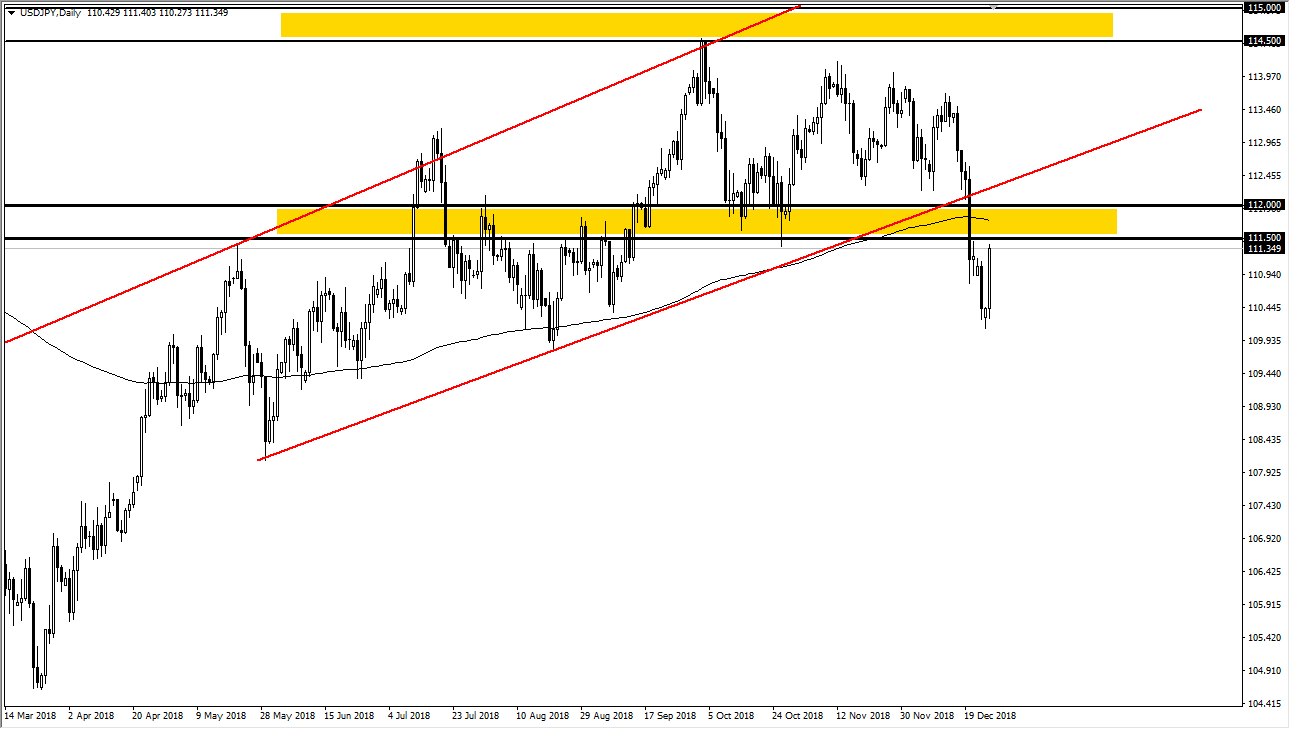

USD/JPY

The US dollar has exploded to the upside against the Japanese yen during the trading session on Wednesday, reaching towards the 100 level ¥0.50 level. This is an area that should offer resistance, and of course we have the 200 day EMA just above that. We have broken through major support, and it’s very likely that sellers should return. I think at this point; the US dollar has got ahead of itself and this bounce may be due to lower liquidity than anything else. I have no interest in buying this market, because this was a major technical breakdown that I think leads to much steeper losses. The Japanese yen is expected to be one of the leading currencies after New Year’s, which of course going to put weight upon this market as well.

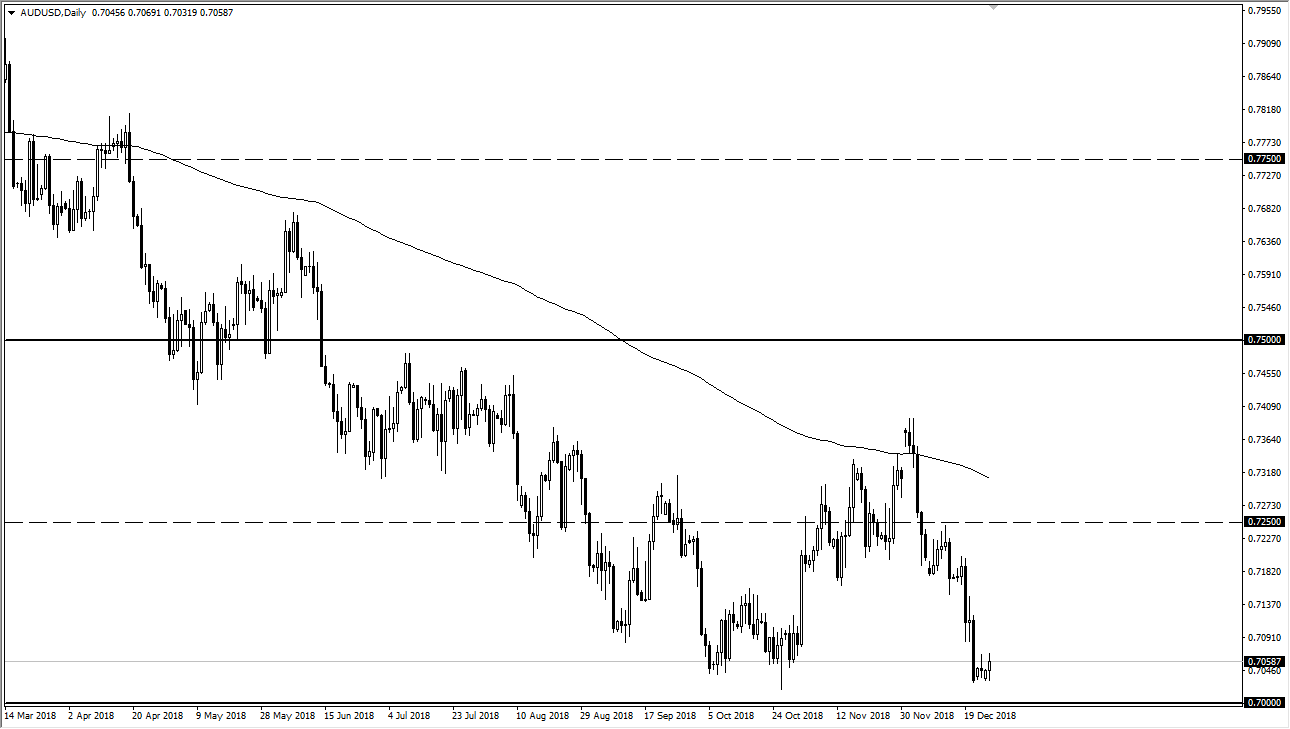

AUD/USD

The Australian dollar initially pulled back during the day on Wednesday but then bounced a bit. In the end though, we pull back even further, as the market continues to look very soft. The Australian dollar is synonymous with risk appetite, so keep that in mind. I believe that the stock markets in America rallying of course help a bit, but at the end of the day I also believe that rallies are not to be trusted, as there is far too much in the way of financial and economic uncertainty right now.

That being said, there is a massive amount of bearish pressure above, so I think rallies should give you an opportunity to short the market. Ultimately, if we break down below the 0.70 level, then the market could go much lower, perhaps reaching down to the 0.68 handle. Above, I see the 0.7250 level as massive resistance. I will fade rallies as they occur.