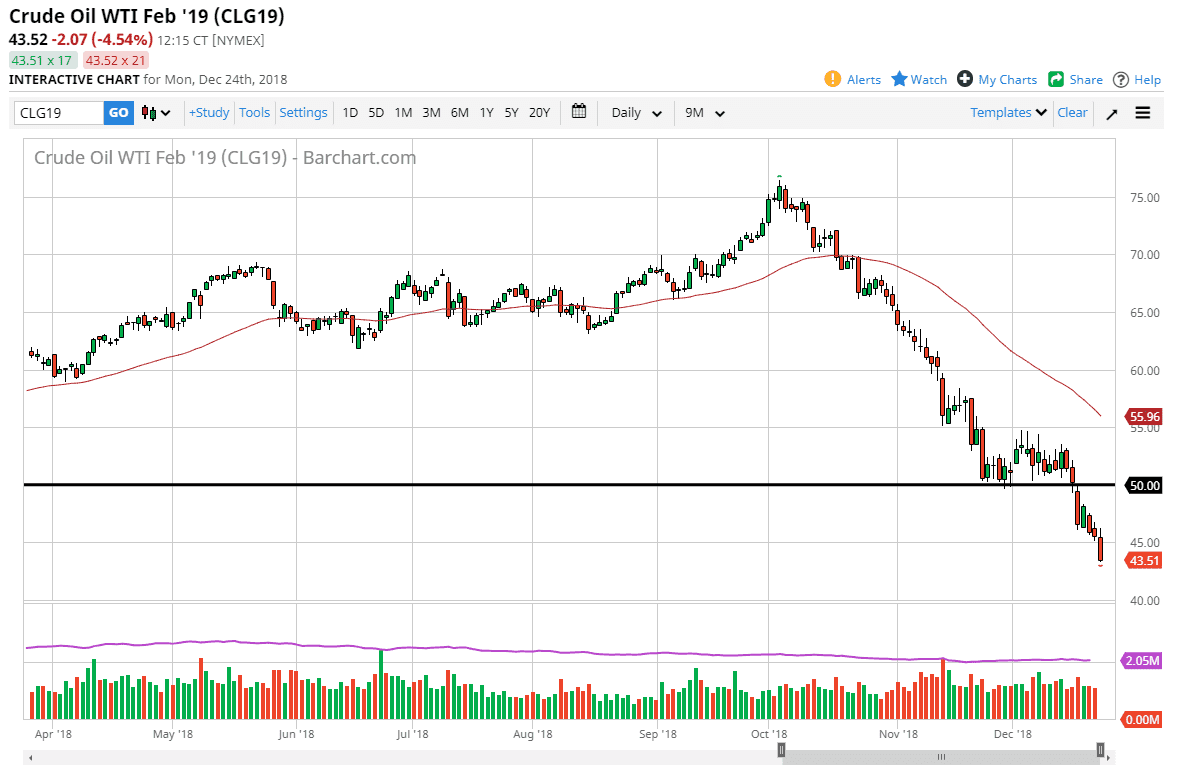

WTI Crude Oil

The WTI Crude Oil market initially rallied during the session on Monday, but then broke down rather significantly, slicing through the $45 level. That of course is a very negative turn of events, as we have wiped out another large come around, psychologically significant level. Oil simply cannot get out of its own way, and therefore it looks as if we are going to continue to go lower. I can’t call this capitulation yet, but it certainly looks as if we are going to continue to struggle. Given enough time, there should be an excellent buying opportunity but we are nowhere near that from what I see. The $50 level above is resistance, but at this point it’s likely that the $47.50 level will be resistance as well. There is nothing good about this chart right now.

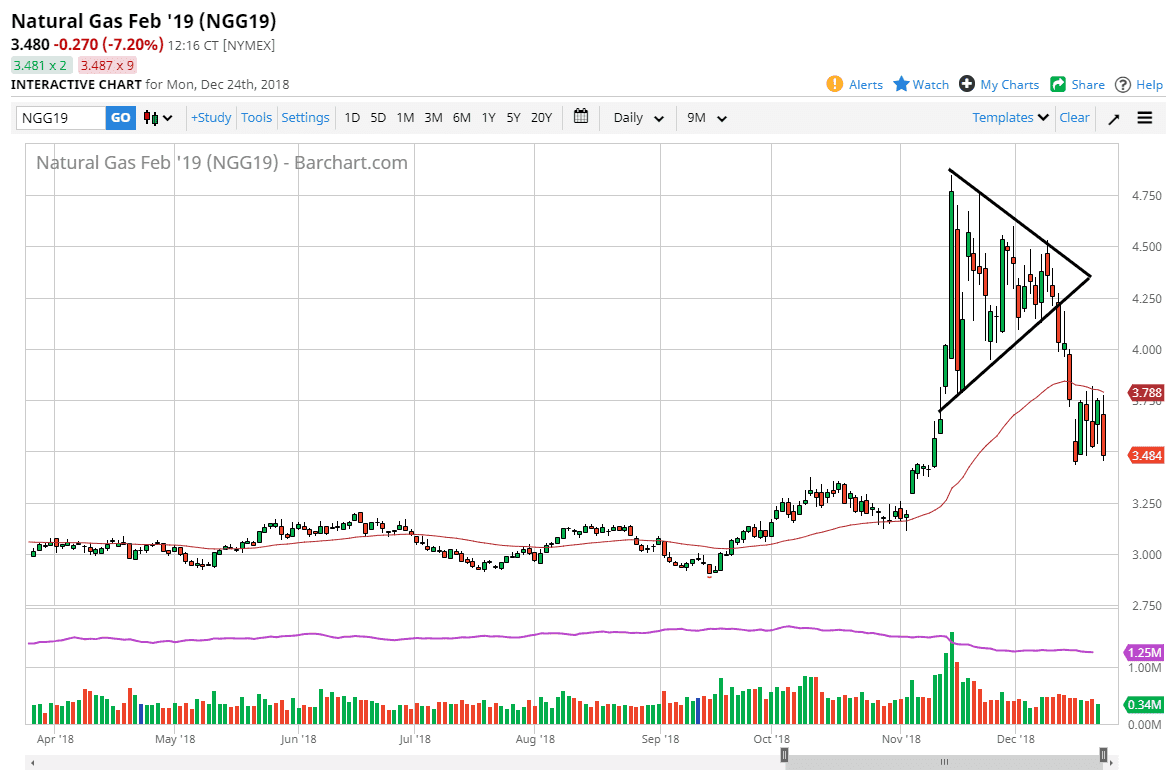

Natural Gas

Natural gas markets initially rallied during the trading session on Monday as well, struggling at the 50 day EMA. By doing so, we have fallen out of bed again, breaking down through the $3.50 level. It looks as if we are going to go down to the $3.25 level, and it seems likely that we are going to continue to see this market get hammered every time it tries to rally. I would use short-term charts to get involved, but at this point I think the only thing you can do is sell this market. The 50 day EMA is turning lower, and it looks to be very resistive. There is a longer-term situation when it comes to natural gas, as there is far too much in the way of supply to worry about the man taking that out.