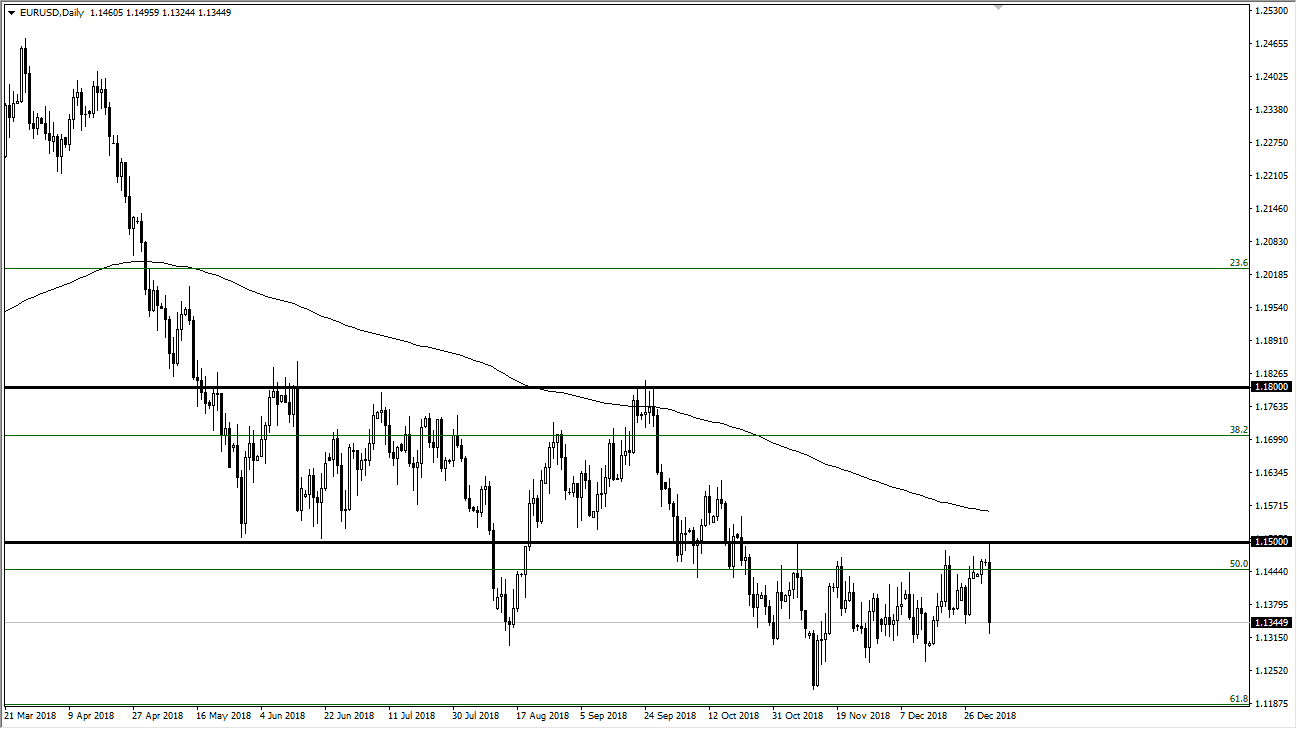

EUR/USD

The Euro initially tried to rally during the trading session on Wednesday, reaching to the 1.15 level before turning over and rolling rather significantly to the downside. The 1.14 level underneath got sliced through like it wasn’t even there and because of this I think that the Euro is going to continue to struggle. We have been consolidating for some time, with the 1.1250 level underneath offering significant support. Ultimately, I think we are going to reach towards that level, because of the ferocity of this move. The alternate scenario of course is that we broke above the 1.15 handle, breaking above the 200 day EMA eventually. That obviously would be very bullish and send this market towards 1.18 handle. In the short term though, I think we are ready to go back and forth as we have seen for a while.

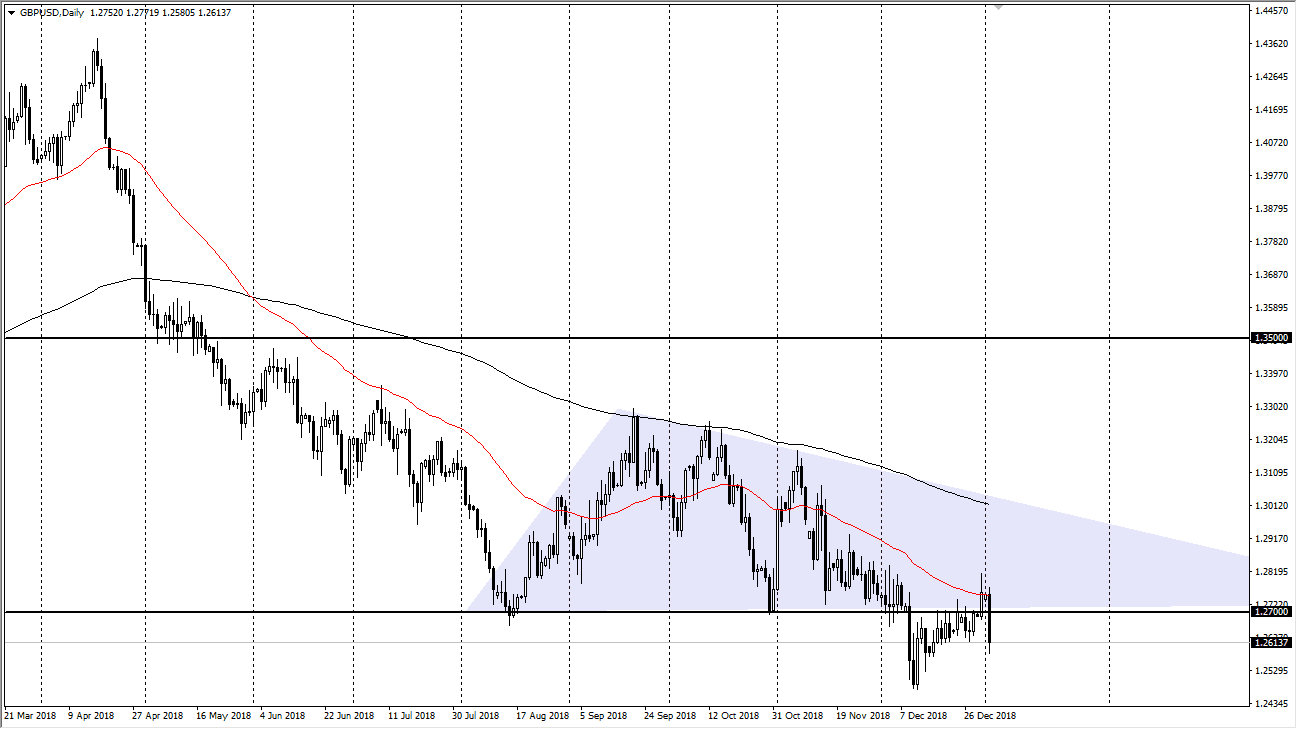

GBP/USD

The British pound also broke down during the trading session on Wednesday, slicing back through the 1.27 level during the trading session as people were freaking out about less than anticipated numbers coming out of China. There are still massive concerns about the Brexit, and that of course will continue to cause a lot of bearish pressure in this market. The massive candle stick of course is a sign of weakness, and I think given enough time we will continue to reach even lower. Based upon the descending triangle that we had broken through; the market still should be looking towards the 1.22 handle underneath. Rallies were to be sold, and the fact that the bounce occurred at the very end of the year suggests that it was simply a short covering rally at best. Ultimately, I believe that we go much lower.