The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 20th January 2018

In my previous piece last week, I was long AUD/USD and NZD/USD. AUD/USD fell by 0.77% and NZD/USD fell by 1.35%, producing an averaged loss of 1.06%.

Last week saw the strongest rise in the relative value of the British Pound, and the strongest fall in the relative value of the Japanese Yen.

Last week’s Forex market was livelier and was dominated by a continuing recovery in stock markets, and a lesser recovery in the U.S. Dollar. The British Pound also strengthened as the British Parliament took steps to prevent a “no deal” Brexit outcome. The British Pound is experiencing higher volatility.

This week is likely to be dominated by central bank input concerning the Euro and the Japanese Yen.

Fundamental Analysis & Market Sentiment

Fundamental analysis remains unclear on the U.S. Dollar. The stock market has continued to recover from its lows but remains a bear market technically. There are major fears over the seeming high sensitivity of the economy to any further rate hikes, as evidenced by the fact that the FOMC appears to have given up on its originally planned further rate hikes for 2019. The ongoing trade dispute with China appears to be moving towards a positive resolution, which is a good sign. However, the government shutdown appears to be an intractable dispute with no end in sight. JPMorgan currently suggest that the market is pricing in a 60% chance of an economic recession in the U.S. occurring at some point during 2019.

The British Parliament rejected the European Union’s Brexit deal by its widest margin in recent history, but the Government survived a confidence vote the following day, and the British Pound has continued to strengthen. This is because it seems clear that Parliament will ultimately vote to either postpone or even cancel Brexit before 29th March, with a “no deal” exit looking very unlikely despite the media hysteria which suggests otherwise.

Precious metals and the Australian and New Zealand Dollars have sold off despite looking strong only a few days ago.

Technical Analysis

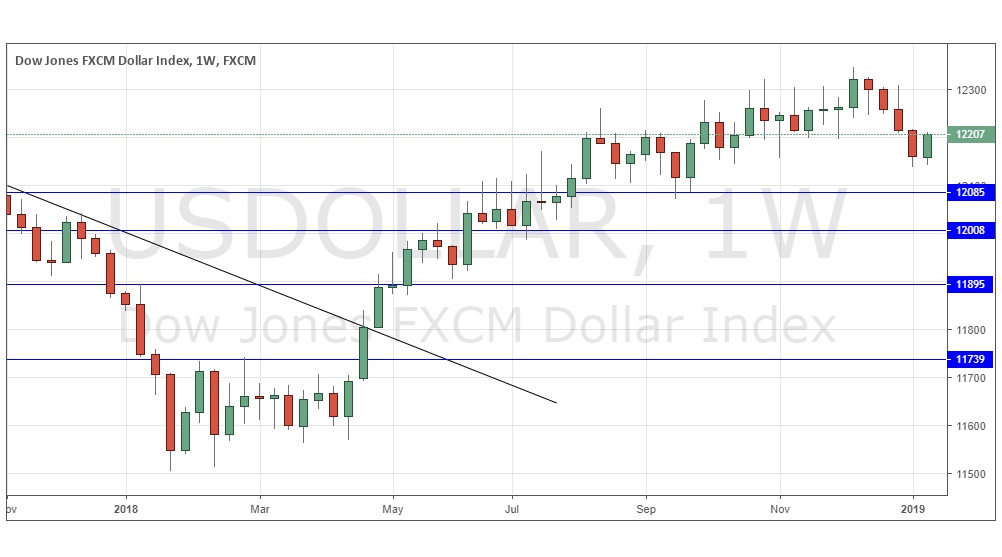

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index rose, printing a bullish inside candlestick that closed right on its high. However, there is truly no 3-month trend at all, and the price has broadly consolidated over the past several weeks, suggesting forecasting movement has become almost impossible. The price is still up over 6 months, which is conversely a bullish sign. The situation looks mixed up and dangerous.

The major difficulty in trading the current market is that there are no clear long-term trends to exploit anywhere. For this reason, it may be wise to stand aside over the coming week.

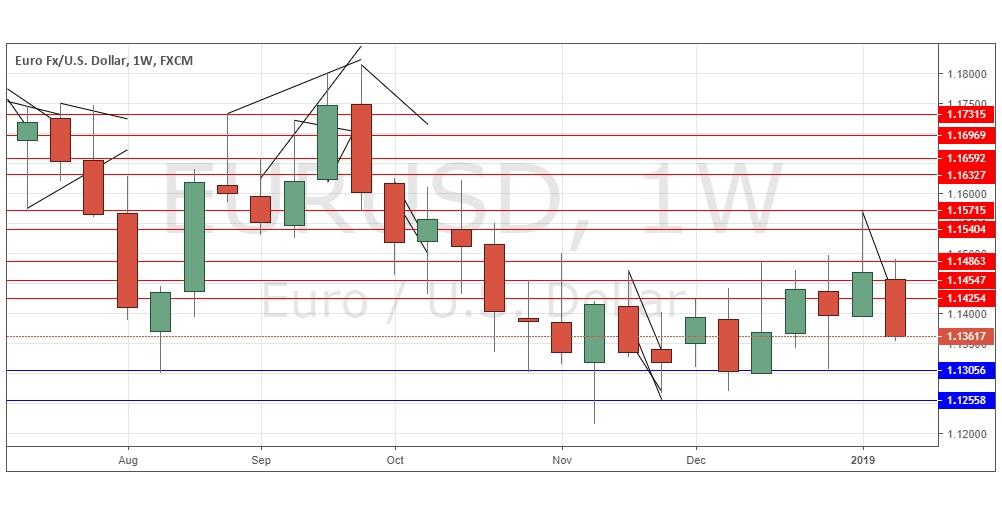

EUR/USD

The weekly chart below shows last week produced a large bearish engulfing candlestick which closed very near its low price following the previous week’s large bullish candlestick. Additionally, the price has room to fall before meeting the next support level. A further bearish sign is that the price is below its level of three months ago and of six months ago. The trend is very slow and weak but there seems to be a bearish trend here while there are no other strong long-term trends in the Forex market.

Conclusion

It is probably unwise to take any long-term trades on a weekly basis in the current market.