BTC/USD

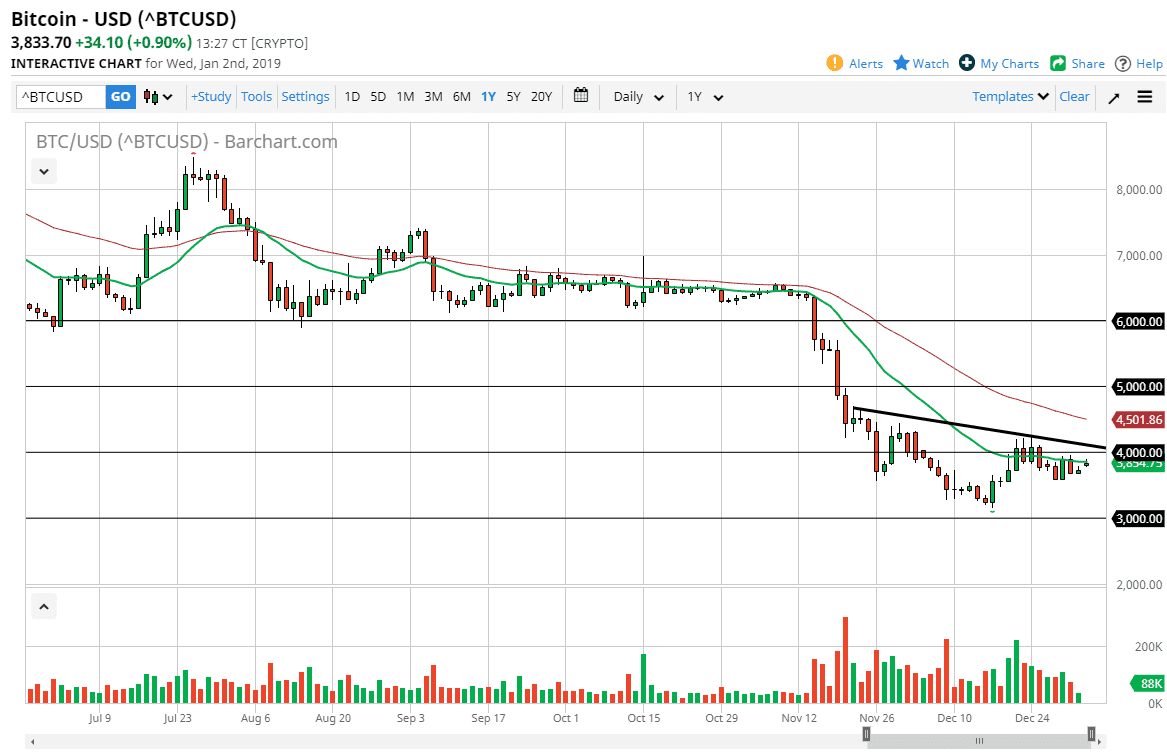

Bitcoin gapped higher to kick off the session on Wednesday which of course is very bullish but gave back quite a bit of the gains as the 20 day EMA is in the same neighborhood. Beyond that, we have a downtrend line that we need to break above, which is just past the $4000 level that could cause issues. Because of this, it’s only a matter of time before the sellers return and as we continue to consolidate around the $4000 region, I think there are plenty of reasons to suspect that perhaps we may roll over in the next couple of sessions.

However, if we break above the downtrend line, we could have a run towards the 50 day EMA which is basically at the $4500 level. Above there, we could make a serious run at $5000. That of course would be a very bullish move, but it would still simply be a reach raise from the massive drop that started in the middle of November. At this point, I much more interested in shorting small rallies that show signs of exhaustion, because I think that the trend is still very much intact, and ultimately this is a market that is still trying to find a reason to go higher, but doesn’t have one. I think the $3000 level causing a bounce isn’t much of a surprise, and therefore this rally shouldn’t be a surprise either.

The one bullish thing I see here is a potential inverted head and shoulders, which could lead this market going towards the $5000 level. Obviously, we would need to break above the downtrend line, which is also the neck line. It’s early to call this as an inverse head and shoulders, but there is a possibility and I would be remiss for not pointing that out. Ultimately though, I still think the sellers are very much in control.