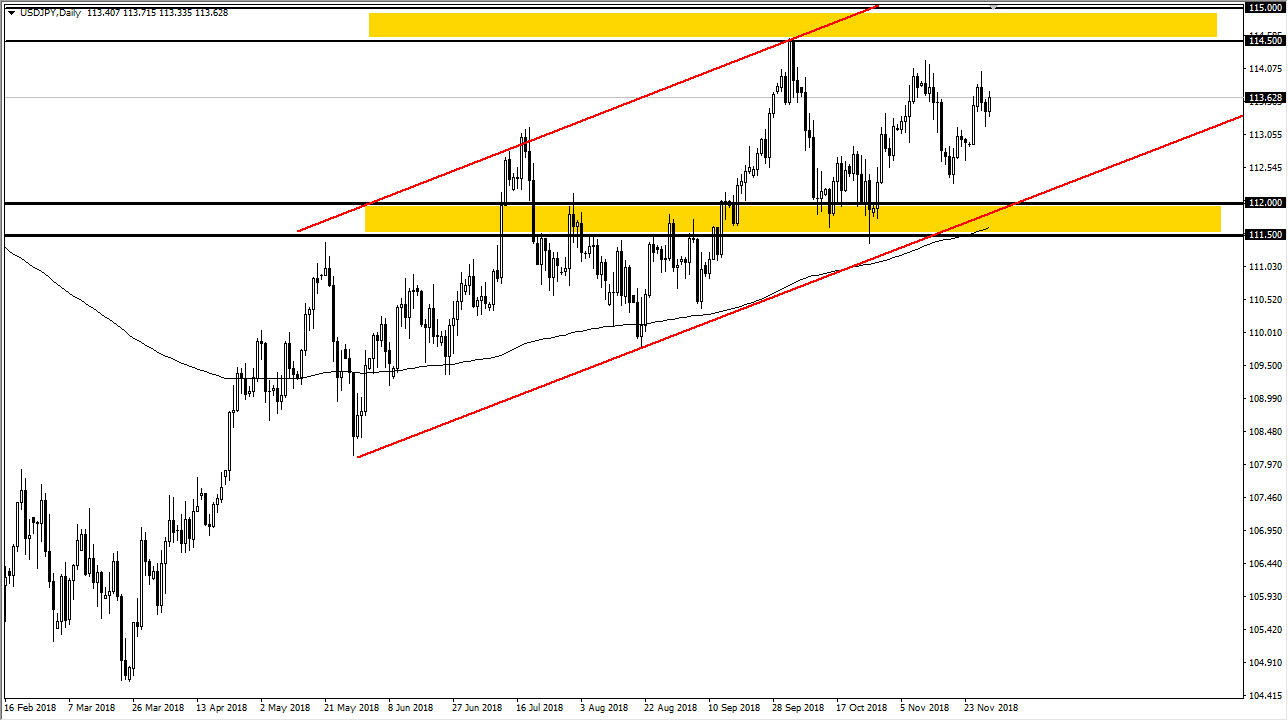

USD/JPY

The US dollar rallied a bit during the trading session on Friday against the Japanese yen, breaking above the hammer from the Thursday session. The market continues to show signs of bullishness overall, as we continue to rally every time we pull back. The ¥114.50 level above is the beginning of significant resistance to the ¥115 level. Overall, I think that if we can break above there, then the pair could go much higher. In the meantime, I do like buying short-term pullbacks, as the uptrend line underneath could continue to lift this market, just as the 200 day exponential moving average will. I expect plenty of volatility, but I still think that there are plenty of reasons for the market to rally based upon the structural dynamics that I see. If we break down below the uptrend line, then the market will probably unwind towards the ¥110 level.

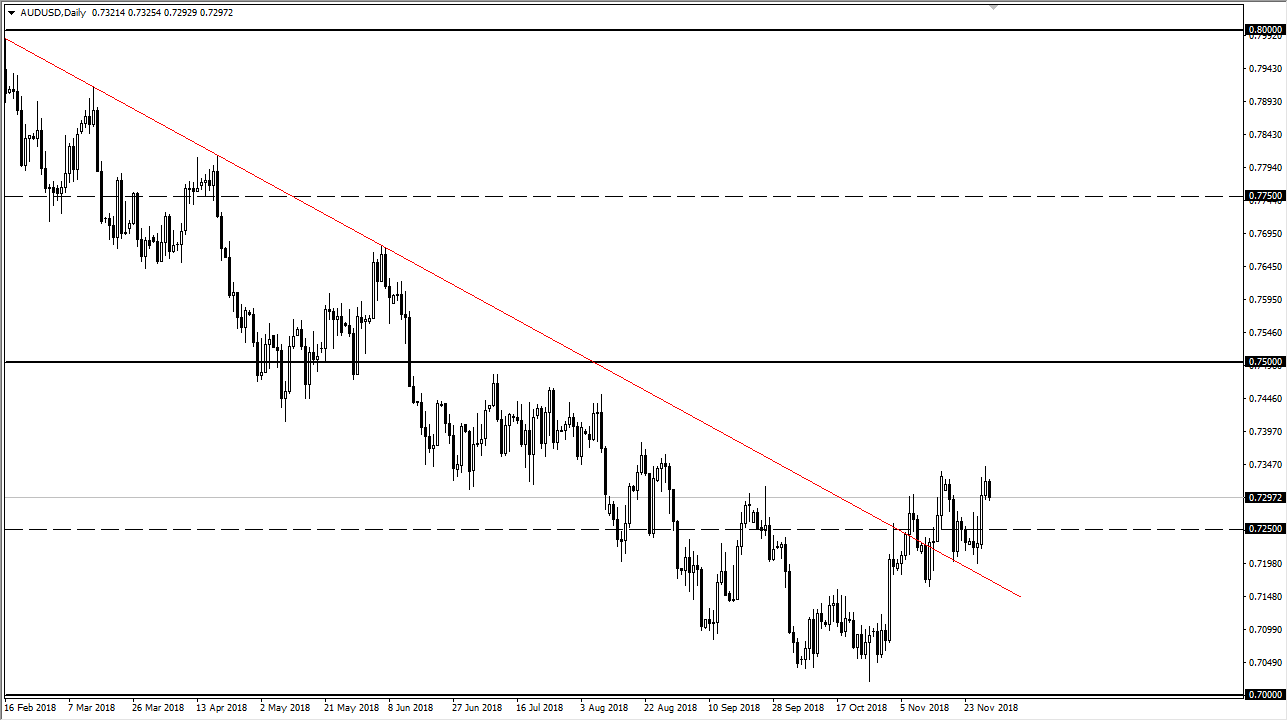

AUD/USD

The Australian dollar fell during the trading session on Friday from the rallies of the week, as we go into the weekend. It makes sense, as the Americans and the Chinese are set to talk over the weekend. Ultimately, I think that the Australian dollar will be highly levered to how that turns out, because the country of Australia provides so much in the way of raw materials for the export economy of China, and of course the construction. If it looks like we are going to avoid further tariffs, then it’s likely that the Australian dollar will rally due to a reaction to increased demand. We have recently broke through a major downtrend line though, so it does look like the market is expecting something good. This will literally be a binary event due to the meeting more than anything else. Monday morning should tell us exactly which direction this market is going to go. If it rallies, the 0.75 level would be the target. Otherwise, we could go back down to the 0.70 level.