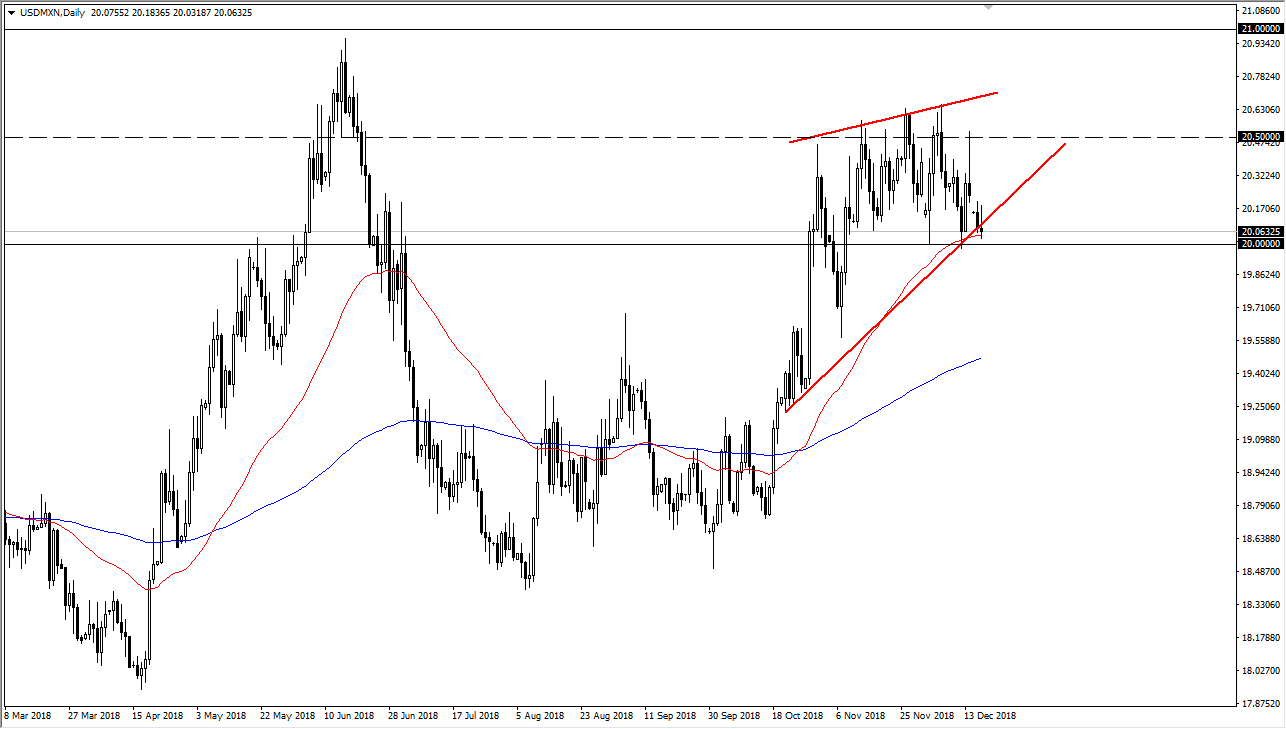

USD/MXN

The US dollar initially tried to rally during the trading session on Tuesday but rolled back over to form a bit of an inverted hammer. As you can see, I have the same trendlines up on the chart that I have been talking about for a few days now, and we are hovering just below the uptrend line. We formed an inverted hammer sitting on top of the 50 day EMA, so it will be interesting to see how this plays out. The fact that the Mexican peso pick up a little bit of strength later in the day while oil was selling off is also a bit counterintuitive and interesting to say the least.

From a technical standpoint, I believe that if we can break down below the 20 pesos level, it’s a good sign that we will probably lose about half a peso, reaching down towards the 19.50 pesos level. Alternately, if we were to break above the top of the candle stick, that would be a very bullish sign and could send this market back towards the 20.50 pesos level, simply continuing the overall consolidation. This pair will be extraordinarily volatile during the day, especially near 2 PM Eastern Standard Time in the United States, as the Federal Reserve is expected to not only raise interest rates but have a very important statement afterwards.

That statement is going to be what we are looking for, and we are going to try to find out whether there is going to be US dollar strength based upon a handful of interest rate hikes next year, or whether the Federal Reserve is starting to sound a bit more dovish, which would be US dollar negative. On a daily close below 20 pesos, we have a selling opportunity. Alternately, if we close higher than the highs from the trading session during the day on Tuesday, then we have a buying opportunity.