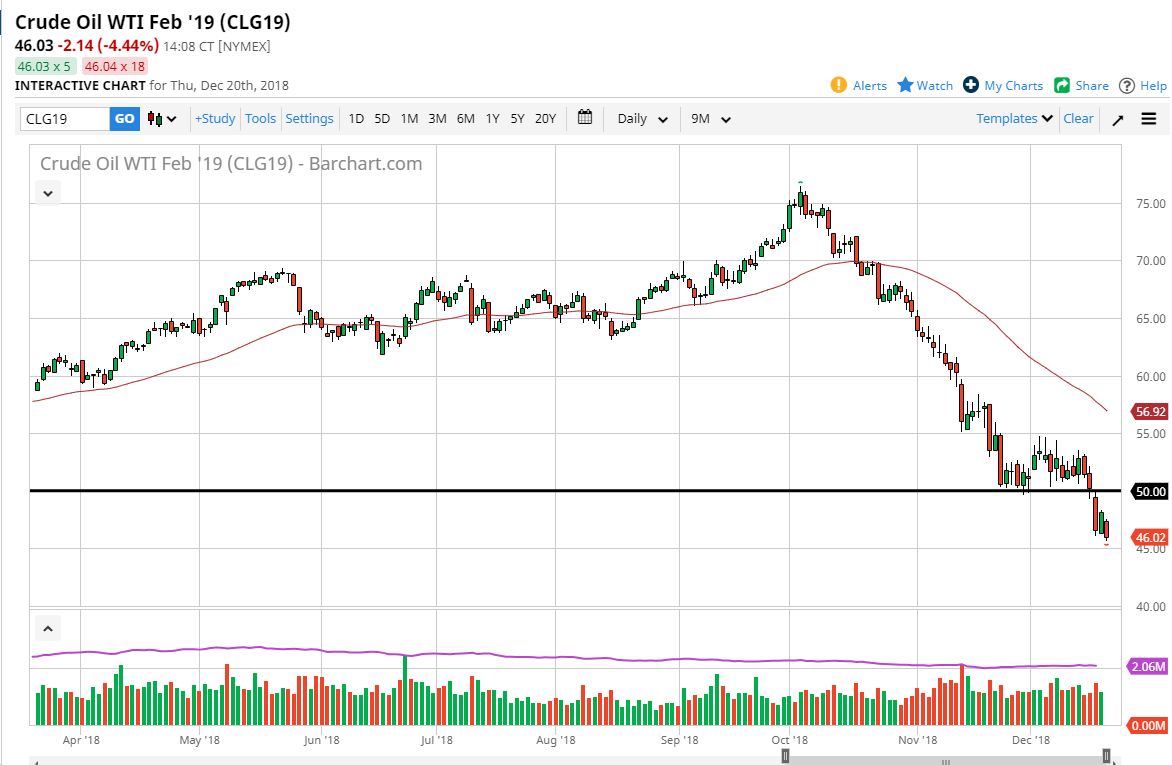

WTI Crude Oil

The WTI Crude Oil market broke down a bit further during the trading session on Thursday, after gapping lower at the open. It looks as if we are going down to reach towards the $45 level at the very least, which was my suggestion based upon the previous consolidation between 50 and $55. The question now is whether or not we will continue to go even lower. I believe that rallies will invite selling until we can break above the $55 level, which is my signal to start going long. Ultimately, it’s not until we get signs of global growth, or perhaps more action by OPEC before this market rallies significantly. Regardless though, we have lost 1/3 of value this quarter alone, which needless to say is extremely overdone.

Natural Gas

Natural gas markets continue to be very noisy as we continue to go back and forth, showing the $4.00 level above as a massive resistance, but I think that given enough time we will find sellers on rallies that we can take advantage of. I think it’s likely that traders will continue to punish rallies, and it should send this market back down towards the $3.50 level, perhaps down to the $3.25 level. Overall, I think that we will see a lot of volatility, and I think it’s only a matter of time before rallies will be punished due to the fact that we are well oversupplied in natural gas overall. If we did break above the $4.00 level, that would be a very bullish sign and would simply have me “resetting” by in tensions, and looking to sell at higher levels.