EUR/USD

The Euro tried to rally initially during the trading session on Tuesday but found the 1.15 level to be far too resistive, and then broke down as traders awaited the results of the Brexit boat at the UK parliament. This of course will have a direct effect on the European Union, and of course the United Kingdom. Ultimately, we are still trying to form a bit of a rounded bottom, and that of course is a bullish pattern. The 200 day EMA is just above, so at this point it looks as if we are simply going sideways with a slightly upward tilt still. I believe it will continue to be very noisy, and I think that it’s only a matter of time before we go in one direction or the other. I believe that short-term momentum will be in both directions, so expect a lot of high-frequency traders to jump into this market and grind it.

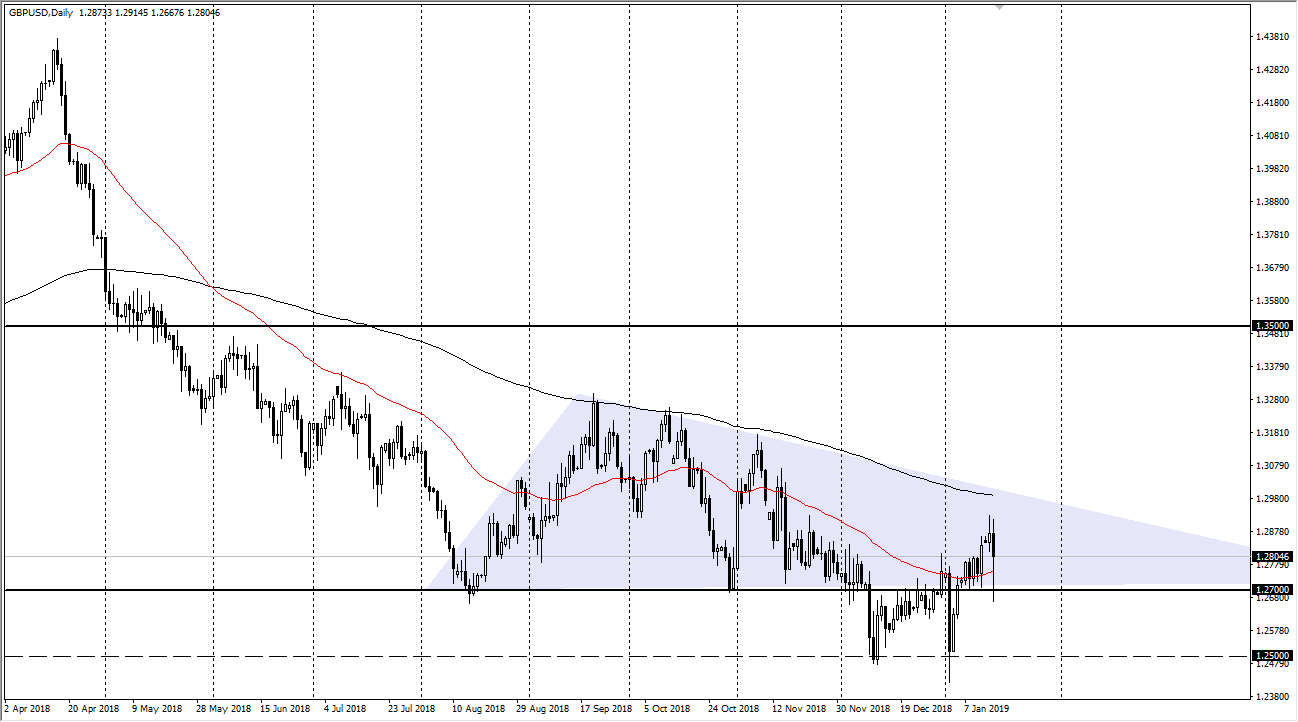

GBP/USD

The British pound broke down significantly during the trading session on Tuesday, as we awaited the results of the Brexit boat. Ultimately, as the referendum is defeated, the question now is where do we go from here? This certainly could be very negative for the British pound longer-term, and we could go down to the 1.25 level after that. I think that the negativity of this candlestick shows just how dire things have become. I think we are about to see this market return to the 1.25 level, although obviously we have seen a lot of destruction in short order. At this point, I believe that we could be looking at the next leg lower. If we do rally from here, the 200 day EMA would be a bit of a ceiling.