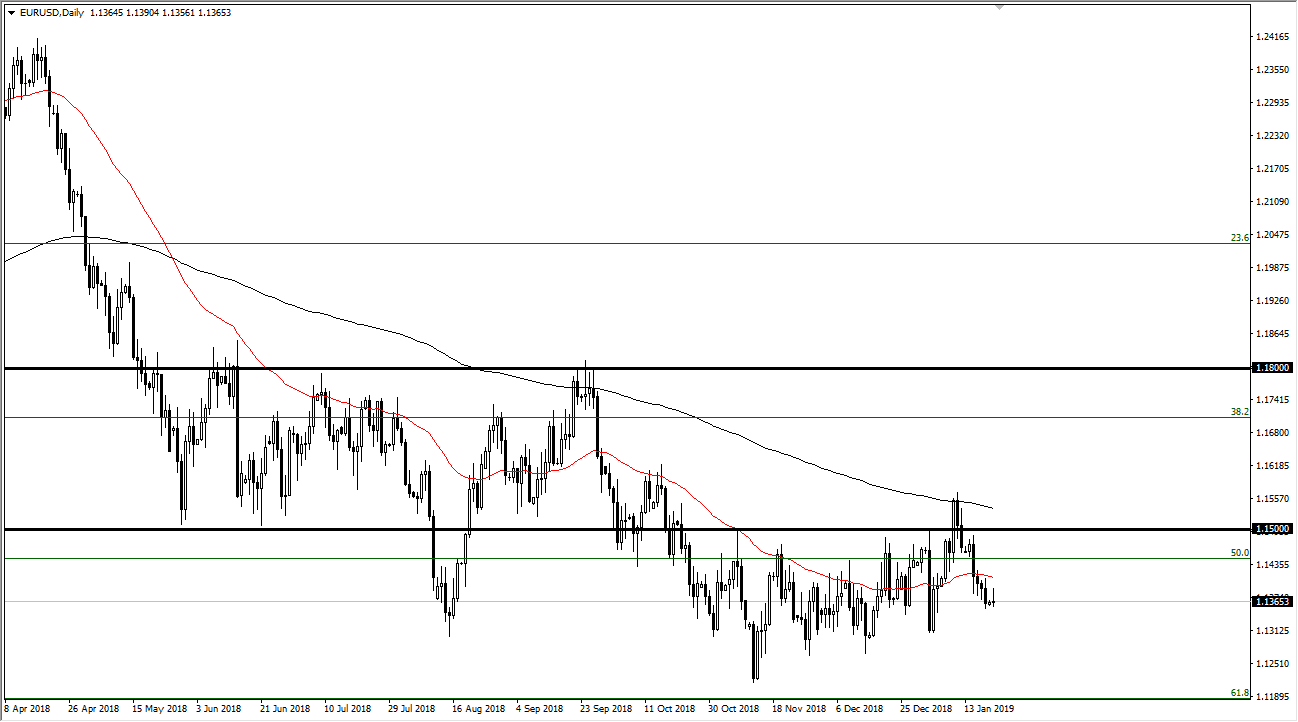

EUR/USD

The Euro initially tried to rally during the trading session on Monday, but then rolled over later in the day in what would be a somewhat illiquid environment as the Americans were away for Martin Luther King Junior holiday. That being the case, I wouldn’t read too much into the candlestick though, and I would also point out that we are still in the “rounded bottom” that I’ve been looking at. The question now is whether or not we can stay above the 1.13 level? If we can, then I think there’s a good chance that we do rally eventually. That doesn’t mean that it’s going to be easy, because this pattern tends to be very slow moving at best. If we do break down below the 1.13 level, then we could drop another 50 pips or so, perhaps even 100 pips.

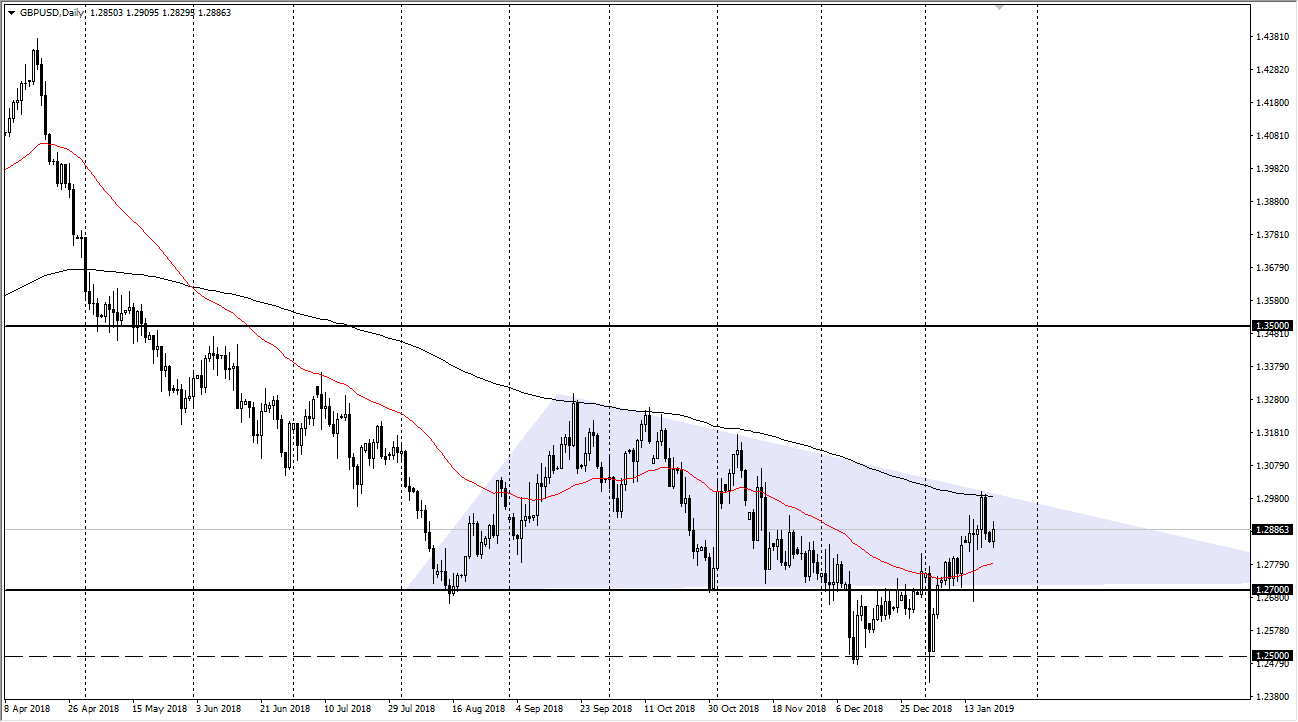

GBP/USD

The British pound initially tried to fall during the trading session but then rallied to bid. This has been a very choppy area as of late, with the 200 day EMA, pictured in black, offering a major amount of resistance. The downtrend line from the previous descending triangle also comes into effect, so I think that rallies will continue to struggle. However, if we can break above all of that noise, then we could go to the 1.32 handle after that.

At this point, I do think there is major support underneath at the 50 day EMA, which is the red EMA on the chart, and then of course the 1.27 level which has been important more than once. Overall, I think that this will continue to be an area that is very important. If we were to break down through there, then we probably go looking towards 1.25 handle.