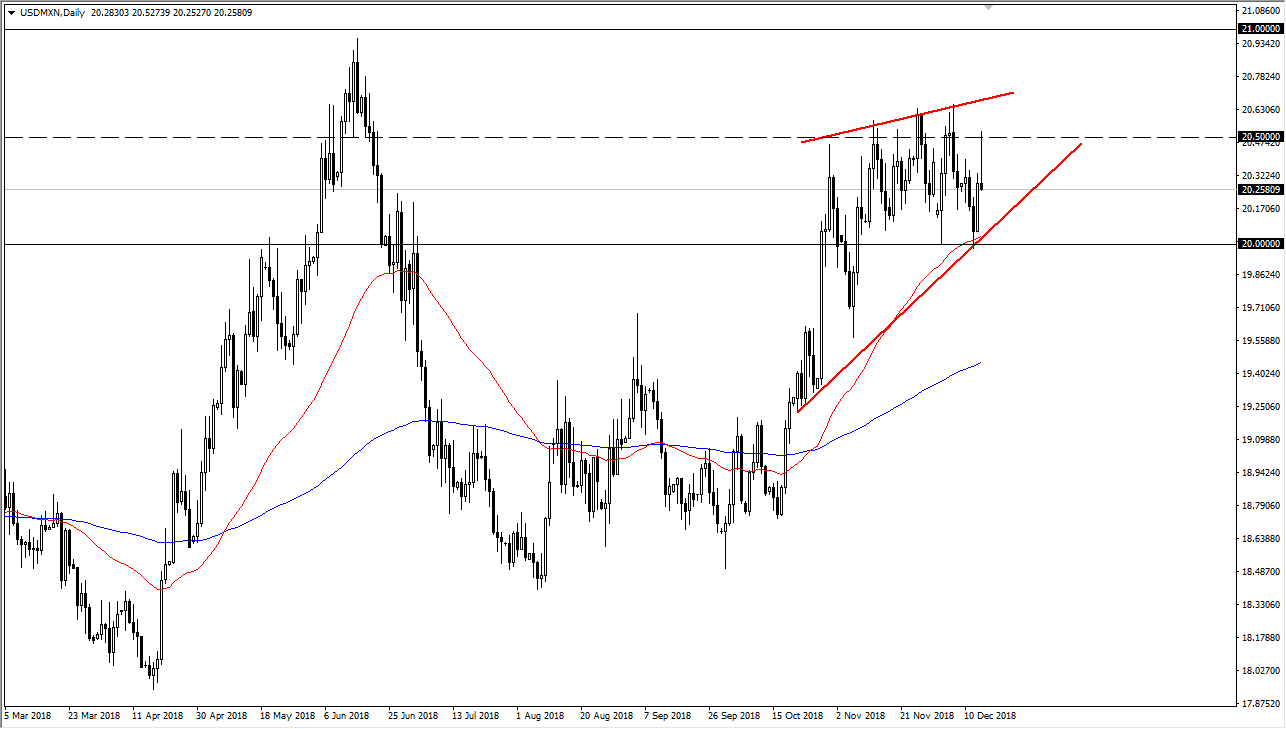

USD/MXN

The US dollar initially rallied against the Mexican peso, reaching the 20.50 pesos level, an area that I pointed out previously. We turned around to form a massive shooting star, which of course is bearish. That being said, oil markets still look a bit soft, so we could see the US dollar rally again. I think that the uptrend line underneath should continue to offer a bit of support, just as the 50 day EMA just below that uptrend line should also offer support. At this point, we are still very much in and uptrend but if we break down below the 20 pesos level, at that point I think we could unwind a bit.

The US dollar has been strengthening overall due to a slowing down of global growth according to economic figures, and therefore you will need to worry about whether oil has any demand. Remember the Mexican peso is highly correlated to crude oil, and emerging markets in general. Emerging markets are a bit erratic at this point, but it does look like oil is trying to find support near the $50 level in the WTI market. If we can stay above the $50 level, then this pair has a chance to rollover and break down. However, if crude oil breaks below the $50 level I suspect that the US dollar will spike against the Mexican peso, and any other Petro currency out there such as the Canadian dollar, Norwegian krone, and so on.

On a move to the upside, if we can break above the recent highs then I think it opens the door to 21 pesos. That’s an area that was massive resistance previously, and I think it’s likely that the area will cause a bit of resistance if we do get to that level. However, it makes a clean target.