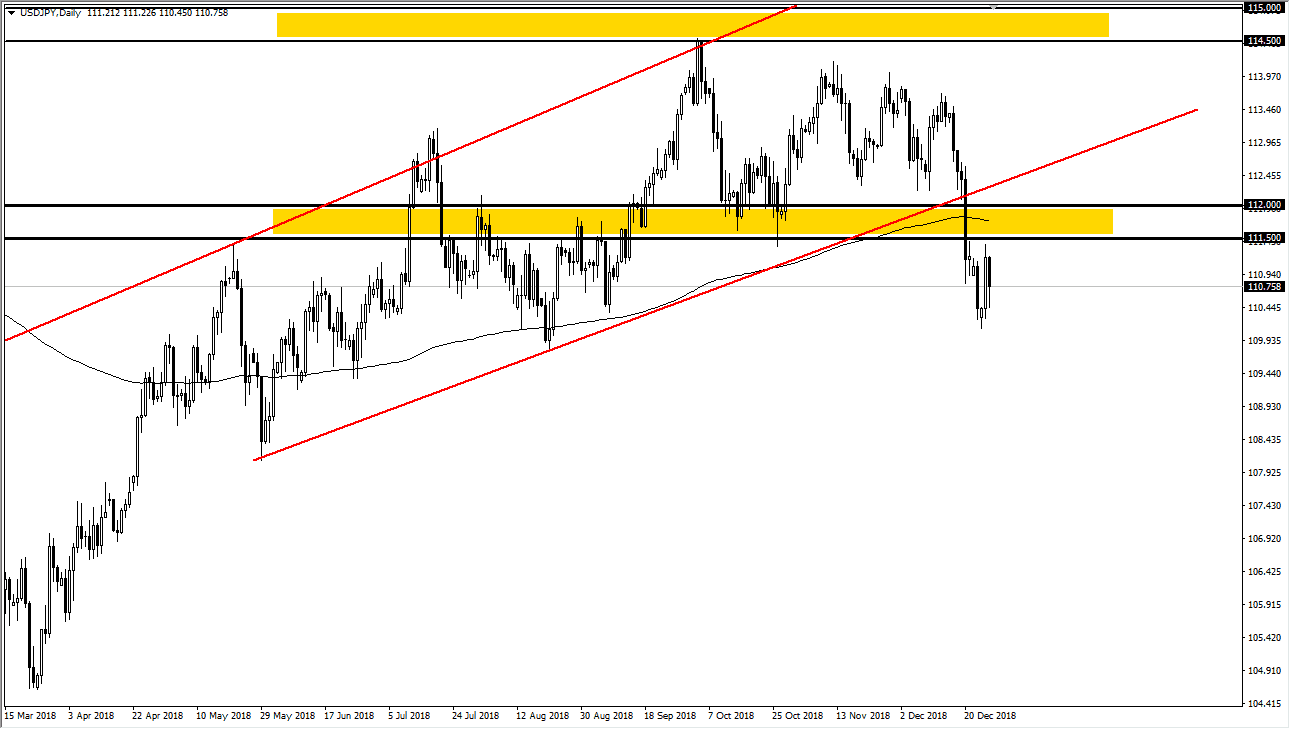

USD/JPY

The US dollar fell rather significantly against the Japanese yen on Thursday, showing signs of weakness yet again. The 100 and level ¥0.50 level offered that resistance, just as the 200 day moving average has. Ultimately, I think that the market will probably reach down towards the ¥110 level, perhaps even down to the ¥108 level after that. There is a lot of fear out there, so don’t let sudden rallies give you fits, because liquidity is going to be an issue. I believe that the Japanese yen will continue to fall at this point, and it makes sense that we would see a lot of trouble on the horizon. Ultimately, I do think that rallies are to be sold and that the recent break down is in fact indicative of something larger. The US/Chinese trade war alone could cause that problem.

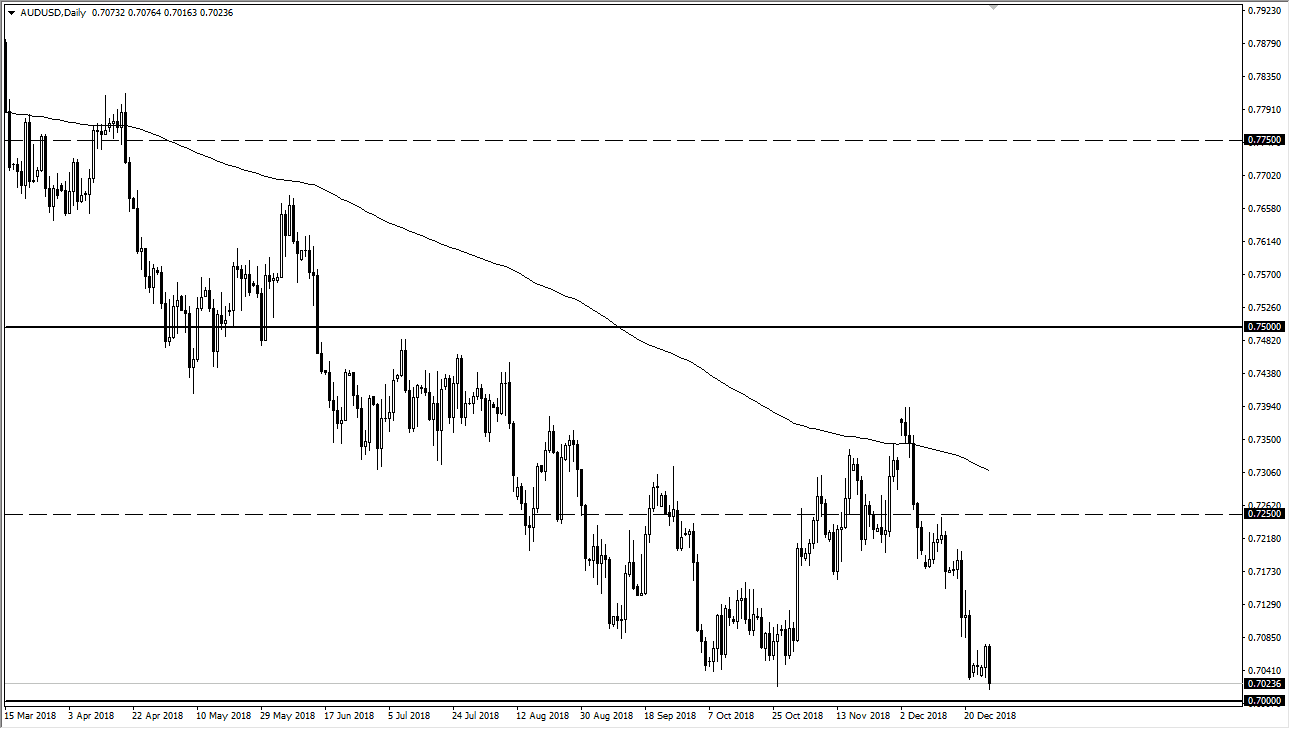

AUD/USD

The Australian dollar broke down significantly during the trading session on Thursday, reaching towards the 0.70 level yet again. We did not break through, but it looks as if we are making significant headways into doing so. If we do break down below the 0.70 level, it’s likely that we go to the 0.68 handle, and at that point we could even go lower. Rallies at this point are to be sold, and I don’t think that this market goes any higher than the 0.7250 level, and that is looking very unlikely at this point. Fade rallies that show signs of exhaustion, this candlestick on Thursday is a very ominous sign. I believe that at this point, 2019 is going to end up being a very ugly year to start out, and the Australian dollar may face the brunt of this negativity in the Forex markets.