Gold

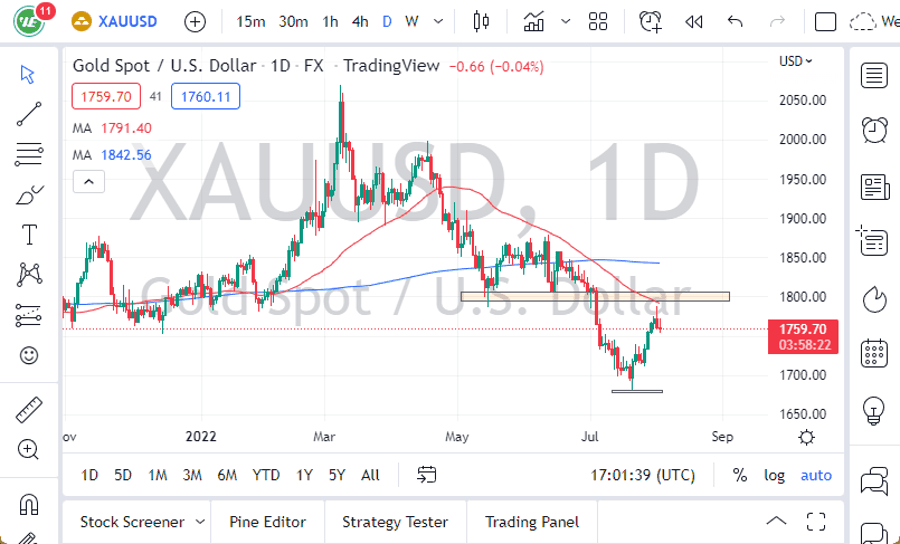

Gold markets initially fell during the trading session on Wednesday again, but just as we had seen on Monday, the buyers came in to pick the market up below the 20 day EMA and form a nice-looking hammer. Because of this, it appears that the market is going to continue to find plenty of support, and therefore I think we are essentially looking to climb towards the top of the recent consolidation. This opens up a move to the $1300 level, an area that will be obvious resistance. Because of this, I believe that it is only a matter time before we get bullish momentum, and I would be more than willing to buy gold at this point. An obvious stop loss would be set underneath the Tuesday hammer, because breaking below there of course would be a very negative turn of events. Ultimately, I believe that the US dollar will continue to soften due to the Federal Reserve so that should help gold as well.

Looking at the charts, if we did break down below the Tuesday hammer, then the 50 day EMA comes into play near the $1265 handle. I think there would be plenty of technical buyers in that area as well and looking at some of the other currencies against the US dollar, it makes sense that perhaps we will continue to see strength in Gold longer-term. A break above the vital $1300 level should have the market looking towards the $1325 level, and then eventually the $1400 level in $25 increments based upon the recent technical analysis that we have seen play out. I think that gold is in fact going to eventually try to reach the $1400 level, but it is probably something that we will see later this year as the US dollar softens mainly due to Federal Reserve policy.