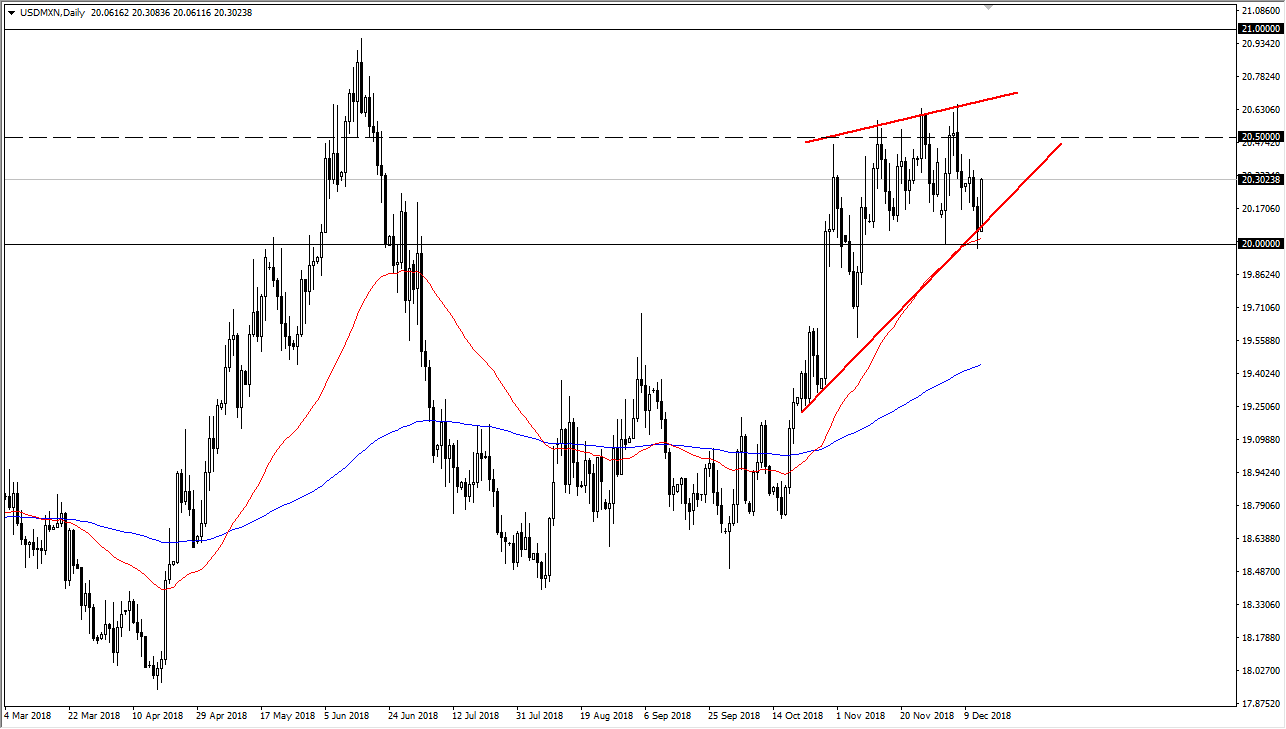

USD/MXN

The US dollar exploded to the upside during the trading session against the Mexican peso, validating the uptrend line underneath, and perhaps even more importantly, the 20 pesos level. That’s an area that will of course attract a lot of psychological attention, as well as structural as we have seen both support and resistance at this level over the last several months. Remember, you should always pay attention to the oil market when trading the Mexican peso, but right now it looks as if oil is essentially soft and could even possibly break down below the crucial $50 level in the West Texas Intermediate grade. If that happens, I fully anticipate that the US dollar will break above the 20.50 peso level and reach towards the 21 peso handle. That was the highs of the year, and if we can break above that it would be an extraordinarily bullish sign.

The alternate scenario of course is that we break down below the 20 pesos level, and on a daily close I think that would be assigned that it’s time to start shorting. Remember, this needs to coincide nicely with an oil surge higher, which I think is coming, but it may not be happening in the short term. After all, eventually the OPEC producers will cut enough to support the market. There is also concern at this point with the Mexican government and its spending, as a socialist President has taken power. Ultimately, I think at this point it’s likely that the Mexican peso will be a bit soft now that we have seen this bullish pressure during the Thursday session, wiping out the losses from the last couple of candlesticks on the daily chart.