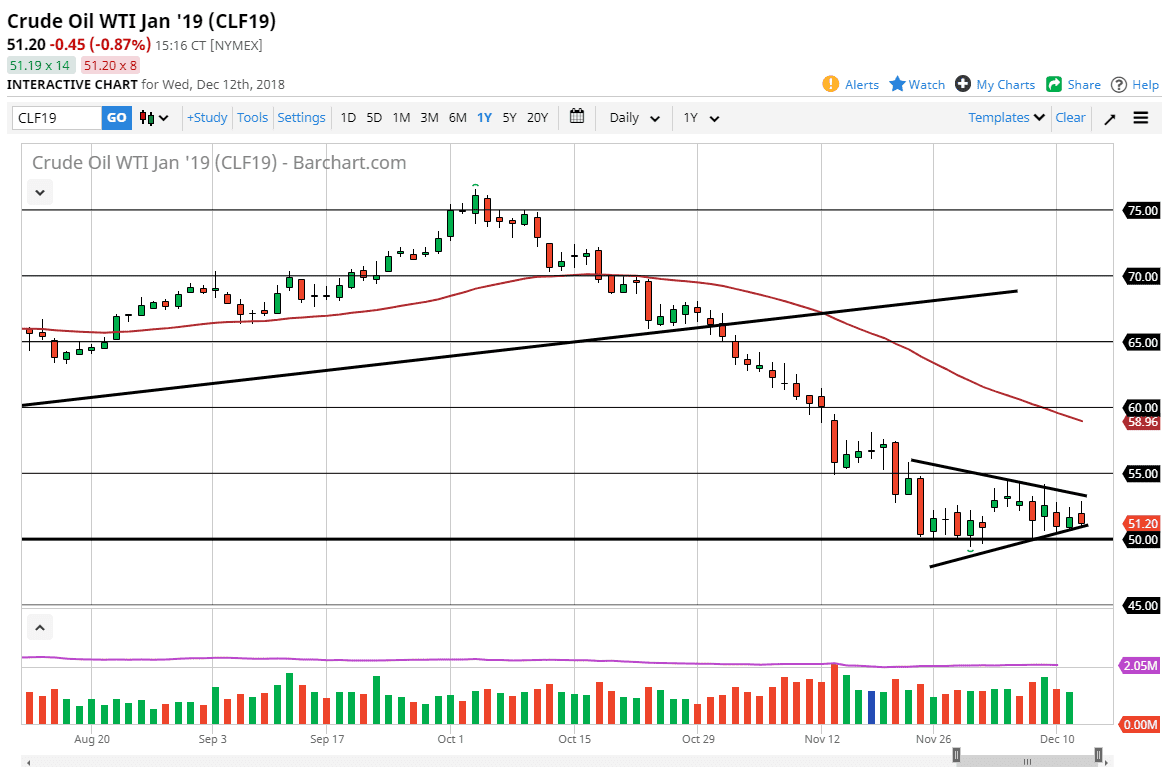

WTI Crude Oil

The WTI Crude Oil market initially rallied during the trading session on Wednesday, reaching the top of the consolidation triangle that we have been trading in. We are still within it, and I think at this point it’s likely to see a lot of volatility in the short term. If we can break down below the $50 level, then I think the market continues to go much lower. I will say that we have been selling rallies every time we get them on short-term charts, and that does cause a little bit of concern for the value of crude oil. If we break down below the $50 handle, I anticipate that we will go looking towards the $45 level. The alternate scenario is that we can break above the downtrend line of the wedge, and then perhaps go to the $55 level, possibly the $57.50 level after that.

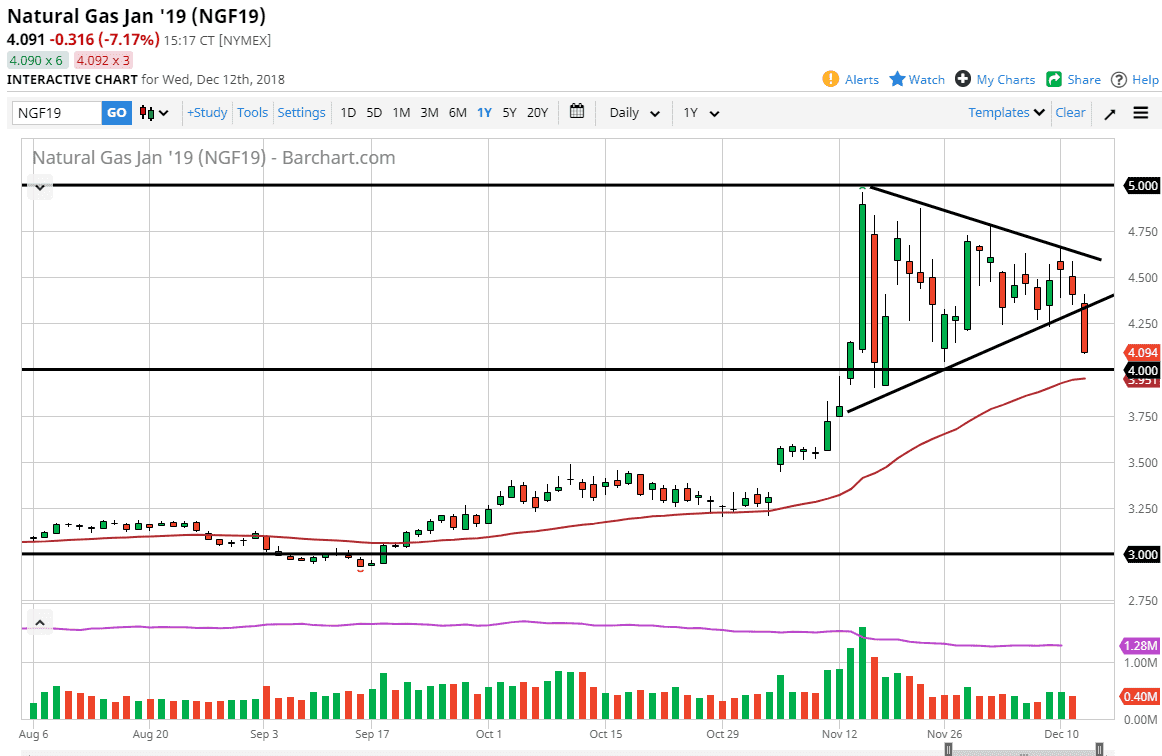

Natural Gas

Natural gas markets collapsed during the trading session on Wednesday, slicing through the bottom of the symmetrical triangle that we have been trading in, showing that we are ready to start rolling over. At this point, I think the $4.00 level in the 50 day EMA will continue to offer support, and that short-term rallies will continue to be selling opportunities at the first sign of exhaustion. At this point, I would anticipate some type of bounce after losing almost 8% during a single session, but I think that we are simply looking for opportunities to short signs of exhaustion on short-term charts. I believe that we will go looking to fill gaps underneath at the $3.75 level, and the $3.30 level. I don’t have any interest in buying natural gas although I fully anticipate seeing it bounce from here.