EUR/USD

The Euro has been very choppy as of late, bouncing around in a relatively tight range. We ended the month of December slightly positive, but the keyword here is “slightly.” In other words, the market really hasn’t been doing much. As for the month of January, things could get interesting because we have a lot of competing factors on both sides of the Atlantic Ocean that will move this pair.

As for the bearish case, you can make an argument that there is a lot of global uncertainty, and that does tend to favor the US dollar. Beyond that, there are massive demonstrations in the European Union, and of course there are a lot of questions about whether or not the EU is going to head into recession. In general though, one thing that should be thought of is that this is a two-sided market, meaning that we need to look at both sides of the equation. For what it’s worth, right before the end of the month it was announced that the Italians were acquiescing to demands by the ECB as far as budget is concerned. This of course would be positive.

As for the bullish case, not only the situation in Italy seems to be working itself out, you also have questions as to whether or not the Federal Reserve has become a bit more dovish. If that’s the case, then it could be negative for the US dollar. Ultimately, I think a lot of this comes down to a couple of levels that we are paying attention to.

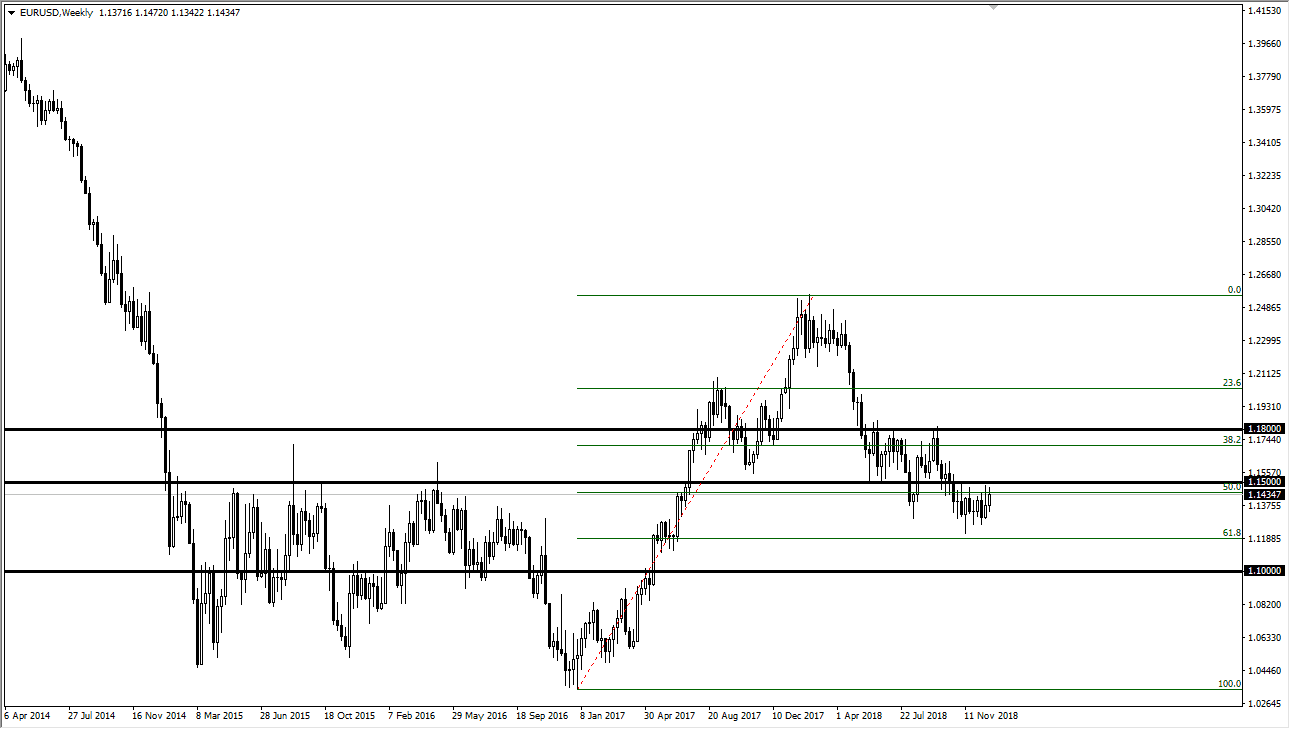

The 1.15 level above being broken on a daily close is a sign that perhaps we could go to the 1.16 level, or perhaps the 1.18 level if we get serious momentum. On the downside, I think the 1.12 level is going to offer a lot of support, as it is the 61.8% Fibonacci retracement level. I believe that January is going to be very choppy, but it should be pointed out that it looks as if we are trying to break out to the upside. Pay attention to the 1.15 handle, and the 1.12 level as it will give you directionality once we leave that box.