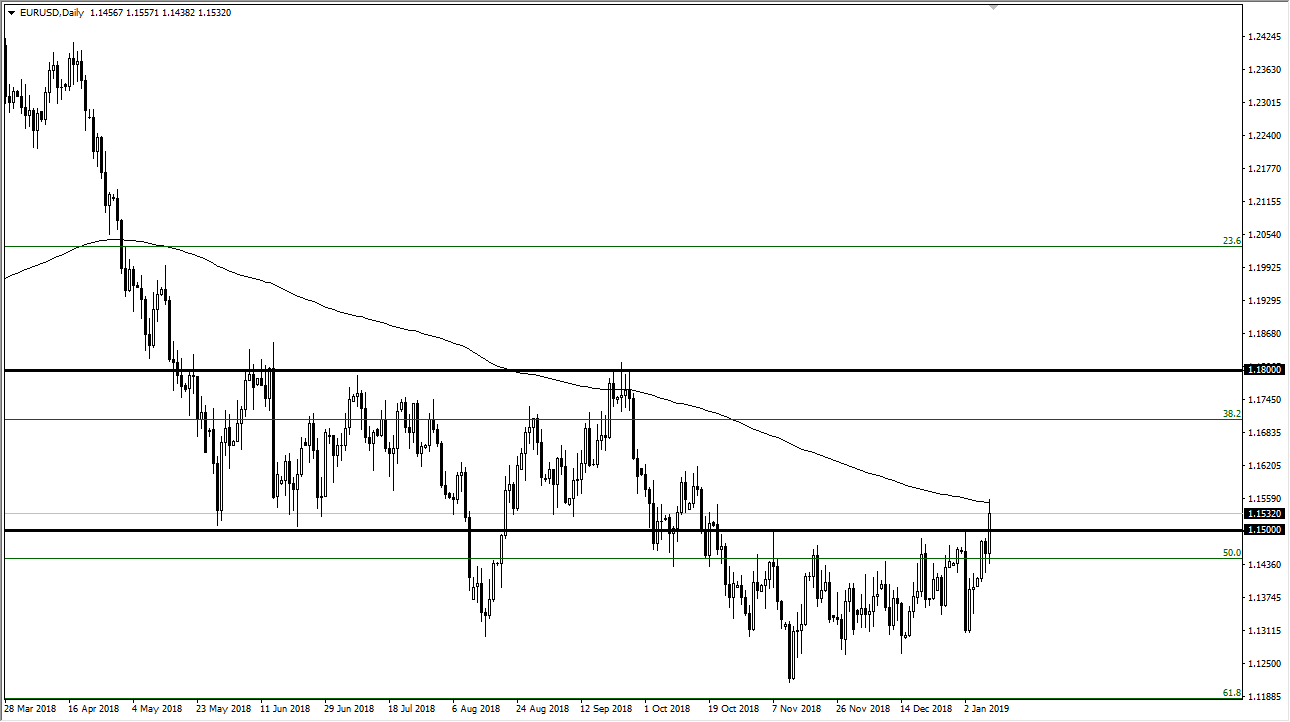

EUR/USD

The Euro rallied significantly during the trading session on Wednesday and accelerated a bit after the Federal Reserve release the meeting minutes of the December meeting. However, we did struggle directly at the 200 day EMA, so I think the next 24 hours will be crucial. If we get any follow-through whatsoever, the Euro should go looking towards the 1.18 level. However, we get a pullback, then I think we will go looking at the 1.15 level for support. As long as we can maintain above the 1.15 handle, I believe that we are going to continue to see strength in this market as we are forming a bit of a “rounded bottom.” I have no interest in shorting this pair currently, at least not until something fundamentally changes. It’s obvious for me that the momentum has started to shift to the upside.

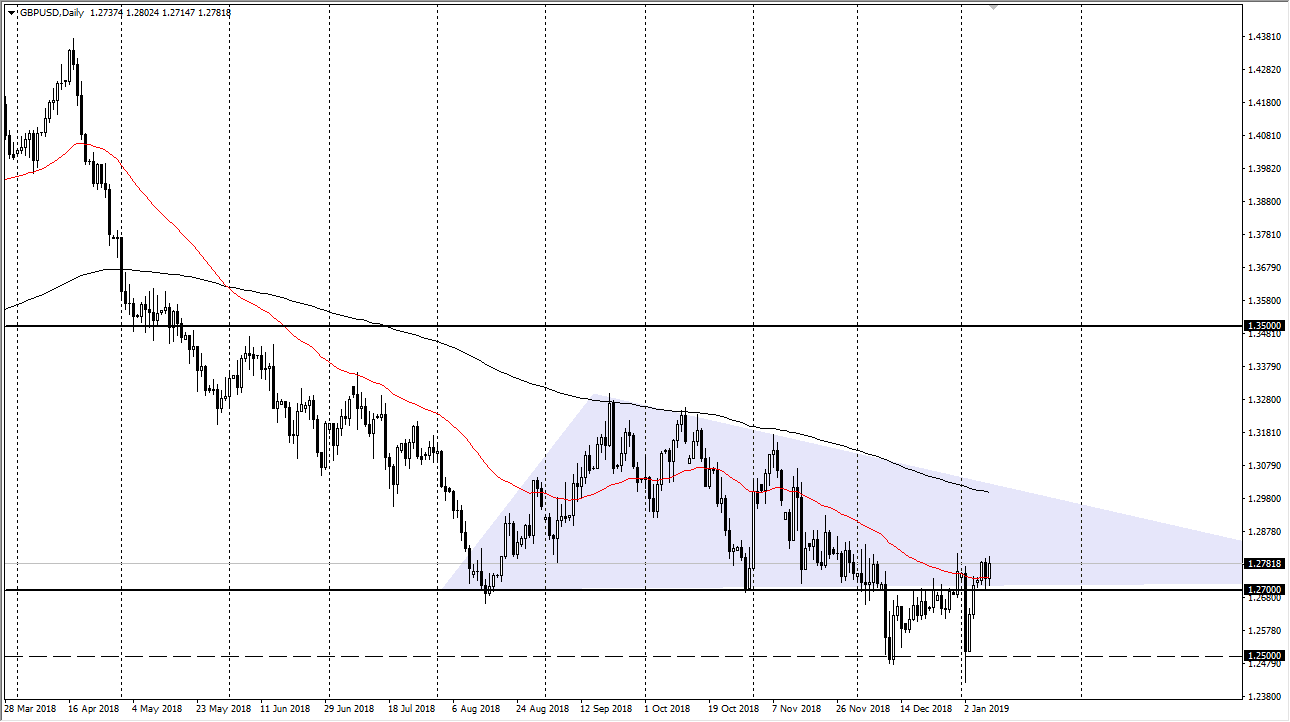

GBP/USD

The British pound has also shown some strength during the trading session, but of course it is lagging a bit behind the Euro. This makes sense, because we have so many issues when it comes to the United Kingdom, as the Brexit drags on. Ultimately, I think this is more about the US dollar than the British pound, as it has been weakening over the last several days. I do believe however that the sellers are waiting above on the first signs of trouble when it comes to the Brexit. The 200 day EMA above should continue to cause resistance, and a descending triangle that we had just been in should also offer resistance. I think there is still a lot of uncertainty when it comes to the Brexit and the vote coming out of the government, so we may see sudden flushes lower. If we break down below the 1.27 level, I would be more convinced to start selling. At this point though, if I’m looking to sell the US dollar a much more comfortable buying the Euro against it.