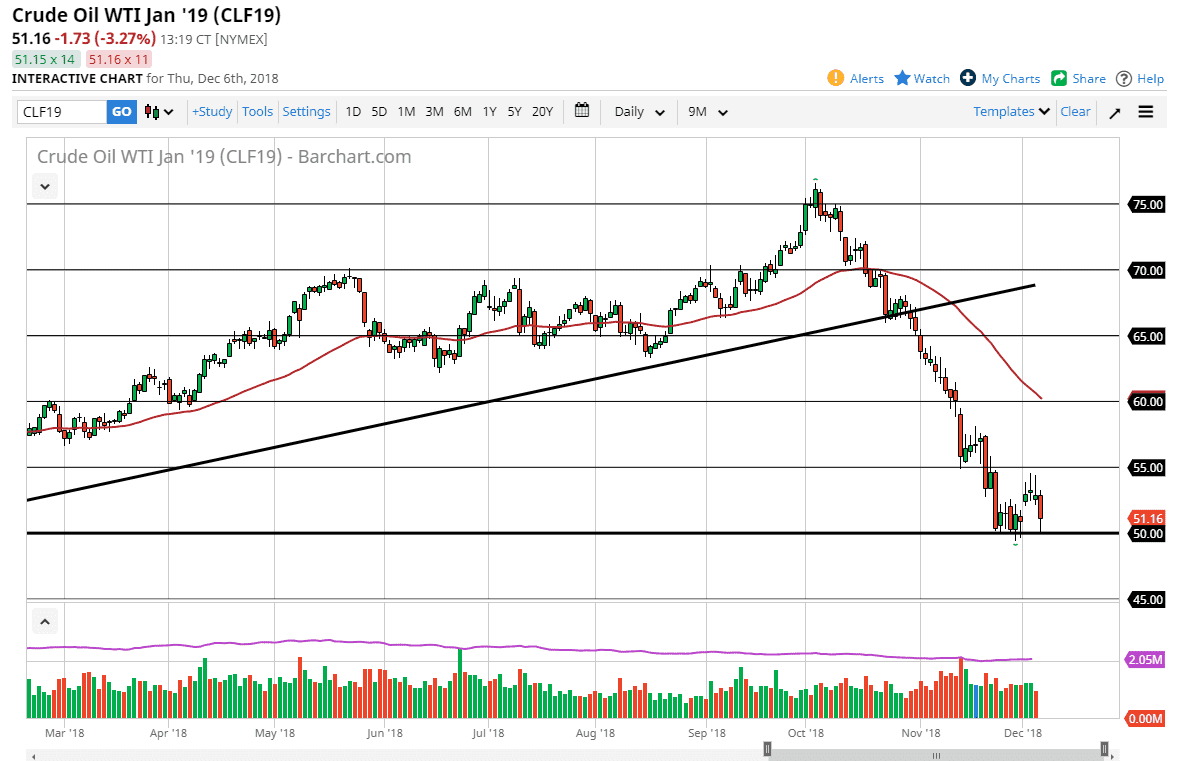

WTI Crude Oil

The WTI Crude Oil market fell rather hard during trading on Thursday, slamming into the $50 level yet again as OPEC concluded their meeting without announcing any new cuts. Ultimately, I do believe that they will eventually have to cut, and as Russia shows up to the meeting during the day on Friday, that could be a bit of a boost. Beyond that, we also have the jobs number coming out of the United States, that of course can move the markets as far as demand is concerned as well. If we break down to a fresh, new low, then the market will break down rather significantly. However, the $55 level above there would be a barrier that if we can clear, could send this market towards the $57.50 level. I think Friday will be very crucial as to where we go next, so keep that in mind. You may be better off simply waiting for the close of business as to where to place your trade on Monday.

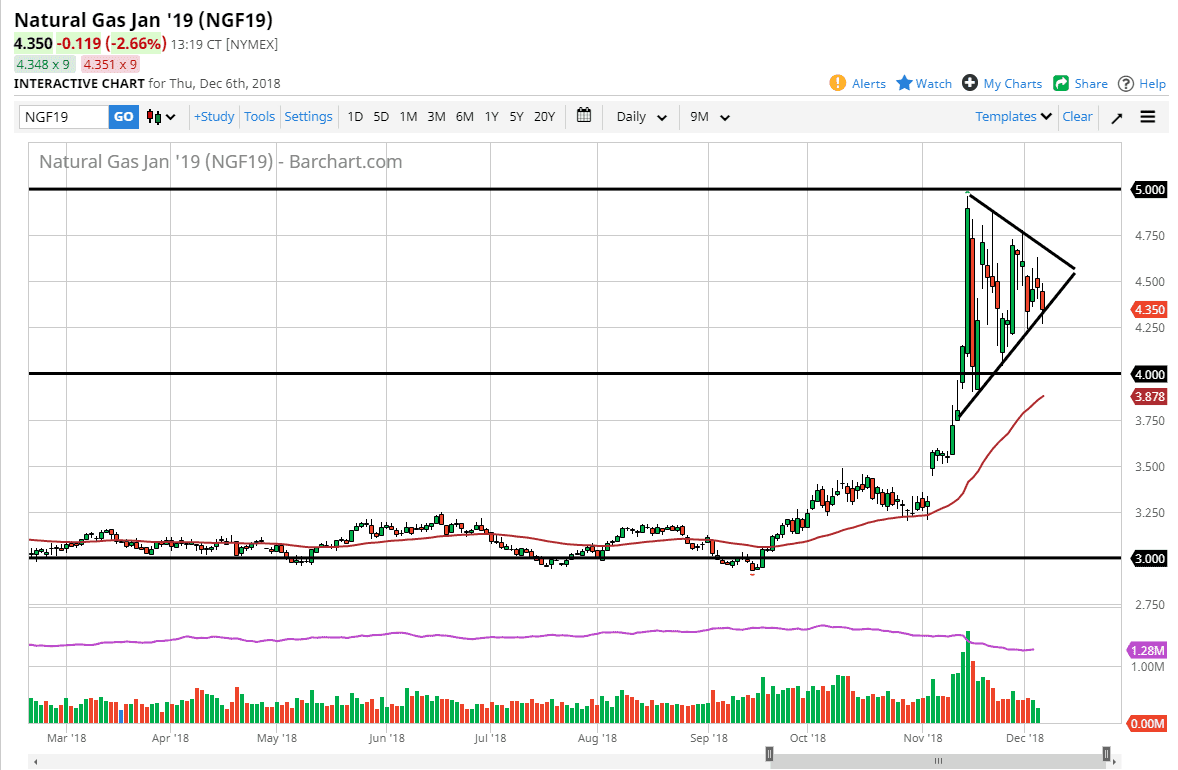

Natural Gas

Natural gas markets fell again during the trading session on Thursday, reaching towards the $4.25 level, before bouncing slightly to stay within the overall wedge. I think at this point, the market may go looking towards the $4.00 level underneath, which of course will have a lot of structural and psychological importance. If we break down below the $4.00 level, then the $3.75 level will be targeted based upon the gap. At this point, if we do rally towards the top of the wedge, I would be looking for opportunities to sell up there as well. This is a market that will continue to grind its way down over time, and I believe that the $5.00 level above should be the high for the year.