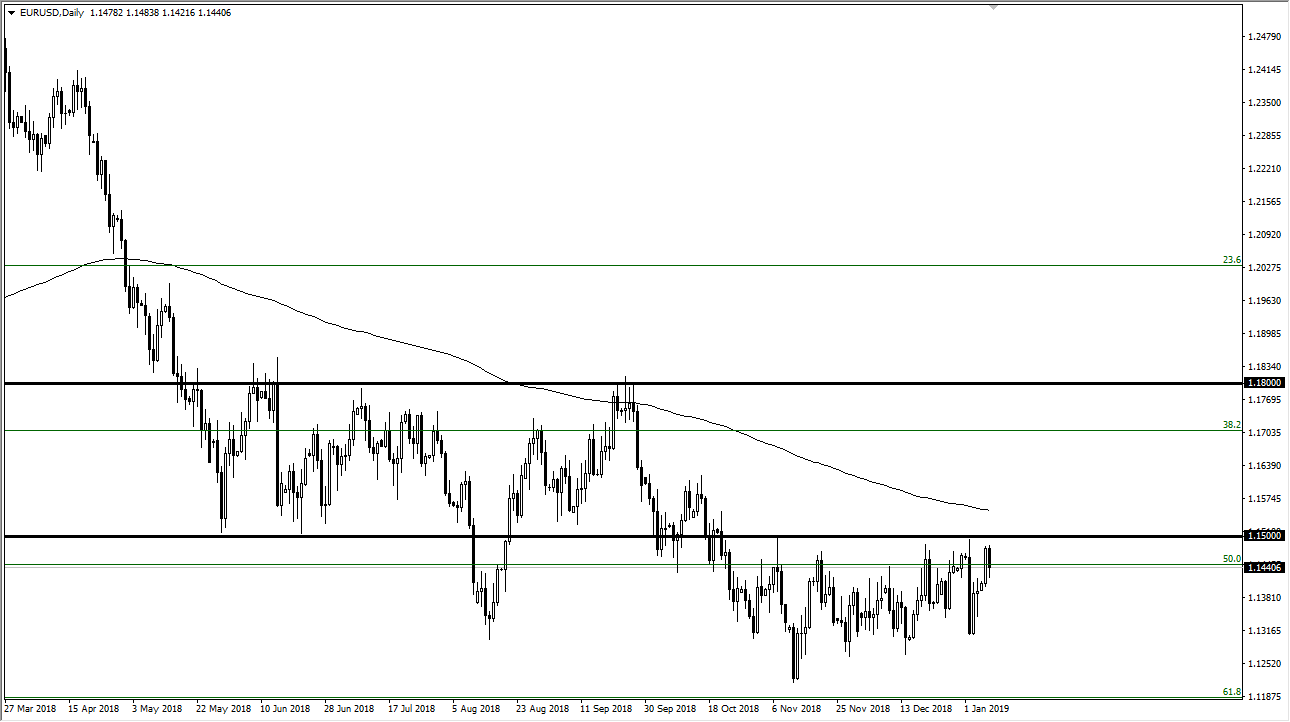

EUR/USD

The Euro fell during the trading session on Tuesday as the 1.15 level continues to be too resistive for the market to overcome. Beyond that, the 200 day EMA is just above there, so I think there’s even more bearish pressure. However, when you look at the longer-term chart you can clearly see that there has been a bit of a “rounded bottom” farming, which of course is a bullish sign. I think that we see more choppiness and indecision in the short term, but it does look as if the market is trying to sell the US dollar off given enough time. If we do break above the 200 day EMA, the market should then go to the 1.18 level over the longer-term. I believe in buying pullbacks, so if you are patient enough you should get an opportunity.

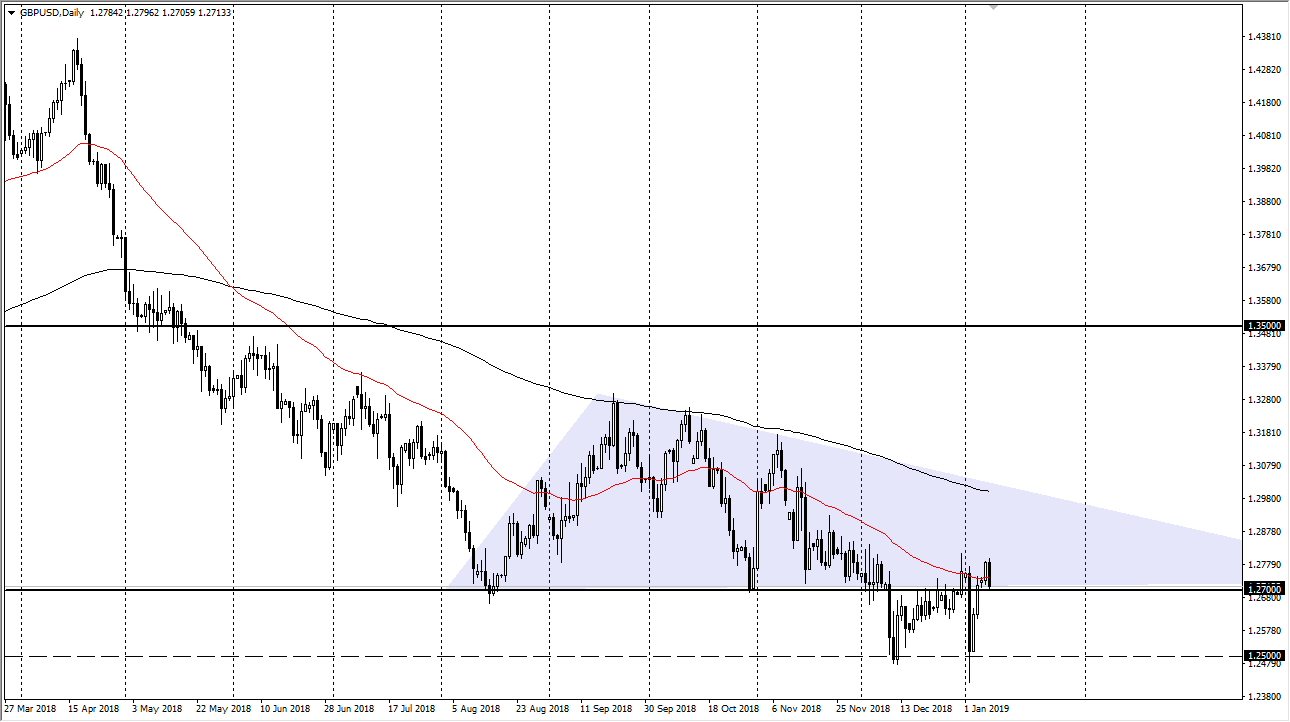

GBP/USD

The British pound pulled back during the trading session on Tuesday, reaching towards 1.27 level. This is an area that has been important more than once, and then after a defeat in the British Parliament of the government, it suggests that the British pound is going to continue to struggle overall. I think that a break down below the 1.27 level is a sell signal, and then the 1.25 level will be targeted. Rallies at this point should continue to be faded, or at the very least not bought as I think there are far too many headlines risks out there for the British pound still. I think the one thing that helped the British pound overall is that the US dollar has been a little bit softer due to the Federal Reserve changing its tone as of late. That being the case, I expect a grind lower more than anything else.