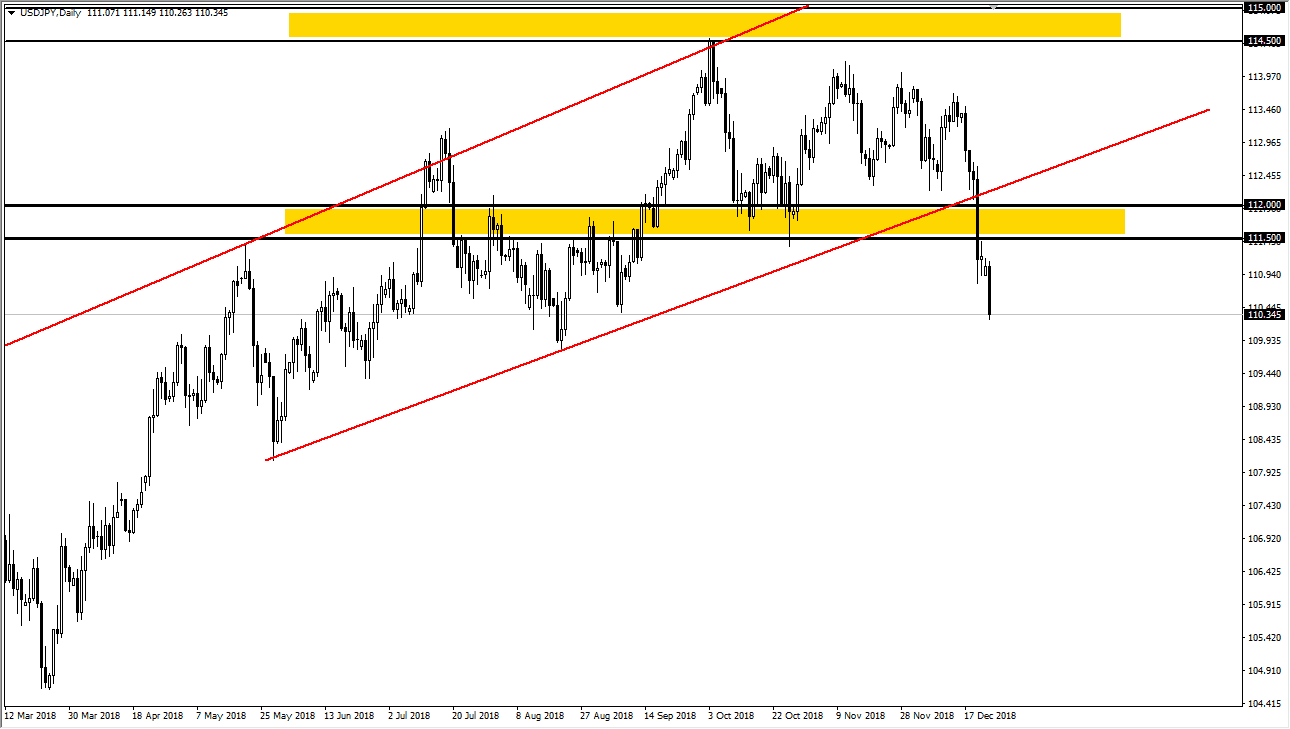

USD/JPY

The US dollar broke down significantly during the trading session on Monday, as fears of liquidity issues gripped Wall Street. The market got wind of the treasury secretary talking to several of the large bankers to and a several questions, and that cause more concerns than that we have already seen. Beyond that, this pair has seen a significant amount of bearish pressure recently anyway, as we broke through a significant support, in the form of the ¥115.50 level. Beyond that, we broke down through an uptrend line, and are now firmly below the 200 day EMA. At this point, it looks as if we are going to try to break through the ¥110 level, an area that obviously will cause a bit of psychological support, but if we do break down through there the market should go to the ¥108 level. If we do rally, it’s likely that the ¥112 level will be a bit of the ceiling. There are a lot of global concerns out there, so that of course will weigh upon anything against the Japanese yen given enough time. I continue to sell rallies.

