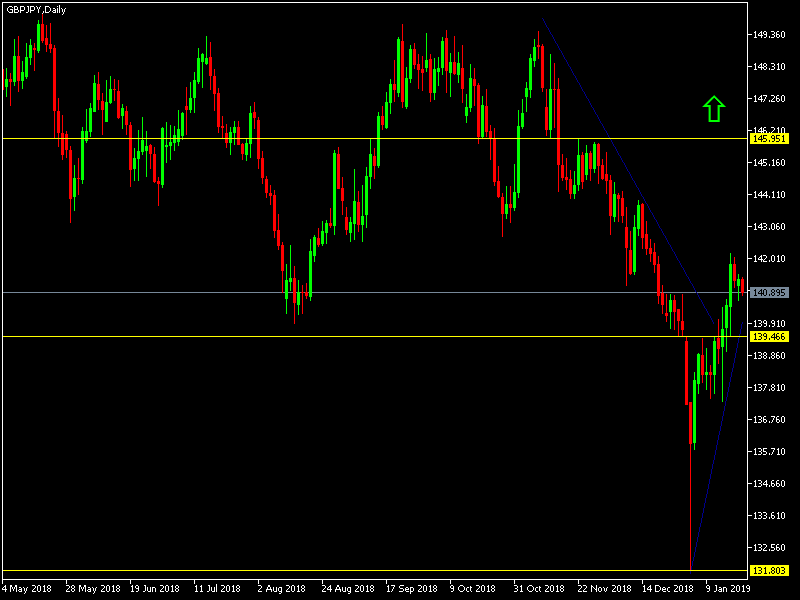

Prior to the release of UK employment and wages data, the GBP/JPY is holding steady moving above the psychological top peak at 140.00, making the opportunity for upward correction stronger. The recent gains have reached to the resistance level at 142.19, the highest for this pair in a month, before setteling at 140.80 at the time of writing. The British prime minister announced an alternation to the BREXIT deal making it more flexible in solving the disputed points in her deal in an attempt to convince the opposition to vote again for the deal and avoid a “no deal” BREXIT, or delaying it for 2 years at least.

The recent gains came with the fallback of the Yen and the increase in risk sentiment by investors amid a new hope regarding the US/China trade conflict. It must be noted that the pair's gains will be vulnerable to collapse in the event where negative updates were released relevant to BREXIT. For the second time, May and her government survives a trust vote in the UK parliament, but what is noticeable this time is that the margin between proponents and opponents is small, which means that May’s future seemed strongly threatened, especially with her failure to pass her BREXIT deal.

The Bank of England, led by Mark Carney, renewed the warning that the country's exit from the union without a deal would mean a severe economic recession, a pounding of the pound and a rise in the cost of food, medicine and all services. The pound will remain in the position of observer for the end of the BRIXET Marathon with the loss of time for the official exit from the European Union in March. The latest opinion poll indicated that Britons prefer to stay in the EU rather than hold another referendum. Increased fears and concerns in the markets are usually in favor of the Japanese Yen as one of the most important safe havens.

Technically: The GBP / JPY fall below the psychological resistance level t 140.00 will restore the pair's bearish momentum and its nearest support levels will be 140.00, 138.80 and 136.00 respectively. On the upside, it will need to stabilize above the resistance at 140.00 to have a good correction opportunity and the nearest resistance levels currently for the pair are at 142.75, 143.50 and 145.00, respectively. I still prefer selling this pair at every rebound as the pound’s future remains uncertain as BREXIT negotiations continue.

On the economic data front today: The pair will be awaiting the announcement of job numbers and wage growth data in Britain. The pair will be in a state of anticipation and waiting for BREXIT negotiations. It will also focus on the uptake of safe havens.