USD/JPY

The US dollar gapped higher during early trading on Monday, came back to fill the gap, and then rally again. Ultimately though, the market has been in a bullish attitude for some time, and the uptrend line underneath should continue to offer support. Beyond that, the ¥112 level also offer support, as well as the 200 day EMA. If we do pull back, I think it should offer plenty of value for hunters out there, as we try to build up the momentum necessary to break above the ¥114.50 level. That area extends to the ¥115 level, so I do like buying dips but I recognize if we break down below the multiple support levels underneath that I have just mentioned, things could get ugly.

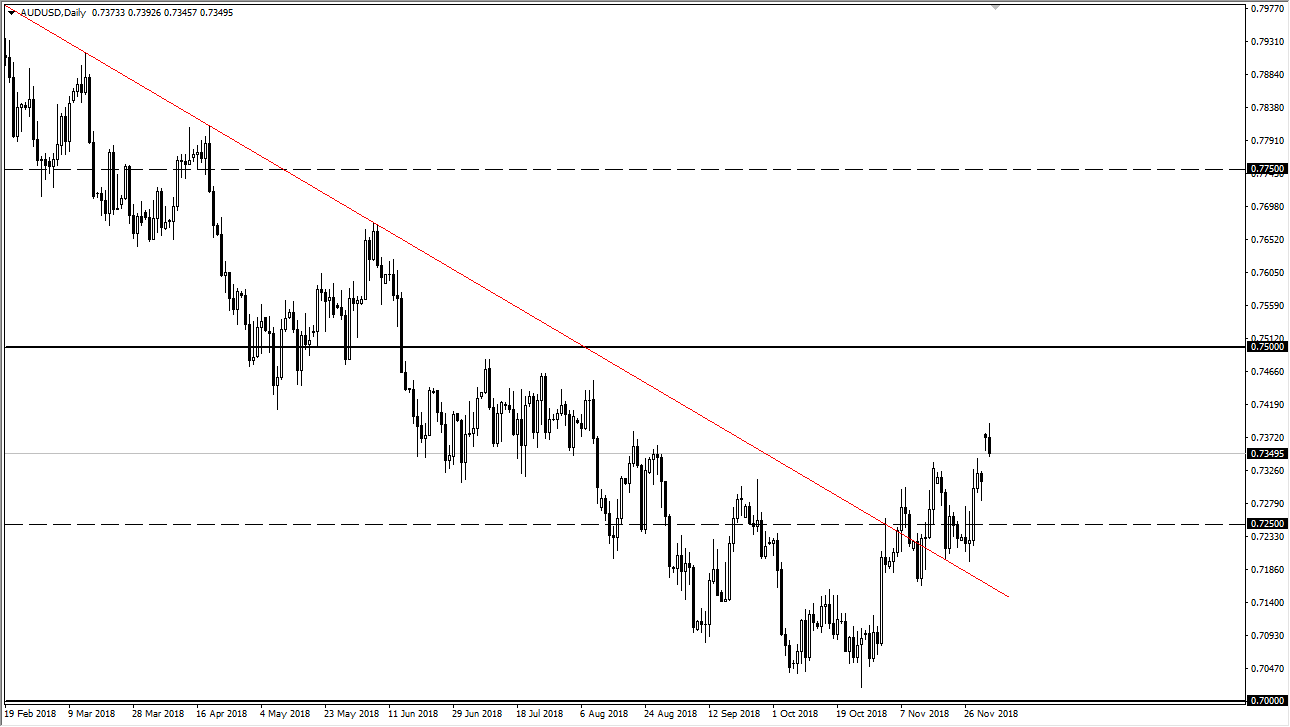

AUD/USD

The Australian dollar was a major beneficiary of the cease-fire in the trade war between the Americans and the Chinese. The market gapped immediately but has spent part of the day trying to drop in fill that gap. I think we will eventually get that fill, and because of this we need to hold the 0.73 level. If we don’t, then I think we go back in the consolidation. It’ll be interesting to see how the markets behave over the next couple of days, because it could dictate where we go between now and New Year’s Day. If we can hold that level, then we should go looking towards the 0.75 level above. If we don’t hold that level, then at the very least we will continue to go back and forth in the previous range. I do anticipate that there should be buyers below, but if that fails it would be a very negative sign.