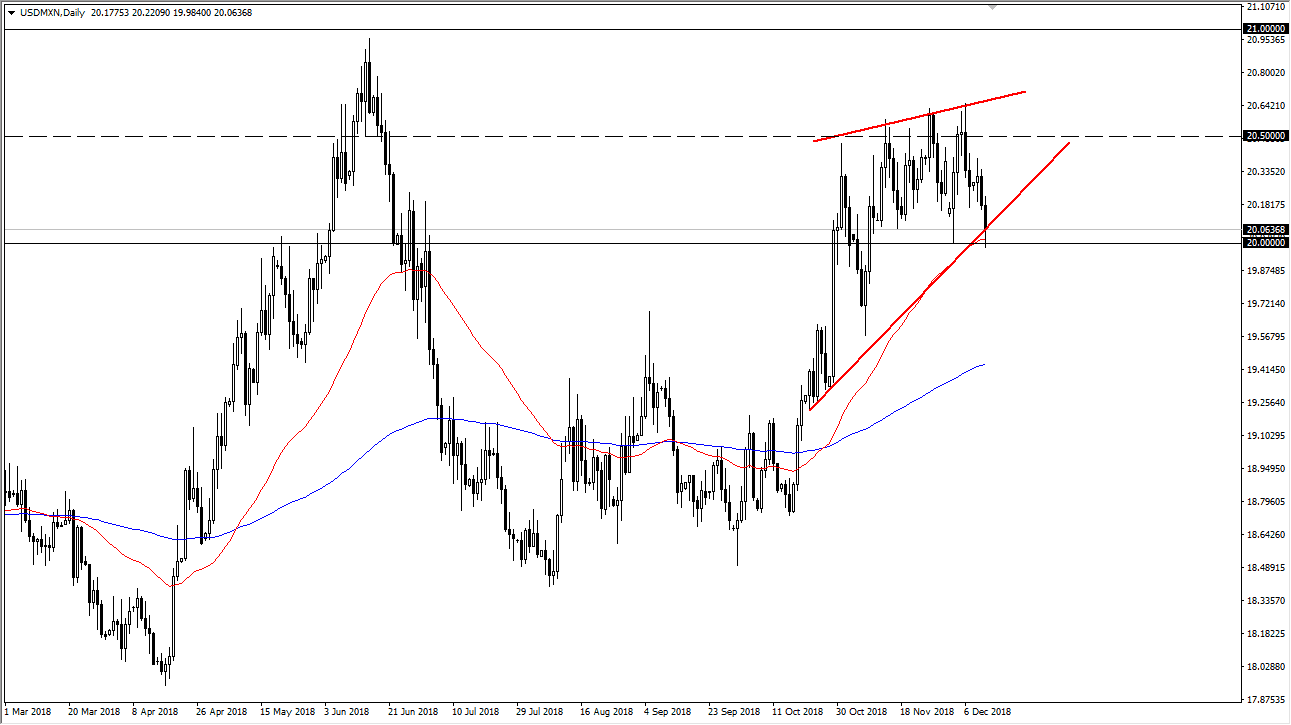

USD/MXN

The US dollar fell against the Mexican peso during trading on Wednesday, slamming into the 50 day EMA which coincides quite nicely with the 20 pesos level. This obviously has a huge effect psychologically on the market, and of course is an area where we’ve seen a bit of support as of late. At this point, I think that if we break down below the lows of the session for Wednesday, we could go much lower, which would probably coincide with higher oil prices. At this point, the WTI Crude Oil market simply cannot hang onto gains. If that’s going to be the case, this market will probably go higher, perhaps if nothing else but a “risk off” type of scenario.

If we do break down, I think we probably goes to the 19.50 pesos level, perhaps rather quickly. The 200 day moving average is close to that level, so I think at that point a lot of algorithm trading will come back into play.

The alternate scenario is that we break the highs of the session for Wednesday, perhaps showing signs of US dollar strength again. If oil can break down below the $50 handle, this market will shoot straight to the upside. That being said, it does look a bit heavy so I still anticipate that we will get a little bit of negativity and let us not forget Mexican politics. With the new president, it’s still a headline driven market as far as that is concerned as well, who at this point looks to be very likely to blow up the Mexican budget if some of his previous campaign points are attempted. In a very shaky world, owning the Mexican peso is going to be difficult, but the technicals do suggest that perhaps you can if we break cleanly and close below the 20 pesos level on a daily candle.