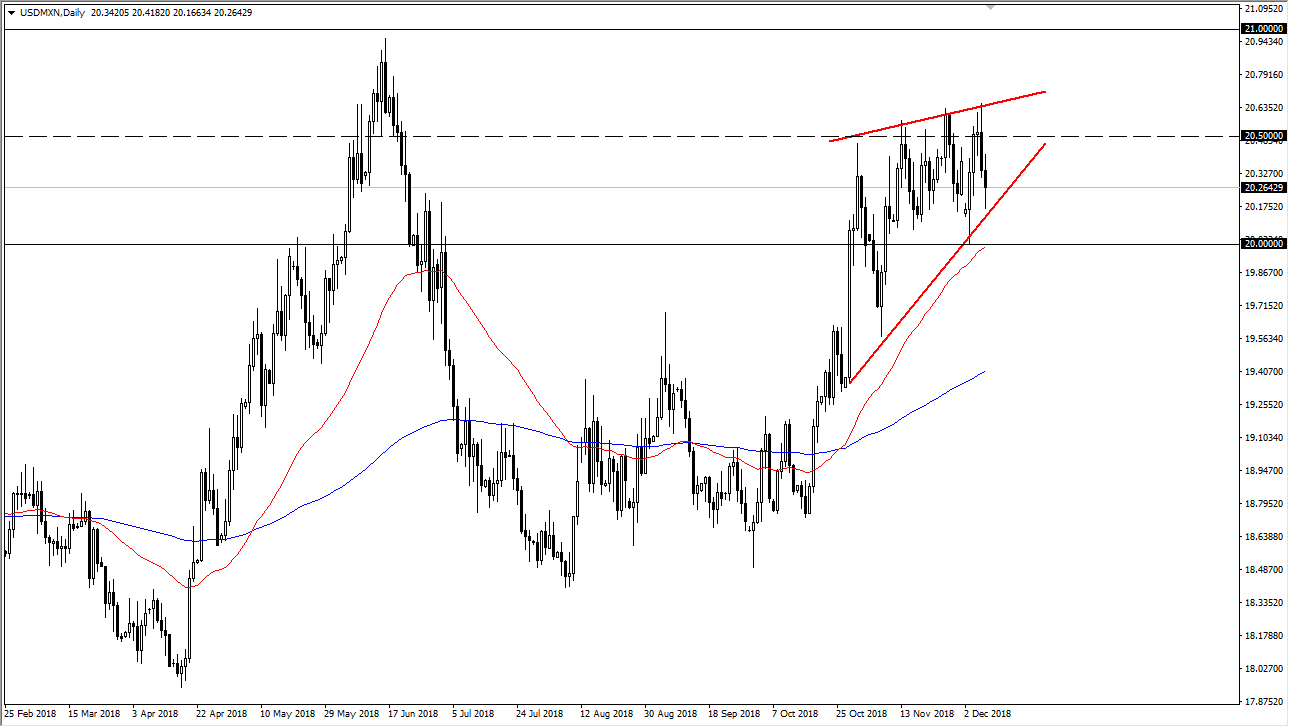

USD/MXN

The US dollar fell a bit against the Mexican peso on Friday after the jobs report was released. Adding 155,000 jobs in the United States was a bit of a mess, but you can see that we have clearly been in and uptrend for some time. The 20.50 level has offered short-term resistance, but I also have an ascending wedge drawn on the chart. There is a significant amount of resistance above the 20.50 level extending to the 21 handle, so I think that it’s going to be more of a grind higher than anything else.

In the short term, if we break down below the uptrend line and I think we could very well drop down to either 20 or possibly even as low as 19.70 going forward, before the support could come back into play. The interesting thing about this pair is that it not only represents Latin America, but it also represents crude oil, something that far too few Forex traders know. If crude oil is in fact starting to make a bit of a stand, most particularly the West Texas Intermediate contract at the $50 handle, we could see the Mexican peso pick up a bit of strength, driving this pair lower.

The US dollar of course is considered to be a safety play in this pair, and gains when people are less than confident about the route going forward. I think at this point, we are starting to see the US dollar softened slightly, mainly because of the Federal Reserve taken on a bit more of a dovish tone. However, if we get more concern about global trade, that will probably drive this pair higher. Keep in mind that we have recently just seen the agreement between the Canadians, Americans, and the Mexicans signed, so that of course could bode well for risk appetite.