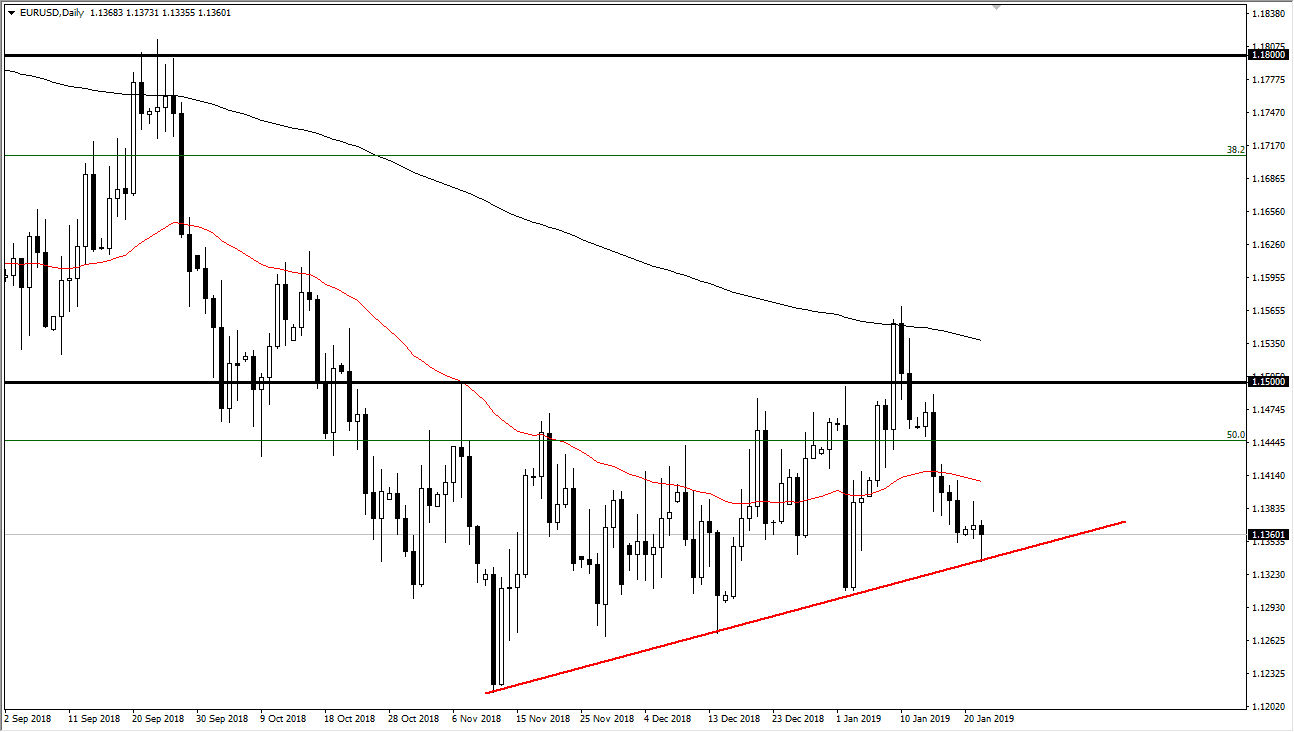

EUR/USD

The Euro initially fell during the trading session on Tuesday but found enough support underneath at the trend line that I have drawn on the chart to turn things around and form a bit of a hammer. This shows that there is in fact support near the 1.13 level, and at this point I think the next major barrier will be the highs from the Monday session. If we can break above that level, extensively the 1.14 handle, then the market could go grinding towards the 1.15 level. That is a major area of contention in this market and will more than likely coincide with the 200 day EMA, pictured in black on the chart, going forward. That is going to be a major barrier to overcome, but once we do I think the market is free to go much higher. The alternate scenario of course is that we break down below the hammer from the session, which also has the market breaking below the uptrend line and that could send this market a bit lower.

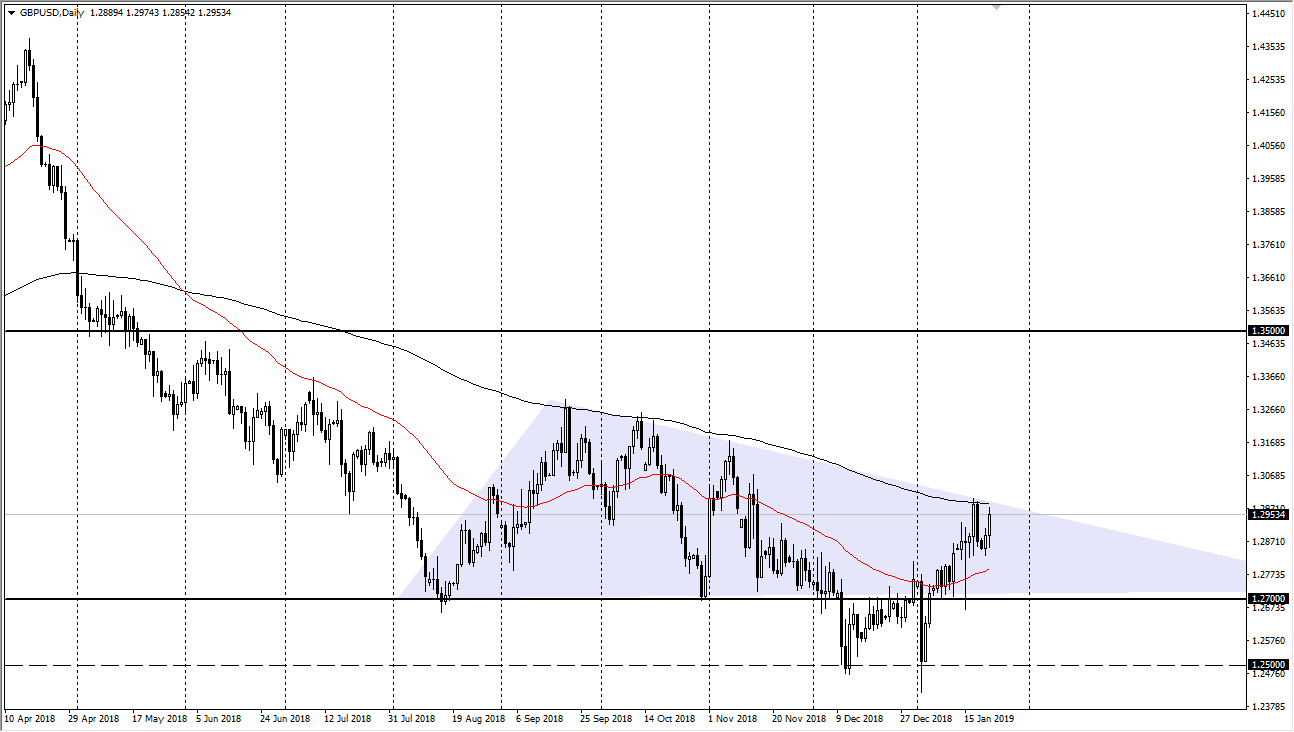

GBP/USD

The British pound initially pulled back during the day but also rallied, reaching towards the 200 day EMA yet again. If we can break above this level, the British pound is likely to go much higher as it would be the very definition of a trend change by a lot of algorithmic traders. It would also be breaking above a downtrend line, which also is a very bullish sign. I would expect that clearing the 1.30 level opens the door to the 1.32 handle next. Pullbacks at this point look like they’ll probably have support near the 1.2850 level, but keep in mind that it’s not to take much as far as headlines are concerned to send this market back into selling mode.