EUR/USD

The Euro rallied significantly on Monday, as we are starting to see more of a “risk on” attitude to the markets, especially as Jerome Powell suggested that perhaps the Federal Reserve may be a bit more relaxed about raising rates. If that’s going to be the case, then it’s very likely that the Euro will be the beneficiary. However, there are a lot of problems in the European Union as well, so I think that rallies at this point will at best be jagged and difficult to deal with. I recognize that there is a lot of major resistance above, extending all the way to the 1.16 handle. Once we break above the 200 day exponential moving average on a daily chart, then I’m willing to buy this pair and hold onto that trade for a huge move. Otherwise, we are definitely pressing our luck right now, and could see a pullback soon.

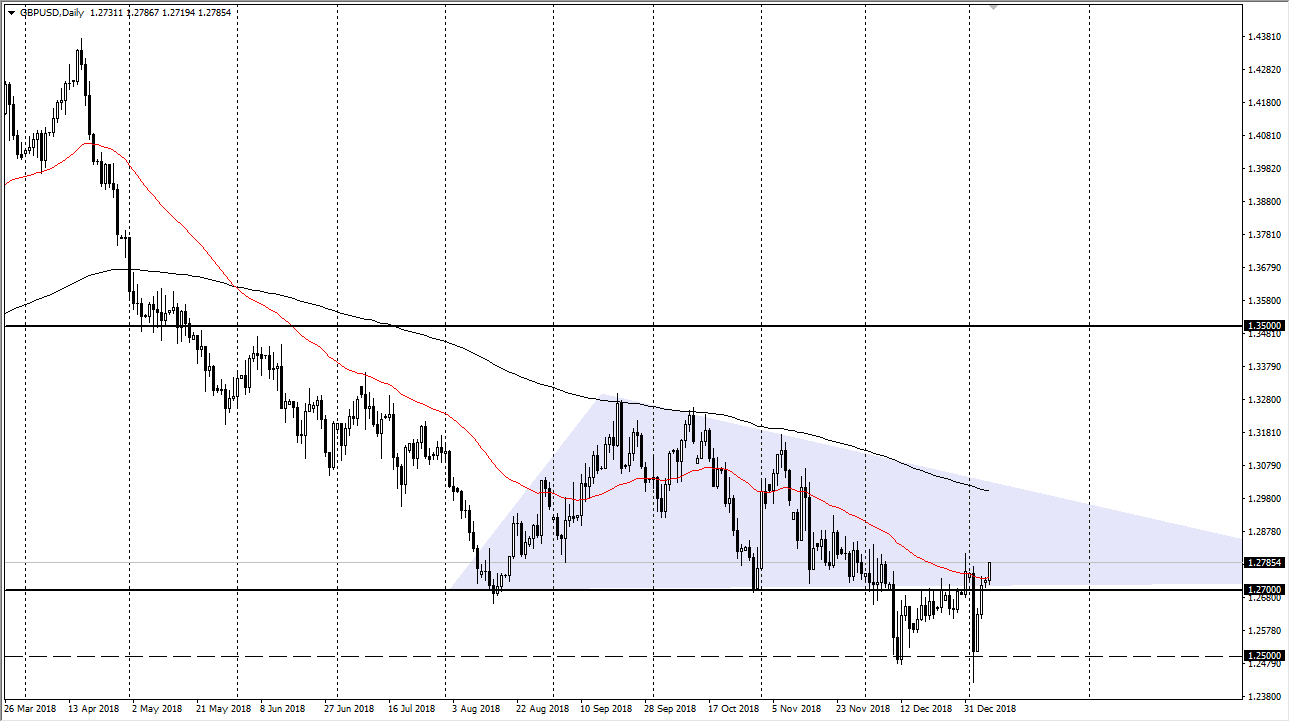

GBP/USD

The British pound has gotten a bit of a reprieve over the last several days, as we approached the 1.28 level, an area that caused a lot of resistance previously. The question now is whether or not headlines involving the Brexit will continue to put bearish pressure on the Pound. I think at this point, even if we do rally from here you need to keep an eye on the 200 day moving average which is at the top of the previous descending triangle. I think that the market is still susceptible to headline shock, so even if we do rally a bit, I would be a bit cautious about putting too much money to work to the upside. However, at the first signs of exhaustion I wouldn’t hesitate to start shorting.