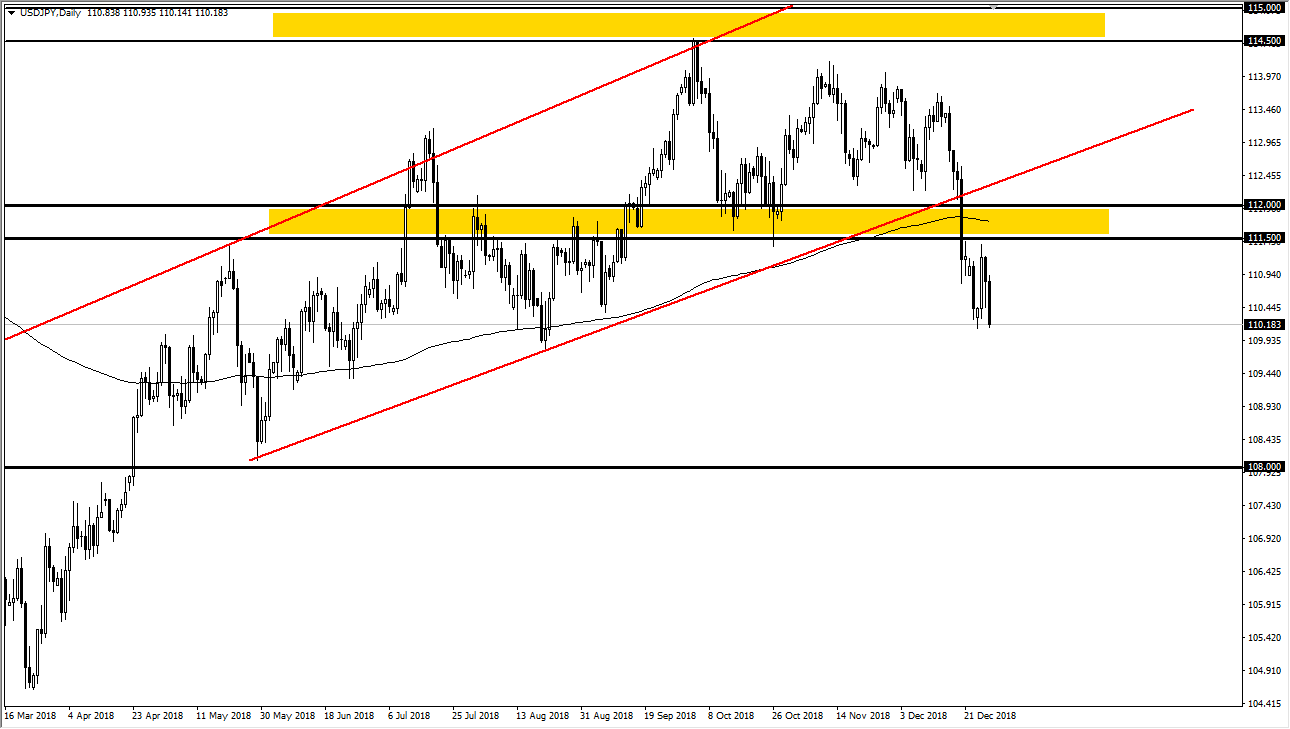

USD/JPY

The US dollar fell again against the Japanese yen, as we continue to see a lot of bearish pressure. The market has been in a very negative trend over the last couple of weeks, and we are now significantly below the 200 day EMA that should continue to push this market to the downside. At this juncture, I believe that the market will continue to sell rallies, as there are a lot of concerns out there with the global economy. Beyond that, there’s also the possibility of the Federal Reserve softening its stance even further, and if it does it’s likely that the pair will continue to drop even further. I presently believe that the ¥110 level offer support, but I think that we break below there then we will go down to the ¥108 level which is my longer-term target.

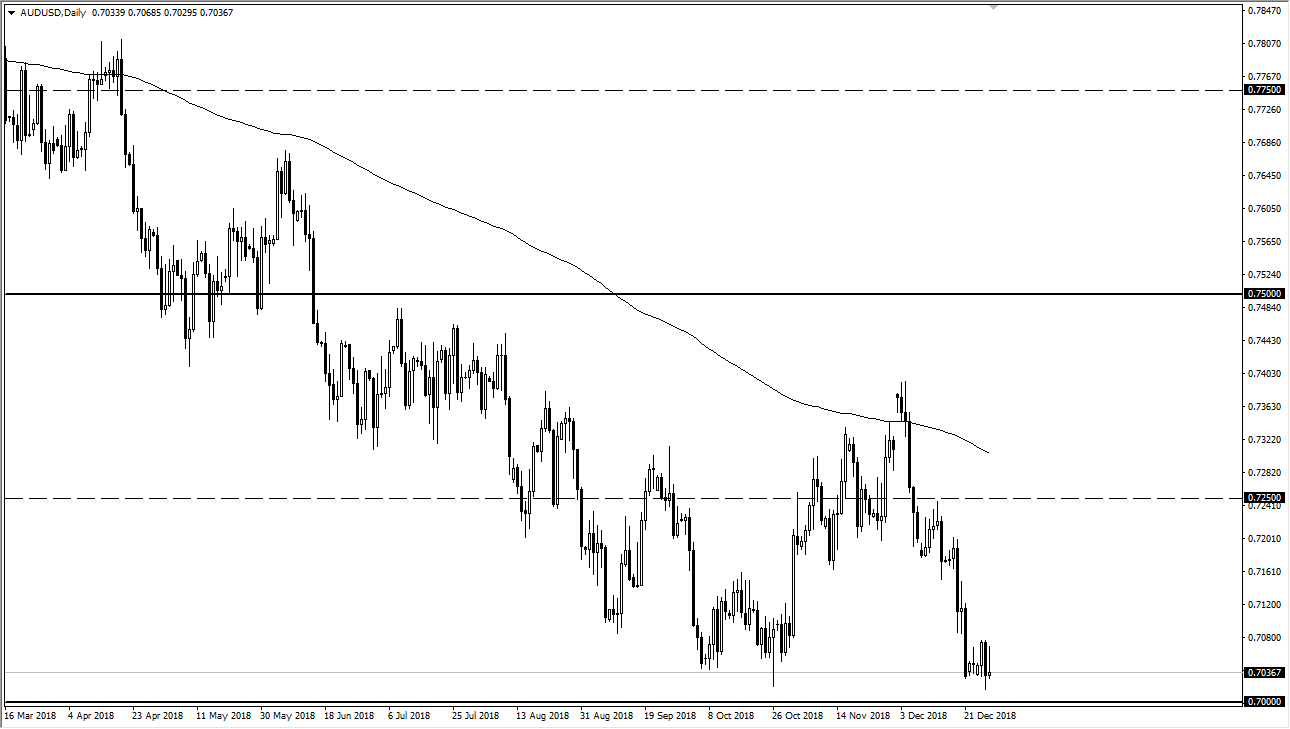

AUD/USD

The Australian dollar initially tried to rally during the trading session on Friday but gave back the gains as we continue to slump. I think this is going to be more of a “fade the rally” type of market going forward and given enough time I do think that we break down below the 0.70 level. It may take some time to get down there, but eventually we will do so based upon the US/China trade problems. Beyond that, we could find this market breaking down to the 0.68 handle, which is the longer-term support underneath. If we do rally from here, then I wait for signs of exhaustion to fade again, because I don’t see any reason for the Australian dollar to rally in the meantime. It’s not until we get some type of resolution to the US/China situation that the Aussie has any chance of attracting attention in the good way.