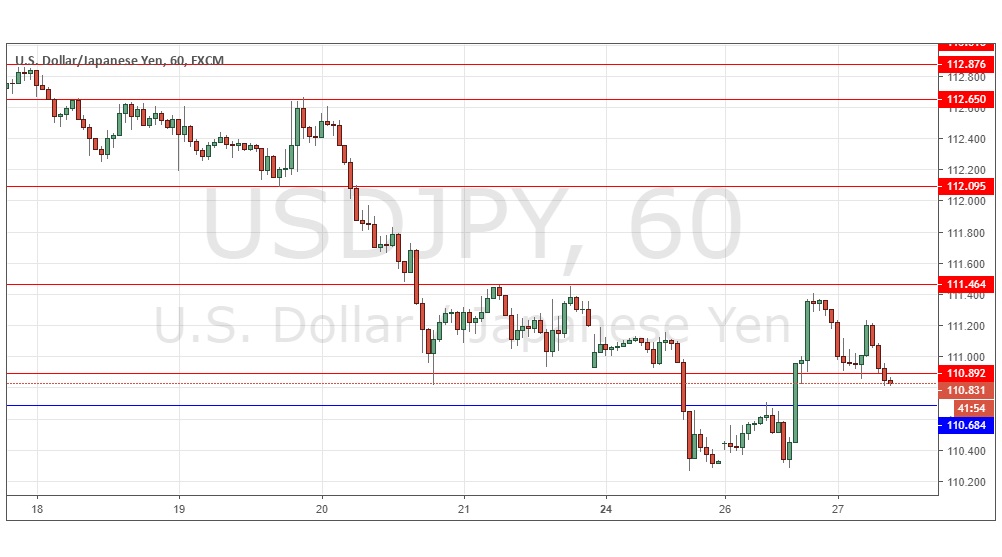

Yesterday’s signals gave a profitable short trade (although only about 30 pips) from the small bearish pin candlestick which rejected the resistance level at 110.68.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be taken from 8am New York time until 5pm Tokyo time today.

Short Trade

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 111.46.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 110.04.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote yesterday that the picture had become more bearish technically than it was previously. Several of the support levels were broken, but it was also significant that 110.00 had held so far. I was generally bearish, and I was ready take a bearish bias if we get any rejections of the new resistance levels nearby after New York opens. This was good for about 30 pips early on, but as I also mentioned, the U.S. stock market was a major driver of this pair’s price, and as the market rallied sharply, the price was driven up back well above the old support and resistance levels. The price has subsequently sold off, so we are left with no obvious resistance until 111.46, and probable support at 110.68. Support may start earlier, at about 110.68. Again, I think much will depend upon what happens to the U.S. stock market later when New York opens. Both the nearby levels look like attractive places to trade reversals, but a short trade off a return to 111.46 would have the best probability of success. I would be bearish below 110.68 and very bearish below 110.00, but I’d want to see the price remain below either level for a couple of hours at least first. Volatility is quite high, so we are likely to see plenty of movement anyway.

There is nothing important due today concerning the JPY. Regarding the USD, there will be a release of CB Consumer Confidence data at 3pm London time.