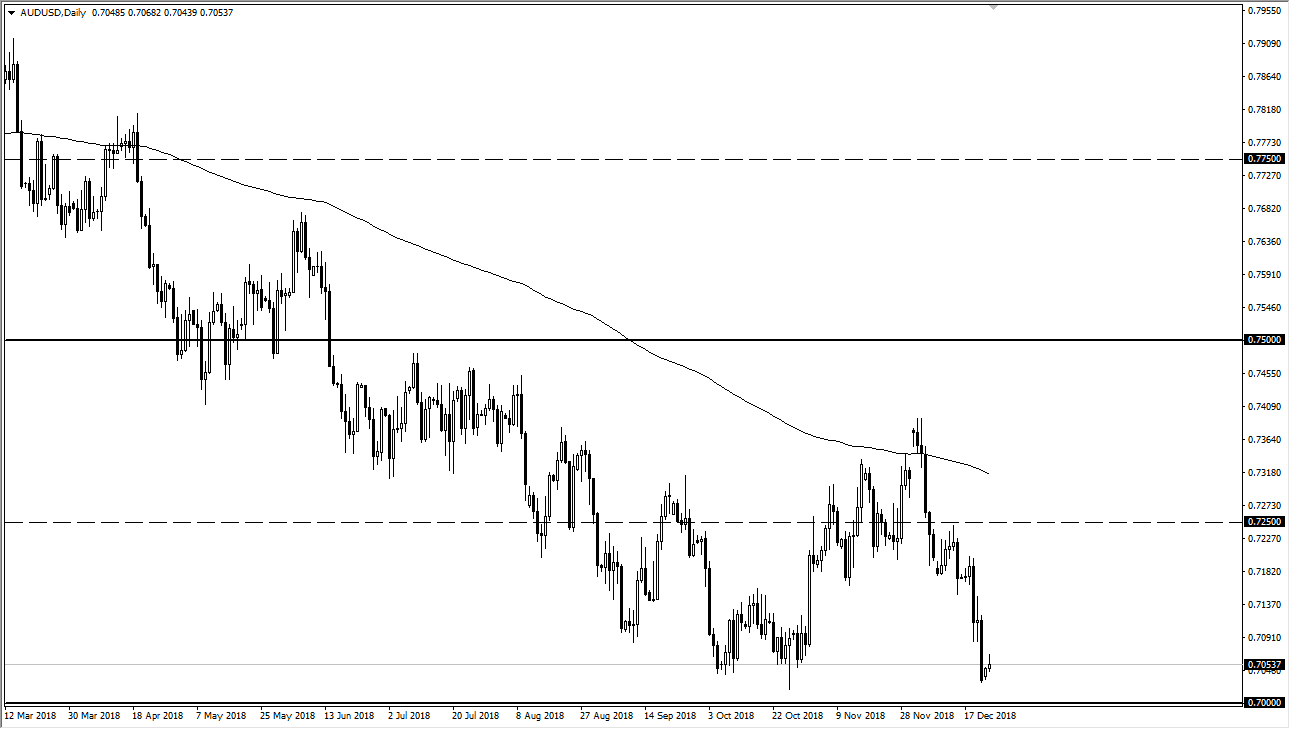

AUD/USD

The Australian dollar of course rallied during the day as well but turned around of form a bit of a shooting star as we are at very low levels. The 0.70 level underneath is massive support level, and therefore if we did break down below there I think it could be a rather significant move. If we do break down below that level, it’s very likely that we go down to the 0.68 handle after that. The other scenario of course is that if we rally and break above the top of the shooting star from the trading session on Monday, then we will probably go looking for resistance at higher levels. I will continue to fade rallies though, as the 0.7250 level continues to be what I think is the “ceiling” in the market.