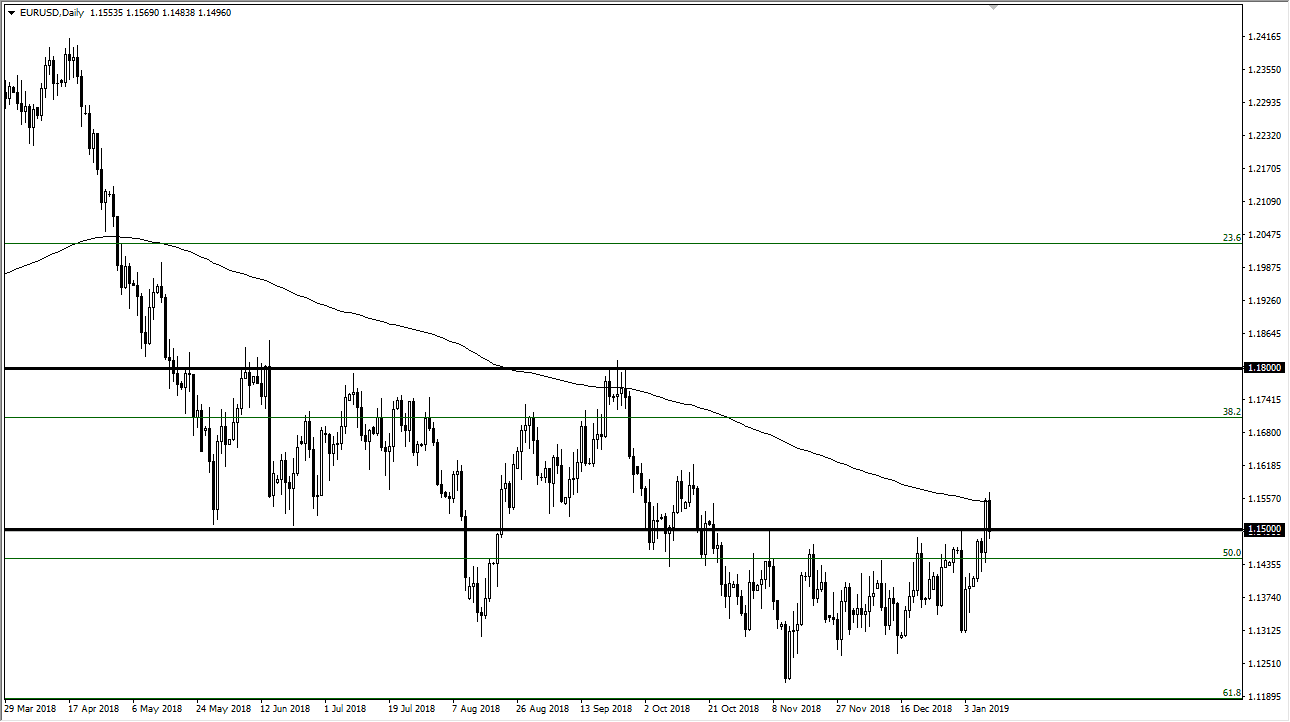

EUR/USD

The Euro initially tried to rally a bit during the trading session on Thursday, but then broke down from the 200 day EMA to test the 1.15 handle. The Euro has benefited from a bit of US dollar weakness in general, and of course Jerome Powell suggesting that the Federal Reserve is probably going to waffle a bit here and there, and that could give a bit of a boost to the Euro by default. A break above the highs from the trading session on Thursday would be extraordinarily bullish. Otherwise, if we break down below the lows of the day from Thursday, then I think the market probably tests the 1.1420 level. This is a market that has been forming a “rounded bottom” as of late, and therefore I do think that the buyers will eventually get above the 200 day EMA.

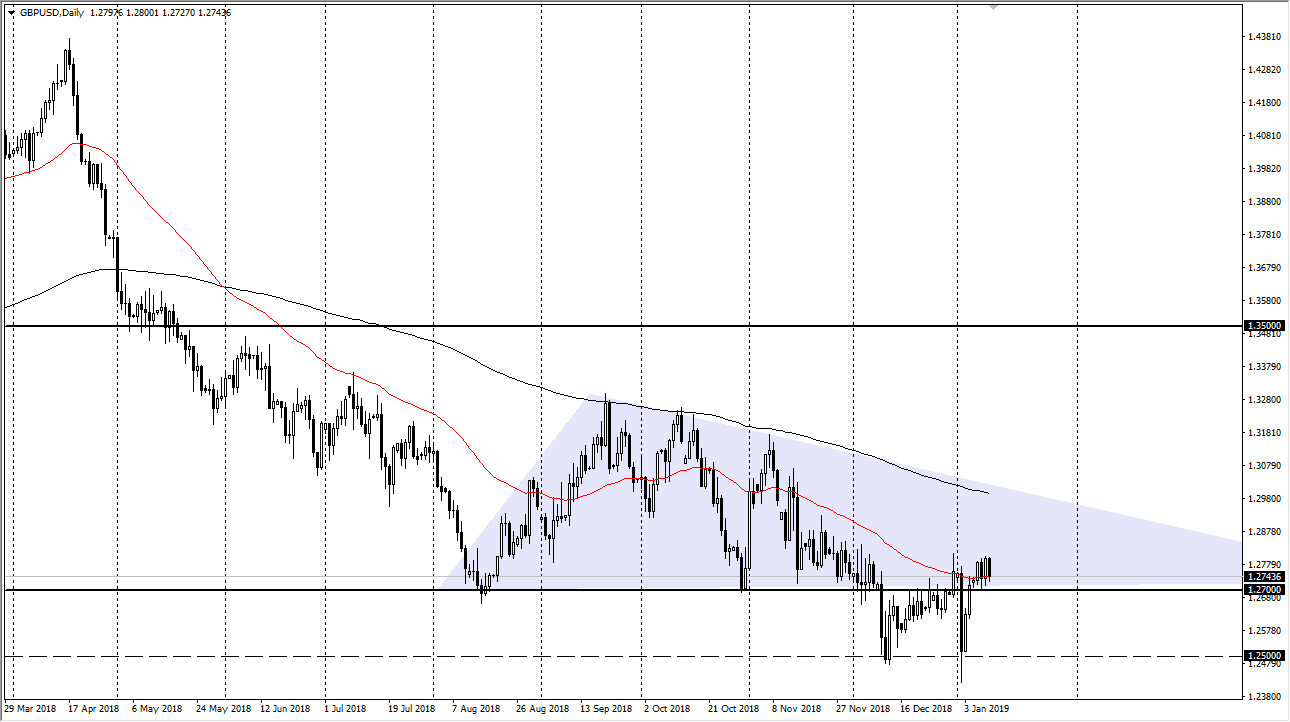

GBP/USD

The British pound pulled back a bit during the trading session on Thursday as well, testing the lows underneath and the support at the 1.27 handle. Otherwise, that’s an area that I think will continue to be interesting and I think that should attract a lot of order flow. If we break down below that level, then I think we continue to go down to the 1.26 handle, perhaps even the 1.25 level after that. Otherwise, if we break above the 1.28 handle, then the market probably goes to the 200 day EMA above, probably based more upon US dollar weakness than British pound strength. There are still a lot of problems out there when it comes to the Brexit, so I think that the British pound will continue to struggle overall. Ultimately, I think that the market will be a bit skittish.