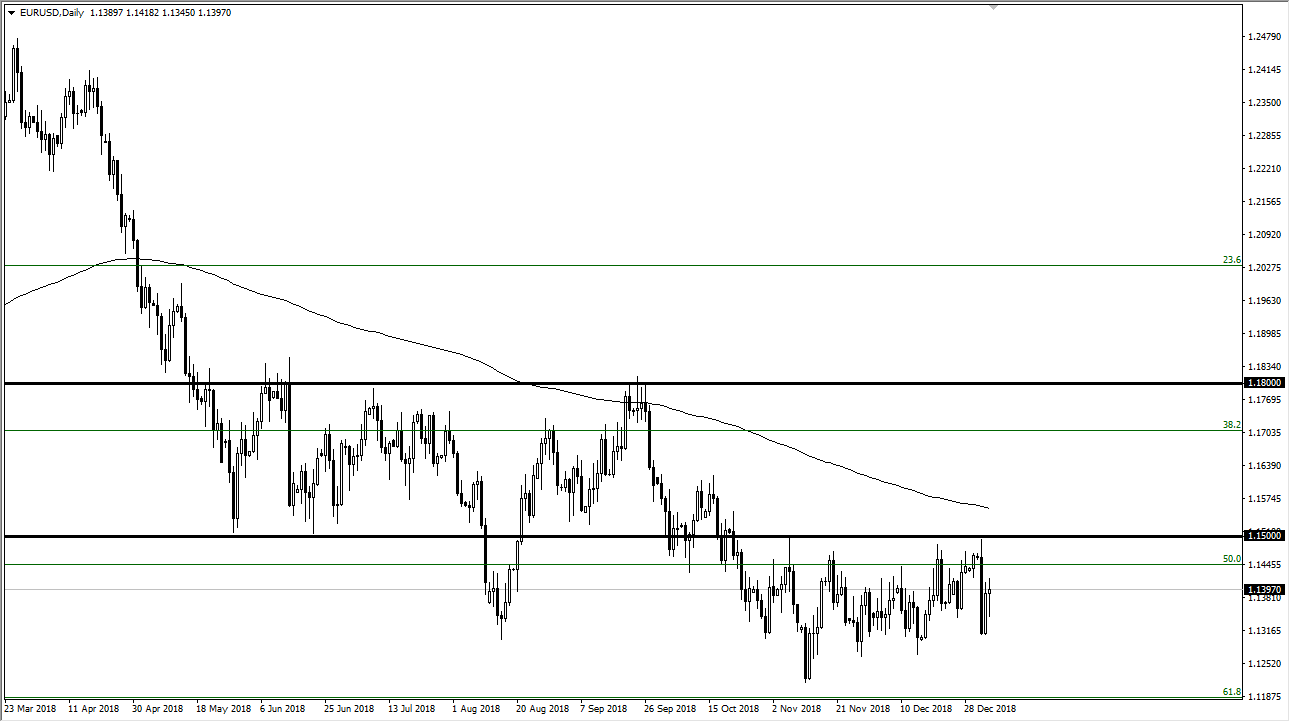

EUR/USD

The Euro initially fell during the day on Friday but then got a bit of a boost as the jobs number was turned around by Jerome Powell, who suggested that perhaps the Federal Reserve was willing to bend to the will of Wall Street and keep the cheap money coming if necessary. This is obviously negative for the US dollar, but at the same time we have a lot of problems with the European Union so I think this just keeps us in the quagmire of sideways trading. The Euro continues to have a lot of resistance built in at the 1.15 handle, just as it has a lot of support built in at the 1.13 level and slightly below. A lot of back-and-forth trading should continue to be the norm, so short-term traders who can take advantage of a range bound system will probably benefit the most from this market plays.

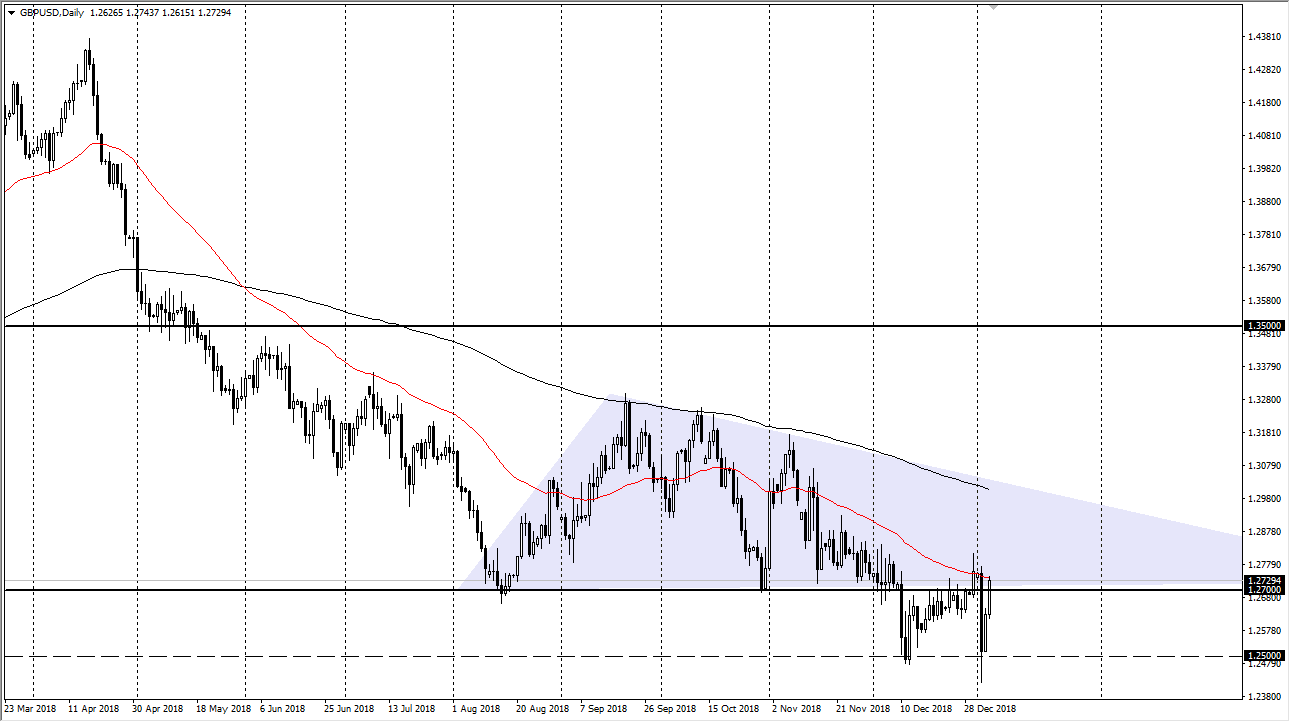

GBP/USD

The British pound was a huge beneficiary of US dollar weakness during the day again, as we continue to see explosive moves in this pair. However, nothing has fundamentally changed with the Brexit, and we are testing the 50 day EMA which of course is rather negative. We have almost wiped out the very negative candle stick from Wednesday, but I think it’s only a matter of time before we roll over because all we need is a bad headline coming out of the negotiations to send people running again. Don’t get me wrong, this has been a strong couple of days, but at the end of the session, we are still very much in a downtrend and I think that the sellers will eventually make their feelings known. I anticipate that a move below the 1.27 level opens the door for a return to the 1.25 handle.